That is your employer could offer to pay the premiums on a group life insurance policy for you as a job benefit but the same employer cannot take any adverse actions against you if you choose. Like we mentioned above employer-paid life insurance is typically offered at a coverage rate equivalent to your annual salary.

The Texas A M University System

Type B Employee is the proposer and life assured.

Employee paid life insurance. But the employer-paid cost of group term coverage in excess of 50000 is taxable income to you. What Is Employer Paid Term Life Insurance. It works in a.

Employers should contact their tax advisor andor legal counsel before entering into or modifying a split-dollar life insurance arrangement. The life insurance company may allow you to purchase additional life insurance through them at group rates but again the coverage level is based off of your salary up to 5 times what you make in a year. Life insurance is an insurance policy that provides in exchange for monthly quarterly or annual premium payments a lump sum of money to the designated beneficiary of an employee who dies.

Employer-paid term life insurance comes as an option through some employee benefits packages. If you have this benefit your employer may pay for some or. Type A Employer is the proposer and Employee is the life assured.

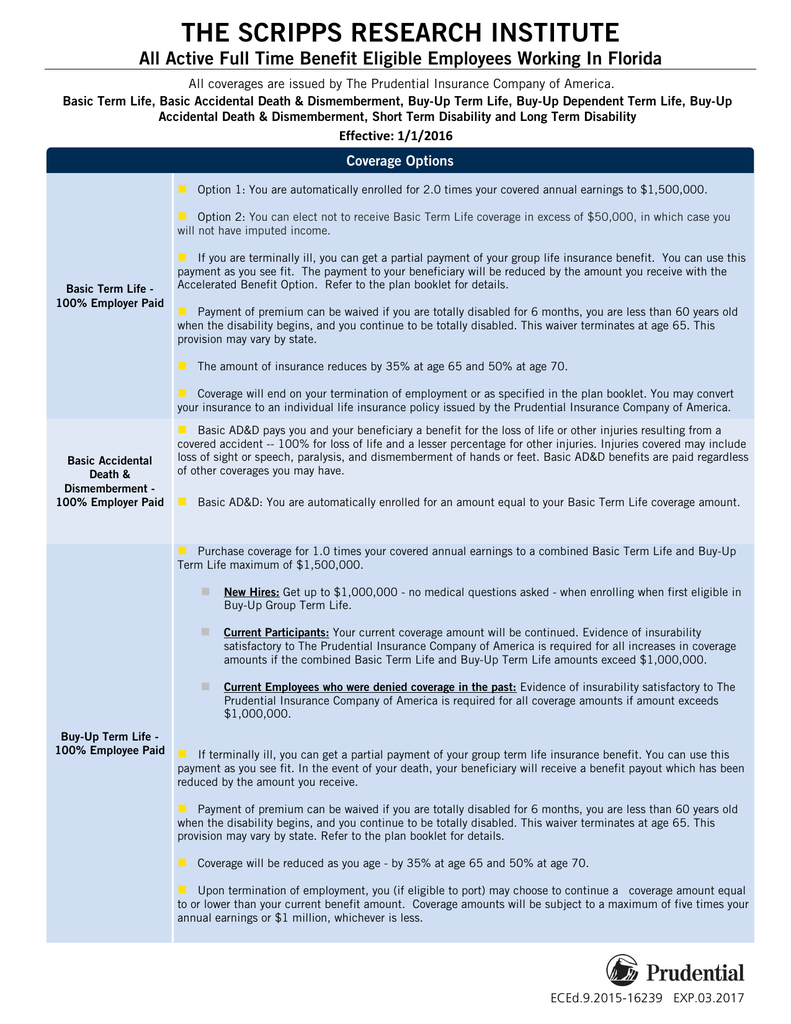

If you pay premiums for your employees group life insurance you can deduct the cost as a business expense on your statement of business income and expenses. Life insurance acquired through your employer is likely to be cheaper than what you can buy on the open. Benefits will be reduced to 65 of your original amount at age 65 and 50 at age 70.

Employer-paid life insurance premiums covering the first 50000 in insurance are not taxable to you. Employer offered benefits are sometimes automatic which means that they are effective even if you do nothing at all but they are not mandatory. Any sum paid by the employer in respect of any premium paid by the employee to effect or to keep in force an insurance on his health or the health of any member of his family under any scheme approved by the Central Government or the Insurance Regulatory and Development Authority established under sub-section 1 of section 3 of the Insurance Regulatory and Development Authority Act 1999.

The premium is paid by the employer in type A until the policy is assigned to the employee usually within a pre-specified period. Under this kind of arrangement the employer owns the policy. Deductible Employer-Paid Life Insurance Premiums.

Optional Employee-Paid Life Insurance Coverage Levels The benefit has no cash or loan value. Using the IRS table this employee would fall into the 45 to 49-year-old range and incur a cost of. Employer owned life insurance often called company owned life insurance COLI may be used to finance the cost of employee death benefits or retirement benefits if the COLI contains a cash build-up feature.

Remember the cost of employer-provided group-term life insurance in excess of 50000 is taxable to employees. Group term life insurance is a group policy where the benefits consist of. Age-related benefit reductions will occur for employees.

The employer can continue the premium payment even after the assignment if he wishes. Many employers offer a certain amount of group term life insurance as part of their employee benefits package. The employee is currently 47 years old.

An employee has a basic life insurance policy with his company that has a death benefit of 150000 which is paid entirely by his employer. Group life insurance is one of the most commonly offered benefits in an employer-sponsored benefits package. Senior Management Life is also offered at no cost to members of the Senior Management Group.

However you cannot deduct costs for group term insurance or optional dependant life insurance. Phantom income The first 50000 of group term life insurance coverage that your employer provides is excluded from taxable income and doesnt add anything to your income tax bill. Life insurance marks an employer as an employer of choice when.

But premiums your employer pays for any face amount of insurance over 50000 are treated by the Internal Revenue Service as income paid to you and you will have to pay income tax on this amount. That means that if you pay the premiums for employees life insurance any premiums you pay for more than 50000 in coverage for one. Employees eligible for mid-level or core benefits are automatically enrolled in Core Life at no cost.

Employer-Paid Life Insurance When an employer provides life insurance as part of an overall compensation package the IRS considers it income which means the employee is subject to taxes. Supplemental Life Dependent Life and Expanded Dependent Life insurance are available for a monthly premium to employees eligible for full or mid-level benefits. As with other life insurance policies group life insurance is designed to cover the financial risks to your family should you pass away.

Group Insurance Prudential Financial Employers Prudential Financial

/types-of-employee-benefits-and-perks-2060433-Final-65c1c14d22de4e10b4f4ea85af6bd187.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.