This means you may qualify for financial assistance on a health plan through the marketplace exchange. Please visit our FAQs to find out why an HSA medical plan might be right for you.

Covered California Small Business Quotes Covered California Get Covered California Rates Dogtrainingobedienceschool Com

Covered California Small Business Quotes Covered California Get Covered California Rates Dogtrainingobedienceschool Com

Our Sharp Individual plans are available through Covered California.

Best covered california health plan. Heres how to choose the best Covered Ca plan for your situation. Eligibility criteria for Covered California. Covered California Health Insurance Plans 212020.

Single 30 yo male no health issues. Covered Californias quality ratings show how our health plans compare on helping members get the right medical care and on member-reported experiences of care and service. To be rated the health plan must have at least two of the three component scores to include the Getting the Right Care score.

Several Covered California plans earned very high or top. Health Net Sharp Health Plan. Covered California has been reporting quality ratings since day one.

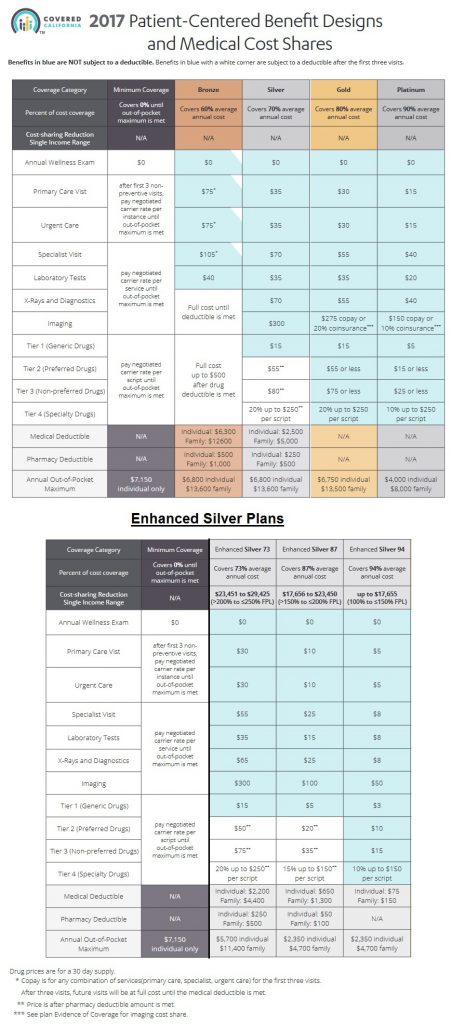

Compare the benefits of the low-cost bronze 60 bronze HSA and minimum coverage plans by viewing the low cost plan benefit comparison chart. Stability in the Face of Uncertainty The Patient Protection and Affordable Care Act created a new era of health care across the nation and Covered California has sought to make the possibility of affordable and meaningful coverage real for millions of Californians. Just got dropped from Medi-Cal for making too much money 28k and now have the pleasure of entering the American medical system.

Anthem Blue Cross Small Group. Start the PlanFinder tool above for detailed help on comparing the plans. In this article we cover the vital aspects that should make it easier for you to avail of the best Covered CA health insurance plan.

Compare brand-name Health Insurance plans side-by-side and find out if you qualify for financial help to pay for your health coverage. Chinese Community Health Plan. Chinese Community Health Plan.

Quote Covered California health plans with Tax Credit to view rates and plans side by side for both carriersFree. Covered California does offer the Bronze 60 HSA medical plan. Covered California is the only place to get premium assistance to help you buy health insurance in California.

We compared quotes for health plans and concluded that the Silver 70 EPO and Silver 70 HMO were the most affordable Silver plans in most counties of California. Run your Covered Ca quote in a new window here. How To Pick The Best Covered California Plan.

Top of the Line Think the Rolls-Royce of the Covered California Metal Plan Portfolio. Differences between HMO EPO PPO plans. In exchange for a higher premium per month.

Again there is absolutely no cost to you for our services. Covered California is the state exchange where Californians are able to shop brand-name health insurance companies and receive financial help based on income. California Choice Small Group Exchange.

Valley Health Plan LA. An overall quality rating is constructed for each health plan by summarizing all of their quality results. Health Net of California.

I was initially looking at the bronze plans but with the absurdly high deductible 6000 it seems to negate the entire purpose of having health insurance to begin with. Shop Compare Health Insurance Plans Covered California. Here is some helpful information to help you find the right plan.

Blue Shield Small Group. It offers a range of plans so consumers can choose the one that best meets their health needs and financial situation. Covered California - which plan to choose.

Blue Shield of California. California health plans perform well in most areas. Regardless of which route you take let Covered Californias.

Covered California provides consumers with an overall quality rating and individual ratings for three major aspects of health plan performance. California Health Plans is a privately operated independent marketing website and is not part of or directly associated with any health insurance company or provider. You must a citizen of the USA or a lawfully present immigrant.

The Platinum plan offers a much smaller out of pocket expense when it comes time for doctors visits labs prescriptions etc. Not all health plans products or coverage options may be offered in your service area. Determine if youre eligible for a tax credit Section 1 Find the best plan level bronzesilver gold or platinum for your needs and budget Section 2.

2020 Covered California Health nsurance Plans 12. As of 2017 Kaiser Blue Shield Anthem Molina and Health Net made up the majority of the California health insurance market. 2018 Covered California Health Insurance Plans 1 Covered California.

Compare brand-name Health Insurance plans side-by-side and find out if you qualify for financial help to pay for your health coverage. These ratings play an important role in helping Californians get better care at affordable prices. We are able to forward inquires to licensed health insurance agencies and their agents who are qualified to discuss the health coverage options available in your state.

Oscar Health Plan of California. You can evaluate your percentage of FPL. Travel Health.

Once you know the score you can avail of the. Covered California has served. Blue Shield of California.

Use the Shop Compare tool to find the best Health Insurance Plan for you. Covered California Platinum 90 Plan. Shop Compare Health Insurance Plans Covered California.

For the 2021 plan year the average monthly cost of health insurance in California is 546 for a 40-year-old. Health Plan Quality Ratings. For your convenience Covered California offers the FPL chart.

Covered Californias mission to expand coverage by making health care more affordable is based on Californians getting the health. Since October of 2013 when you apply through Covered California you may qualify for a discount on your health insurance plan or gain access to the states Medi-cal program.

:max_bytes(150000):strip_icc()/ChooseAmongBronzeSilverGoldAndPlatinumHealthPlans2-d91b2944d5494cd8818e76d01230a608.png)