Select health plan optional Health Plan. Ask your physician to contact your insurance provider and explain why Vyvanse is essential.

Vyvanse Vs Ritalin Differences Similarities And Which Is Better For You

Vyvanse Vs Ritalin Differences Similarities And Which Is Better For You

For the treatment of ADHD in patients 6 years and for adults with moderate to severe BED.

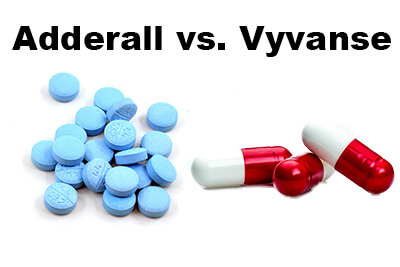

Which insurance covers vyvanse. It is not known if Vyvanse is safe and effective for the treatment of obesity. Add a reasonable 2450 for dentalvision and Im looking at 1070month for employer-subsidized health insurance. I found Vyvanse to work much better so I think I solved the insurance problem and Im going to go back on Vyvance soon after I finish my Adderall generic.

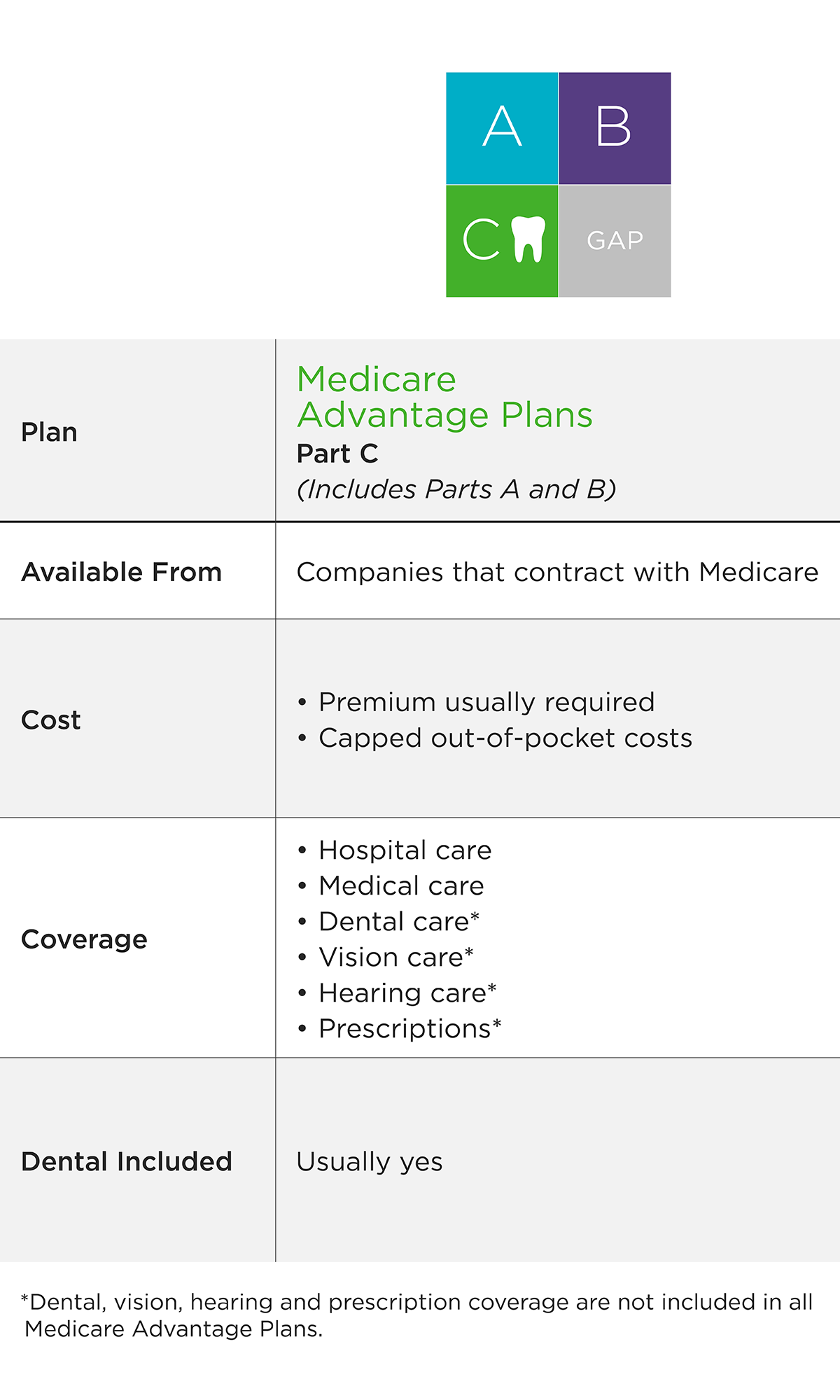

A GoodRx Vyvanse coupon can usually save at least 15 of the full retail price. Vyvanse is covered by most Medicare and insurance plans. VYVANSE and the VYVANSE logo are registered trademarks of Takeda Pharmaceuticals USA Inc.

Compare central nervous system stimulants. Check our savings tips for co-pay cards assistance programs and other ways to reduce your cost. I started out on Vyvanse then due to insurance went to generic Adderall.

Find the official insurance at the bottom of the website. This is especially helpful if two strengths are priced similarly. The generic name of the drug Vyvanse is lisdexamfetamine.

Vyvanse is covered by most Medicare and insurance plans. However a prodrug like Vyvanse is inactive in the system until it is metabolized by enzymes in the body. Get direct access to why won t my insurance cover vyvanse through official links provided below.

You will want to ask your healthcare provider to make sure this is a safe option for you. This drug is a controlled substance. The price of Vyvanse depends on several things.

Vyvanse Prices Coupons and Patient Assistance Programs. In addition prodrugs like Vyvanse are believed to be absorbed much. 2020 Takeda Pharmaceuticals USA.

GoodRx offers discounts for Vyvanse. In pets the cost is 500-1500 depending on the length of testing so I would assume it should be somewhere around that. Vyvanse lisdexamfetamine is a member of the CNS stimulants drug class and is commonly used for ADHD and Binge Eating Disorder.

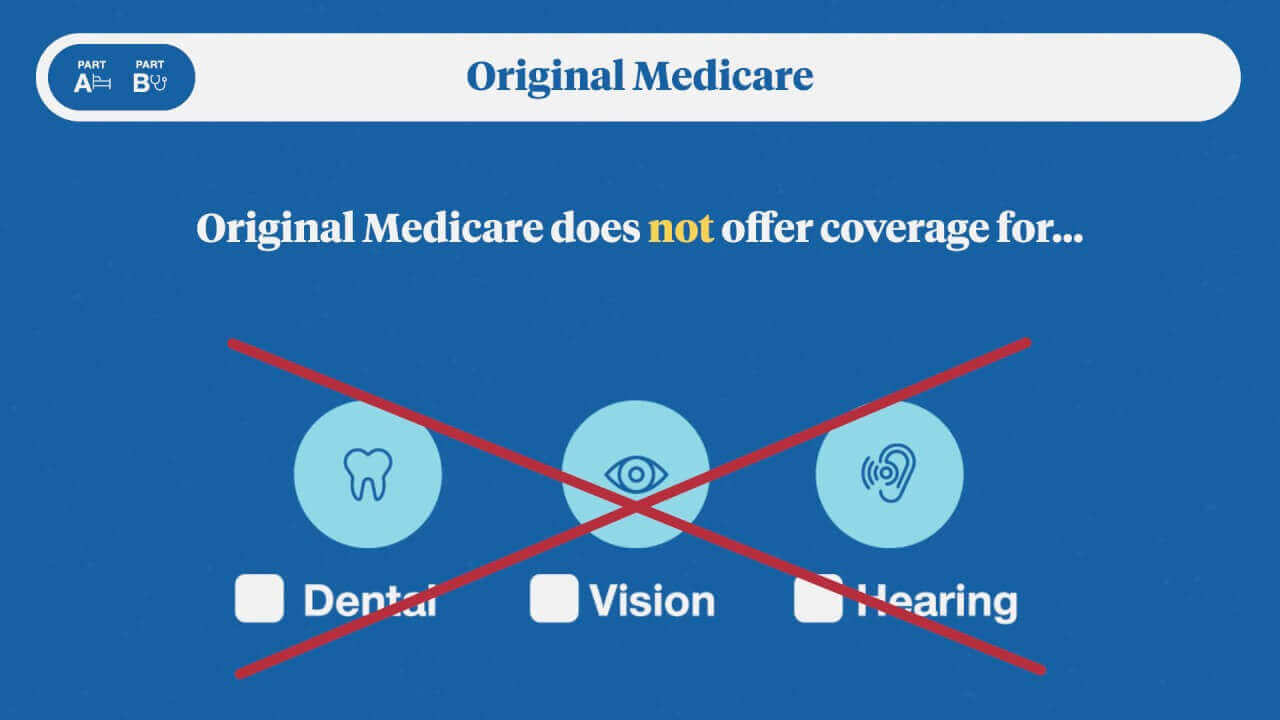

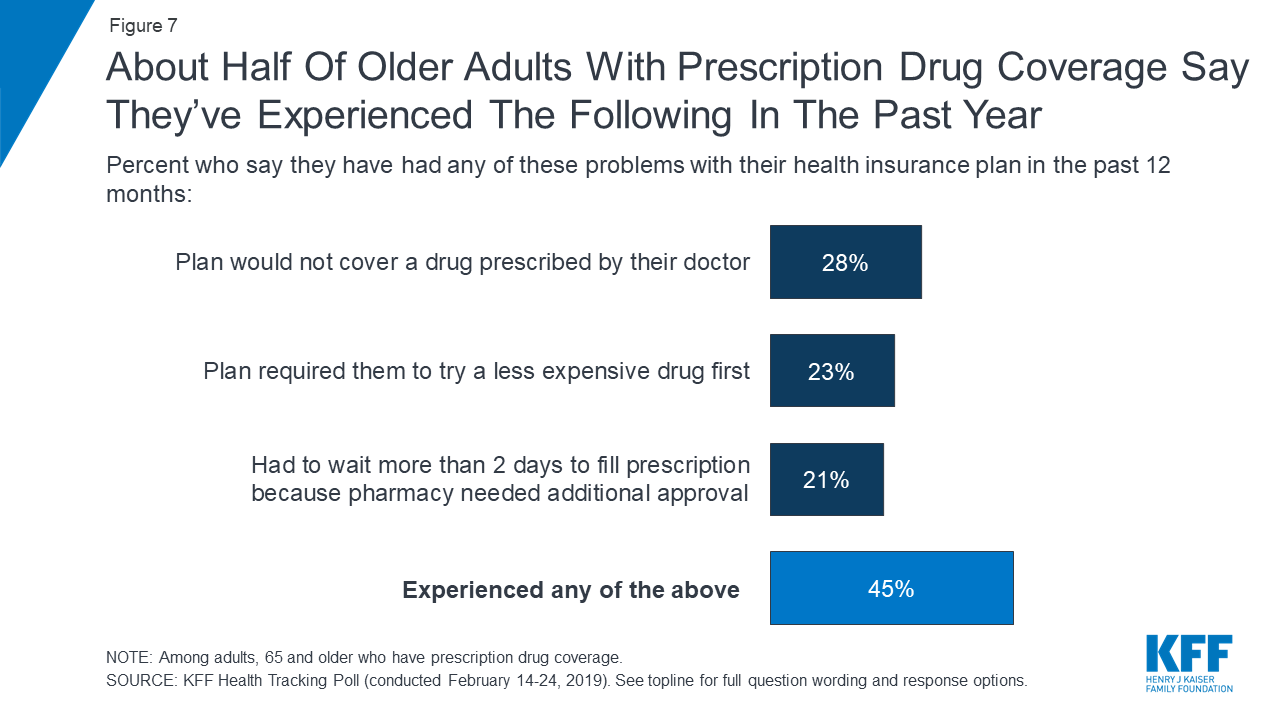

Ive found that you can look up the formularies for most health insurance plans online without much difficulty. The formulary will tell you which drugs fall into which tiers and which ones require prior authorization or have other restrictions. Many insurance companies cover only generic forms of ADHD medications since they are less expensive.

Looking for why won t my insurance cover vyvanse. Vyvanse is not for weight loss. Vyvanse attention-deficit hyperactivity disorder adhd insurance Im 60 years old and have been taking Vyvanse 50 mg for almost 10 years.

Call Takeda at 1-800-830-9159 for more information about your patients Medicare and Medicaid. Health Insurance Car Insurance Travel Insurance Life Insurance And Protection Pet Insurance Home And Mobile Insurance Dental Insurance Legal Expenses Insurance Income Protection PPI Funeral Plans Insurance. Therefore Vyvanse can only be taken orally whereas Adderall can be ground up and snorted or mixed with water and injected.

Vyvanse is still under patent so it will tend to be on a more expensive or more restricted tier. This means that youre responsible for paying the entire cost of. If your eligible patients are covered by Medicare or Medicaid their Vyvanse prescriptions may be too.

Go to why won t my insurance cover vyvanse page via official link below. Now as Im reviewing benefits for the company from which I intend to accept a job offer -- which to be clear is a much smaller company so I expected at least marginally higher insurance costs -- their BCBS medical insurance for my family employee spouse kids is a ridiculous 510 and change per paycheck. GoodRx has partnered with InsideRx and Shire to reduce the price for this prescription.

Note that some pharmacies may not honor coupons for controlled substances. Split a higher dosage pill. How much does Vyvanse cost with insurance.

This past year CVS Caremark all of a sudden decided to no longer cover it. The cost for Vyvanse oral capsule 10 mg is around 1175 for a supply of 100 capsules depending on the pharmacy you visit. Check with your doctor pharmacist or insurance.

Vyvanse works like Adderall but each drug is released into the body in a different way. Use a Vyvanse coupon from GoodRx. Select health plan provider.

TAKEDA and the TAKEDA logo are registered trademarks of Takeda Pharmaceutical Company Limited. It has worked amazing and Ive had no issues. In Canada without insurance it costed me 25 however Im not sure how much is covered by the public health care or if it falls under prescriptions and private insurance.

Doctors prescribe Vyvanse to treat ADHD and moderate-to-severe binge eating disorder in adults. Vyvanse is new and under patent and because of this expensive. Follow these easy steps.

Your insurance coverage your daily dosage and the pharmacy where you shop. This means that the manufacturers of Vyvanse advertise it as being less likely to be abused. Prices are for cash paying customers only and are not valid with insurance.

1File an Insurance Appeal There are some insurance companies that dont cover Vyvanse.