Married life can be great but unexpected things do happen -- often at the worst time. What is an EPO plan.

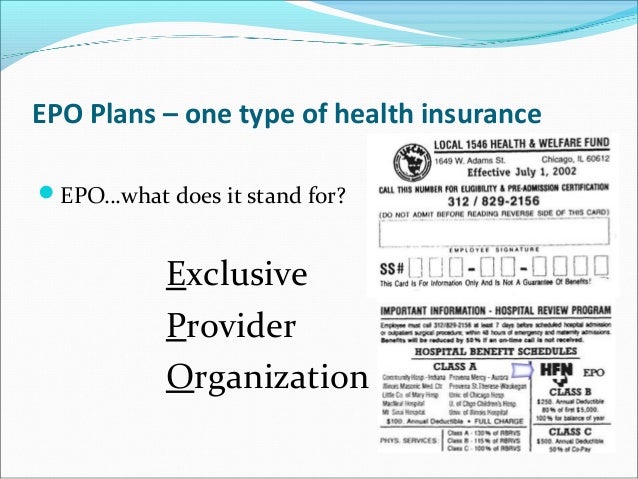

An Exclusive Provider Organization EPO plan is a type of health insurance plan that combines elements of an HMO plan and a PPO plan.

Epo health insurance definition. The plan offers a local network of doctors and specialists in your area in which you can choose from. Also note that there are no out-of-network benefits under an EPO health insurance plan. Your insurance will not cover any costs you get from going to someone outside of that network.

HMOs often require members to get a referral from their primary care physician in. An EPO Exclusive Provider Organization insurance plan is a network of individual medical care providers or groups of medical care providers who have entered into written agreements with an insurer to provide health insurance to subscribersBasically an EPO is a much smaller PPO. As an EPO member you cannot go outside your plans network for care.

Well there are several technical differences between HMO and EPO. It does not require a Primary Care Physician like a PPO plan but there is no out-of-network coverage like an HMO plan. When considering their difference the HMO can be termed as an insured product which means that the insurance.

Exclusive Provider Organization EPO health plans are similar to Health Maintenance Organizations HMOs as they do not cover care outside of the plans provider network. An EPO plan may be right for you if. There are no out-of-network benefits.

You do not want to get a referral to see a specialist. Check out our affordable health plans and calculate your premium. An EPO is a health insurance option similar to a PPO Preferred Provider Organization but.

HMO stands for Health Maintenance Organization and EPO stands for Exclusive Provider Organization. What is EPO Insurance. The EPO is now an important term since roughly half the State for certain carriers will have only have EPOs available to them depending on the carrier.

An Exclusive Provider Organization EPO health insurance plan requires you to use the doctors and hospitals within its own network much like a Health Maintenance Organization HMO. EPO stands for Exclusive Provider Organization plan. Exclusive Provider Organization EPO Plan A managed care plan where services are covered only if you go to doctors specialists or hospitals in the plans network except in an emergency.

EPO Health InsuranceWhat It Is and How It Works Point of Service POS POS plans resemble HMOs but are less restrictive in that youre allowed under certain circumstances to get care out-of-network as you would with a PPO. How does an Exclusive Provider Organization EPO work. An Exclusive Provider Organization plan EPO is similar to an HMO plan in that it has a limited doctor network and no out-of-network coverage but it is similar to a PPO plan in that you dont have to designate a primary care physician upon applying and you dont need a referral to see a specialist.

Definition of the PPO PPO stands Preferred Provider Organization. Exclusive Provider Organization EPO-insurance plan allows access to health care from a network physician facility or other health care professional including specialists without designating a. Lets understand the difference between the PPO and EPO before shopping the Covered California plans.

An exclusive provider organization or EPO is a health insurance plan that only allows you to get health care services from doctors hospitals and other care providers who are within your network. Type of plan and provider network. Advertentie Zilveren Kruis healthcare insurance is the foremost collective healthcare insurer.

Check out our affordable health plans and calculate your premium. Advertentie Zilveren Kruis healthcare insurance is the foremost collective healthcare insurer. As a member of an EPO you can use the doctors and hospitals within the EPO network but cannot go outside the network for care.

EPO insurance plans offer a very limited number of providers who offer. Difference Between HMO and EPO HMO vs EPO HMO and EPO are both health insurance schemes. An EPO Exclusive Provider Organization Insurance Plan can help prevent you from going bankrupt if youre hit with a surprise illness.

Health maintenance organizations HMOs cover only care provided by doctors and hospitals inside the HMOs network.

:max_bytes(150000):strip_icc()/betterhep-c24a5fed18fa46c0814fb6e8da1297c0.jpg)