For patients not covered by health insurance the cost of the most common types of heart surgery can range from less than 30000 to almost 200000 or more depending on the facility the doctor and the type of surgery. A heart transplant in the United States can result in billed charges before insurance coverage of more than 13 million.

Why Organ Transplants Are So Expensive In The United States

My numbers were provided to.

Heart transplant cost with insurance. The specific amount youll owe may depend on several things like. The cost of a transplant varies depending on location hospital organ type insurance coverage and other factors. It would be at least 3000 or 4000 a month Prices.

12 million dollars is the cost of a heart transplant. Youll be responsible for any of your transplant and medical care costs not covered by your insurance company. A study carried out in the US in 2004 discovered that majority of the pediatric patients that go through heart transplant enjoyed proper adulthood and lived a good life.

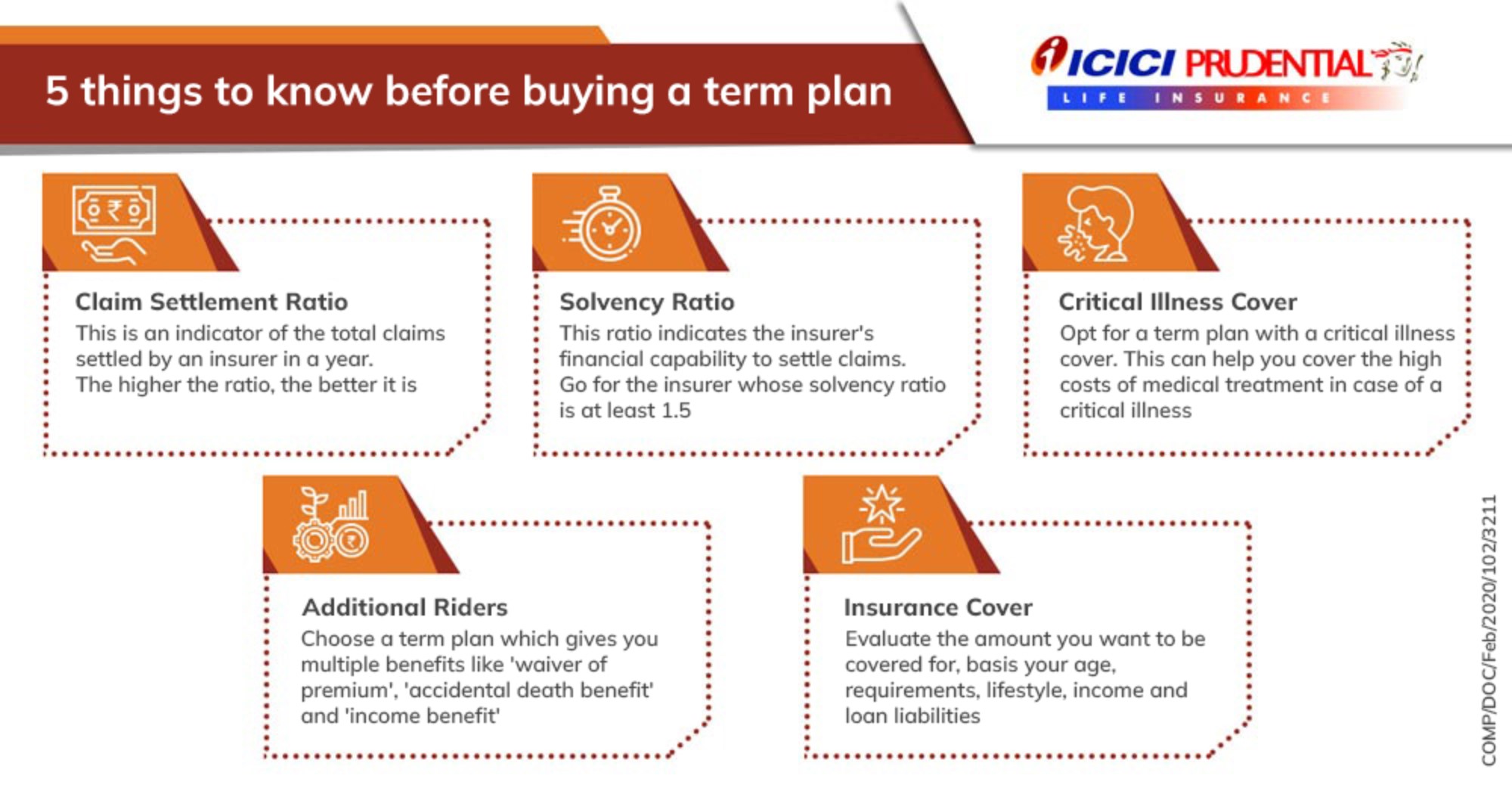

Although many insurance companies offer optional coverage for transplant costs the terms and benefits of insurance vary widely. Pediatric heart transplantation is a beneficial intervention as it helps patients to live long. The cost of a heart transplant can vary from person to person depending on many factors.

We cant pick up those costs said Reed whose family runs an independent insurance firm. This tool does not provide medical advice. To find out how much your test item or service will cost talk to your doctor or health care provider.

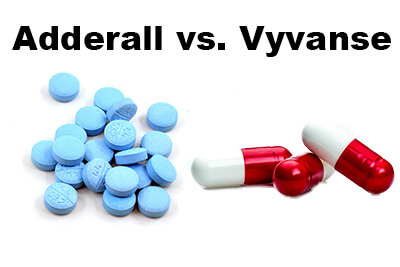

Heart surgery typically is covered by health insurance. This type of insurance covers you for medical emergencies even those related to COVID-19 which is vital to prevent unexpected medical bills and give you the support you need if you have any medical problems while you are away. O Feb 27 2018 Heart Disease.

Other insurance you may have. How much your doctor charges. What you can do is check your policy as early as now to see what kind.

The type of facility. How Long Do Heart Transplants Last. Financial burden of heart transplantation it is not unreasonable to assume that this financial burden may change the financial security for caregivers and recipients over the recipients lifetime with a heart transplant.

For transplant patientsor anyone who anticipates a very expensive surgerythe following tips may help with the financial burden and. If you are researching or preparing for an organ transplant contact your health insurance provider and your transplant centers financial coordinator. USA Today reports that a revolutionary artificial heart transplant has an expected cost of 190000 to 220000 which is on par with the cost of a.

Know what to expect about heart transplant learn how Medicare can help cover costs of heart transplant surgery. If you wish to discuss estimated cost well give you contact information for patient business services and a heart transplant credit analyst. I breakdown the cost of a heart transplant and the annual medication cost.

However each insurance company may provide the coverage differently. Thus it is important to understand what impact heart transplantation may have on health insurance cov-erage over time. Yes heart transplants are covered by health insurance in most cases especially if the insurance plan is comprehensive.

Where you get your test item or service. Whether your doctor accepts assignment. 12 million dollars US.

Read your policy carefully and contact your insurance company if you have questions about how much of your costs they will pay including your lab tests medications and follow-up care after you leave the hospital. This Fortune infographic proclaims the average heart transplant can cost 14 million. As for insurance the Keck School of Medicine of USC says expenses by insurance carriers include but are not limited to the fees for your evaluation surgeon fees operating fees anesthesia costs the hospital length stay blood testing organ recovery costs rehabilitation costs andor the costs of medication.

Speak with a Licensed Insurance Agent 1- 844-847-2659 TTY Users 711 Mon - Fri 8am - 8pm ET. Heart transplant travel insurance covers you if you have had a heart transplant and wish to travel with peace of mind. 1664800 2 Heart disease is the leading cause of death in the United States and about 3000 heart transplants are performed in the US.

Prior to getting listed on the Heart Transplant Waitlist I was required to meet with a hospital financial counselor to discuss my ability to pay for the transplant and the annual cost of my care.

/domestic-partner-insurance-101-2645680_final-aa4fc77cbbca4103a52bbbad3c906435.png)