The average cost of short-term health insurance is 124 a month compared to 393 for an unsubsidized ACA-compliant plan. Plus it is a relatively inexpensive way to safeguard the policyholder dependents in case of death.

What Is Term Insurance Meaning Of Term Plan Icici Prulife

What Is Term Insurance Meaning Of Term Plan Icici Prulife

This life insurance rider is an excellent option for those seeking additional protections in.

Term insurance reviews. John Hancock earns a score of 37 in our 2021 rating of the top life insurance. Term insurance has the lowest premiums when compared to other health insurance plans. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity.

8 We found plans. OneAmerica Long-Term Care Insurance Review A division of the US. Long-term care life insurance is one of the best investments an individual can make in themselves.

Services provided by the members of the insurance company is fantastic online renewal facility reduces the paperwork. Level-premium term life is one of the most common types of term life insurance and the best choice for many people. The updates regarding insurance plan is mailed to me regularly.

Term Life Insurance Policy Reviews Mar 2021. Term life insurance plans have a high sum assured when compared to the other insurance plans. I am very happy to be part of the ICICI Prudential Life Insurance family for the last 12 years.

The 7 Best Term Life Insurance Companies of 2021. Department of Health and Human Services published a study on how long-term services affect retirees finances and found most Americans turning age 65 will need long-term care at some point. Inflation protection and refunds of premiums are available at an extra cost.

45 5 Excellent 38 Customer Comments Reviews - see all comments. Your premiums are the same. Founded in 1909 and with an AM Best rating of A Superior.

Moreover if you are the whole-sole breadwinner of your family then the unsettled claim can come as a huge financial setback for. Costs and Benefits of Transamerica Long Term Care Insurance. Your premiums are designed to build cash value over your life.

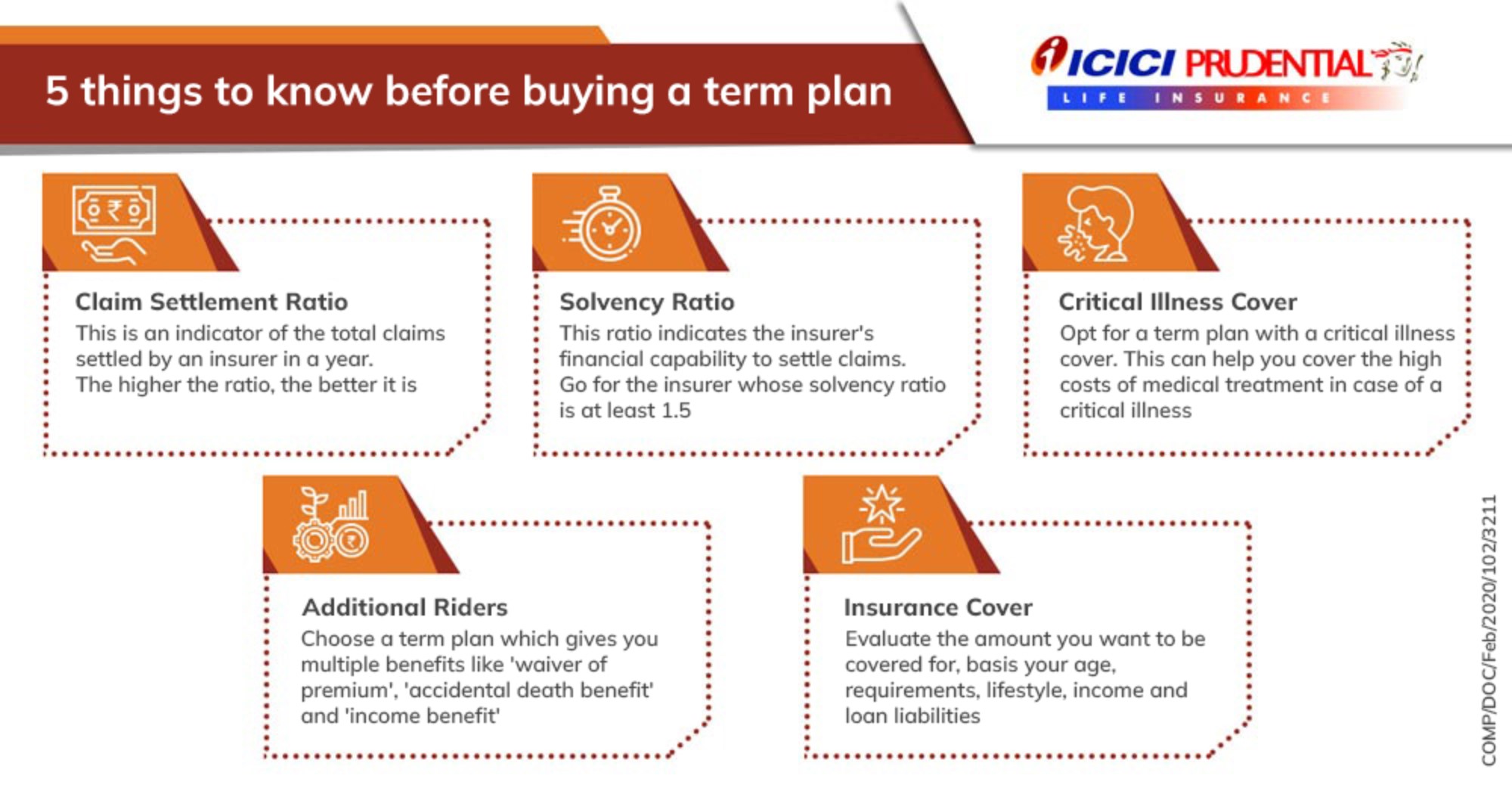

Buying a term plan because of its low cost and ignoring the fact that the company has a low claim settlement ratio can create a lot of problems for your dependents. Term insurance policy issuance is usually time taking with lots of documents and medicals. Claim Settlement Ratio plays an important role at the time of choosing a term insurance provider.

Thanks to ICICI Prudential Life Insurance. The scoring formula takes into account complaint data from the National. Term policies last a fixed number of years while permanent policies remain in place for your entire lifetime.

We reviewed more than two dozen life insurance companies and identified the term life insurance policies that stood out from the rest including ones that provide cash values access to dividends income for disability fitness perks and premium breaks if you become unemployed or have to file a home insurance claim. To help you shop for life insurance we put together a guide with the best term life insurance companies. NerdWallets ratings are determined by our editorial team.

Here are our top picks. Our content is free because we may earn a commission when you click or make a purchase using our site. But dont be fooled - this is NOT a cost-free financial investment and it turns out to be much more expensive and inflexible than other ways of investing.

Bestow earned 4 stars out of 5 for overall performance. AM Best rating of A Superior for financial strength. These companies were reviewed and scored based on five main criteriacustomer experience financial strength policy offerings riders and website accessibility.

Permanent life insurance policies are much more expensive than term life insurance policies because the policy also acts as an investment account. The max life term insurance plan i have bought in low premium is fully satisfactory to me.