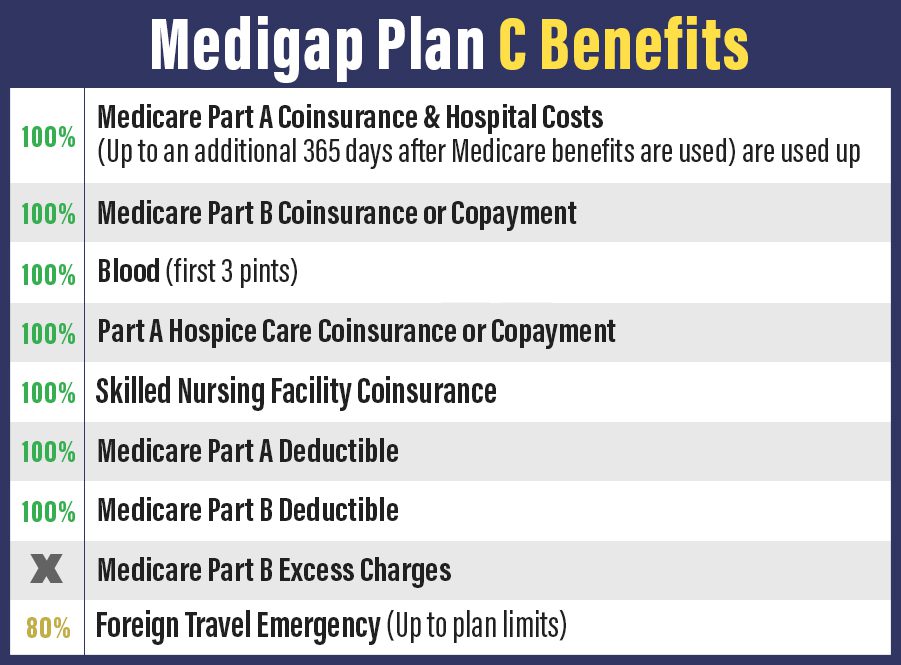

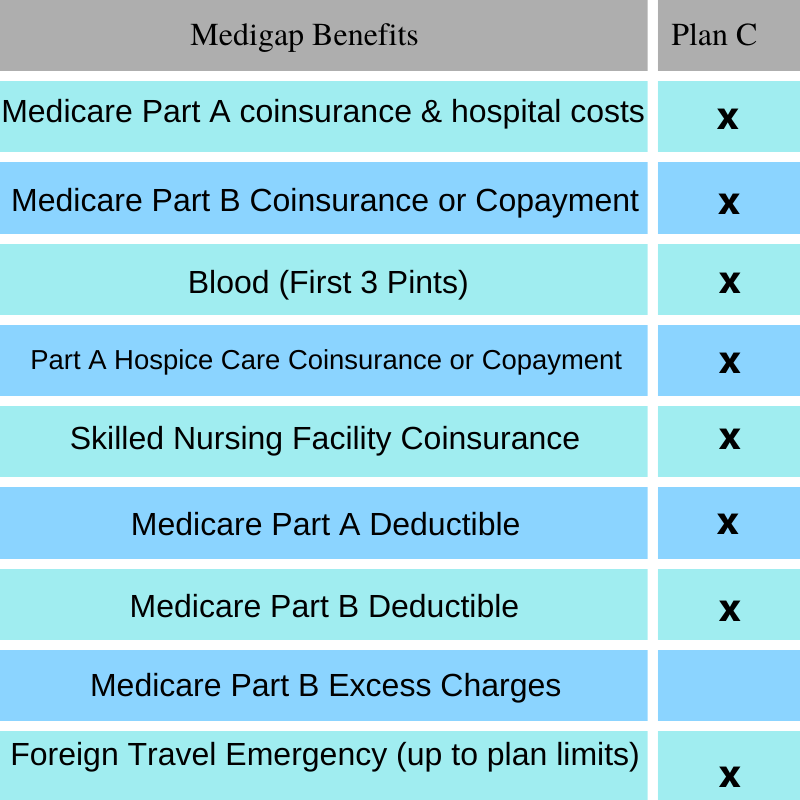

Medigap can cover your Part A deductible and coinsurance. Vision care is not seen as medically necessary so Original Medicare doesnt cover eye exams eyeglasses or other related vision services.

Medicare Supplement Plan G Our Most Popular Plan

Medicare Supplement Plan G Our Most Popular Plan

Youll pay for all medical services or supplies until your out-of-pocket costs reach that amount if you enroll in Plan G.

Does plan g cover dental. Some services such as a routine exam may be covered in full. Does Medicare Cover Vision Care. Plan G also covers 80 of emergency health care costs while in another country.

According to Medicaregov Medigap policies generally dont cover long-term care vision or dental care hearing aids eyeglasses or private-duty nursing. However you must pay a 250 deductible first and the care has to occur during the first 60 days of a trip. Part A however may help with certain dental services while youre in the hospital.

You can purchase this plan through a private insurance company. Comparing and choosing Medigap A person can. This means you should plan to pay for it out of pocket.

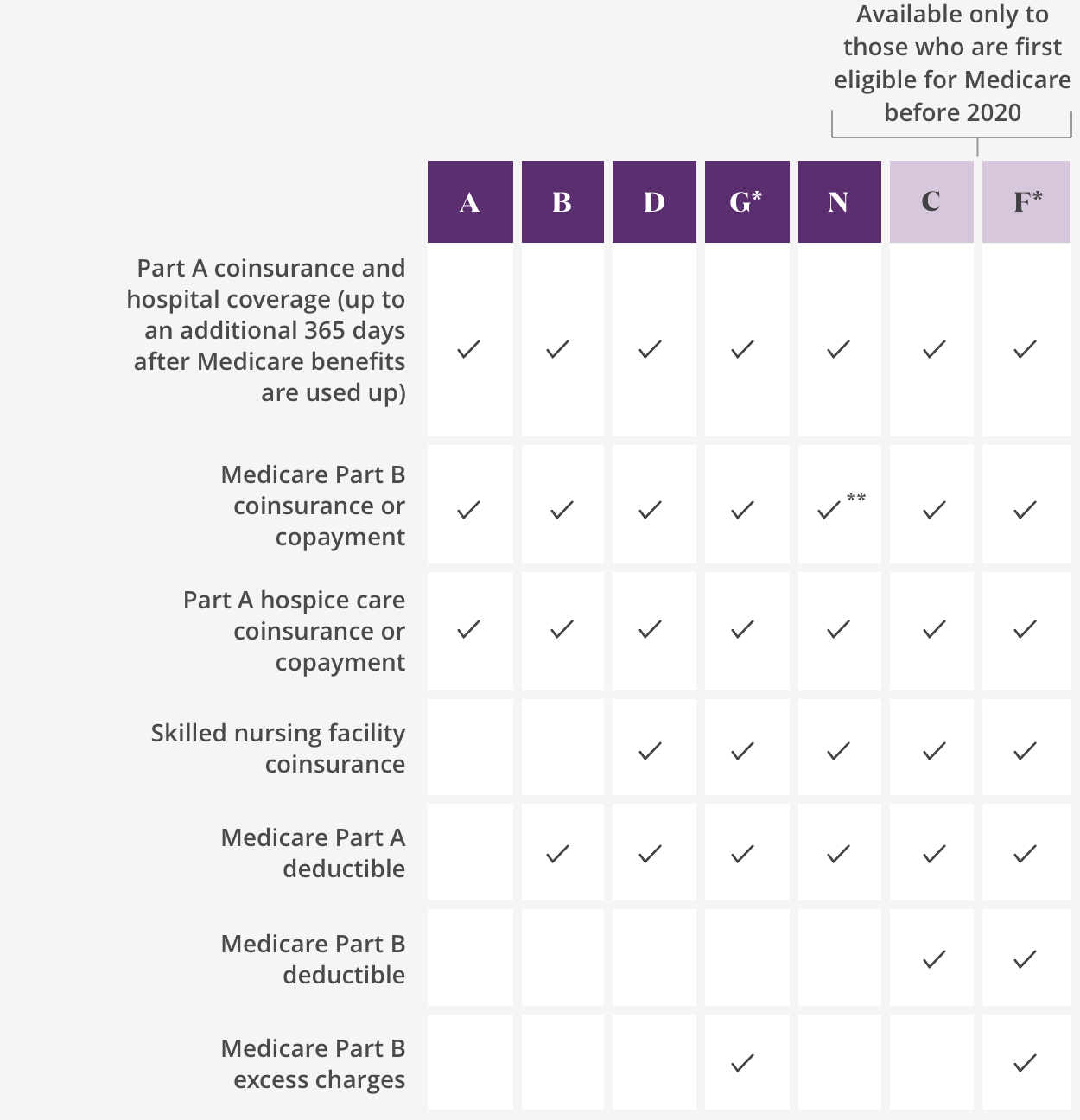

This deductible is 203 in 2021. Dietary advice and counseling. For example MedSup Plan G doesnt cover the Medicare Part B deductible.

Its also referred to as Medigap Plan G. Medigap Plan G is almost the same as a Plan F policy. It is important to know what coverage you have regarding your vision and dental care.

After your out-of-pocket costs hit that limit youll pay 20 of the Medicare-approved. This plan provides almost the same level of coverage as Plan F which offers the highest level of coverage with no out-of-pocket expenses for Medicare covered servicesThe difference is you will pay the Medicare Part B Medical annual deductible before Plan G will kick in to start paying Part B costs. If you enroll in an Aetna Medicare Advantage plan that includes dental coverage some of the services that may be covered include.

Plan G doesnt cover routine dental care. Medigap and Dental Care Neither Medicare nor Medigap cover routine dental care such as teeth cleaning fillings and tooth extractions. Because Medicare Advantage plans are available through Medicare-contracted private insurance companies benefits may vary by plan.

Additionally Plan G does not cover outpatient medications from the pharmacy. Both plans offer seniors comprehensive coverage and are among the most robust of all supplements sold by AARP Insured by UnitedHealthcare Insurance Company. Medicare Supplement Plan G covers your portion of medical benefits with the exception of the outpatient deductible covered by original Medicare.

For 2020 the Medicare Part B deductible is 198 per year. Costs will vary based on where. First Plan G covers each of the gaps in Medicare except for the annual Part B deductible.

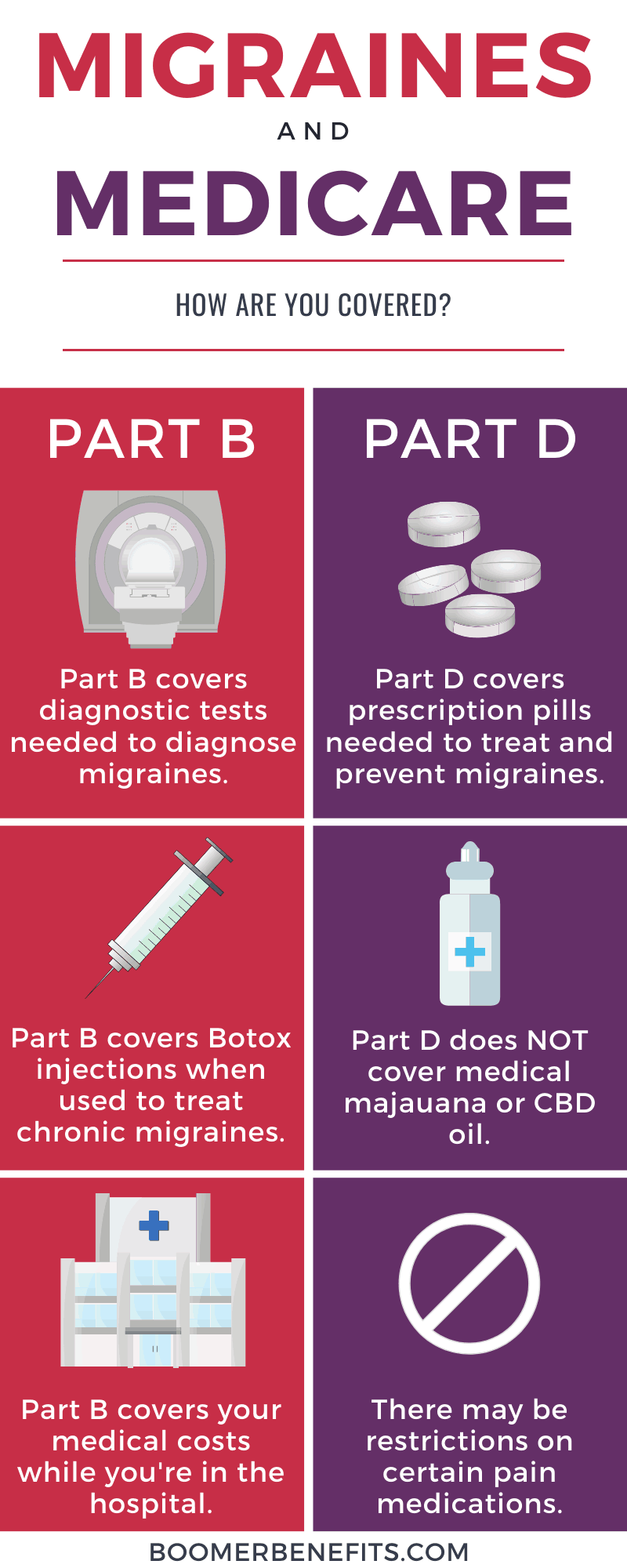

Dental coverage is limited under Original Medicare and you wont be covered for most routine dental services. Your Original Medicare insurance Parts A and B or Medicare Advantage Plan Part C may offer coverage for certain preventive and diagnostic exams treatments surgeries or some supplies. What Plan G Doesnt Cover.

Also the plan sets a lifetime limit of 50000 on this type of coverage. No Medigap plan covers dental and neither does Medicare. For starters it wont cover the cost of your annual Part B deductible.

Teeth cleaning scaling and polishing. Office visits for oral examinations. However routine dental coverage may be available as part of a Medicare Advantage plan.

The Part B deductible in 2020 is 198. Medigap Plan G does not cover the Part B deductible or have an out-of-pocket limit. Unfortunately Plan G doesnt cover every type of medical expense.

However there is coverage for emergency oral surgery that takes place in the hospital. However if you suffer a dental emergency and must visit the hospital a Medicare Supplement Insurance plan may provide coverage for Original Medicare deductibles copayments or. Medicare Plan G also called Medigap Plan G is an increasingly popular Supplement for several reasons.

Dental coverage is an additional benefit that some but not all UnitedHealthcare Medicare Advantage plans offer. Medicare Supplement Plan G is nearly the same as a Plan F policy. Medicare Supplement Plan G is a type of Medigap plan to cover your out-of-pocket healthcare costs.

The only difference is that Plan G makes the beneficiary pay the Medicare Part B deductible out-of-pocket. Emergency health care costs while traveling abroad. Both plans offer you comprehensive coverage and are among the most robust of all supplements offered by Aetna Health and Life Insurance Co.

When using your plan to receive covered dental care you may be subject to a deductible and cost-sharing measures such as copayments or coinsurance. But not all vision and dental care is routine. Original Medicare generally doesnt cover dental exams procedures or supplies.

Outpatient medications are covered through Part D plans. The one difference is that Plan G makes you pay the Medicare Part B deductible out-of-pocket. Heres a quick look at what costs Plan G.

/GettyImages-1193052595-46eed140a7c54f758c94ddf7bfb2375f.jpg)