You have the right to purchase any policy offered by Florida Blue with or without the additional Annual Out-of-Pocket Limit. Members can use any Medicare-participating doctor or hospital they want without referrals even when traveling across the US.

Https Digitalcommons Unf Edu Cgi Viewcontent Cgi Article 2566 Context Flablue Text

Health coverage is offered by Blue Cross and Blue Shield of Florida Inc DBA Florida Blue.

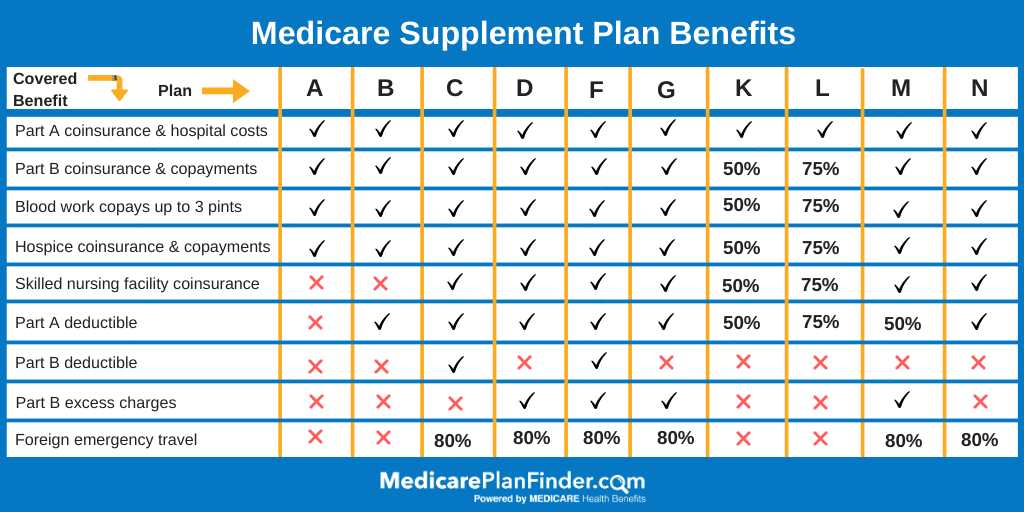

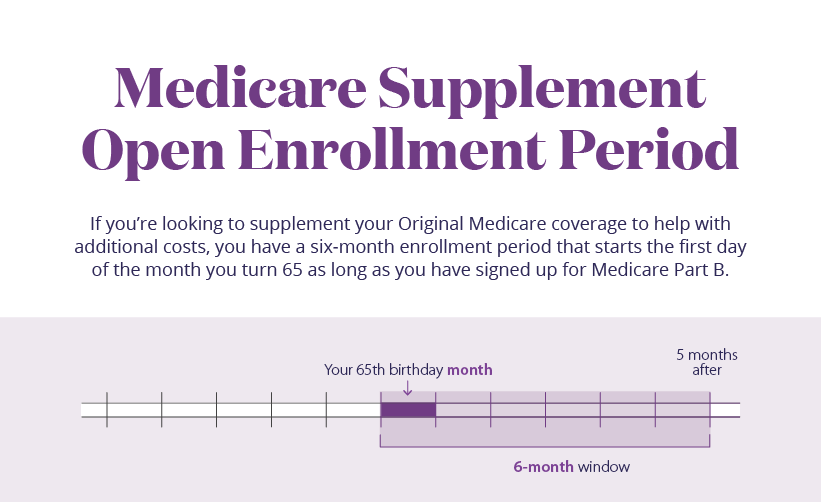

Blue cross blue shield medicare supplement florida. Dental exams and cleanings at no additional cost. Medicare Supplement Insurance plans can help cover of the out-of-pocket expenses that Original Medicare Part A and B doesnt cover. The open enrollment period for Medicare runs from October 15 through December 7 on an annual basis however this is not the case for individuals interested in Medigap Medicare Supplement coverage.

For more information about Medicare including a complete listing of plans available in your service area please contact the Medicare program at 1-800-MEDICARE TTY users should call 1-877-486-2048 or visit wwwmedicare. When trying to compare the best Medicare Supplement plan in Florida offering the best rates it is useful to know that every Medicare insurance including Blue Cross Blue Shield offers the same coverage. These companies are affiliates of Blue Cross and Blue Shield of Florida Inc and Independent Licensees of the Blue Cross and Blue Shield Association.

HMO coverage is offered by Florida Blue Medicare Inc DBA Florida Blue Medicare. Florida Blue is a PPO RPPO and Rx PDP plan with a Medicare contract. Horizon Medicare Blue Supplement plan advantages.

Florida Blue Medicare is an HMO plan with a Medicare contract. Blue Cross Blue Shield BCBS only offers all 10 Medigap policies in Florida and North Carolina but even here plan availability might vary based on the county where you live. These companies are affiliates of Blue Cross and Blue Shield of Florida Inc and Independent Licensees of the Blue Cross and Blue Shield Association.

However original perhaps Naked as its known Medicare doesnt pay for all of your health care expenses and out-of-pocket costs can be significant. Health insurance is offered by Blue Cross and Blue Shield of Florida Inc DBA Florida Blue. Health coverage is offered by Blue Cross and Blue Shield of Florida Inc DBA Florida Blue.

Dental Life and Disability are offered by Florida Combined Life Insurance Company Inc DBA Florida Combined Life. HMO coverage is offered by Florida Blue Medicare Inc DBA Florida Blue Medicare. HMO coverage is offered by Health Options Inc DBA Florida Blue HMO.

Dental Life and Disability are offered by Florida Combined Life Insurance Company Inc DBA Florida. For a little more than 15 a month you can add dental vision and hearing coverage to your Medicare Supplement plan. Starting Feb 1 2021 Blue Cross will offer this package to all Medicare Supplement members.

Providers who participate in a network program to receive full Medicare supplemental benefits. BlueMedicare Supplement Plan K L M and N policies include additional out-of-pocket expenses that must be satisfied before some policy benefits are paid. Dental Life and Disability are offered by Florida Combined Life Insurance Company Inc DBA Florida.

Dental Life and Disability are offered by Florida Combined Life Insurance Company Inc DBA Florida. Blue Cross Blue Shield also offers Medicare Advantage also known as Medicare Part C. An insurance company does not offer Supplement plans that differ from those offered by another agency.

See any doctor that accepts Medicare. You have the right to purchase any contract offered by Blue Cross and Blue Shield of Florida with or without restricted network provisions. Private insurance companies such as BlueCross BlueShield offer Medigap policies to new enrollees.

This additional coverage gives you. And provides a wide selection of Medicare Supplement Insurance also called Medigap plans. Blue Cross Blue Shield BCBS is among the leading health insurance carriers in the US.

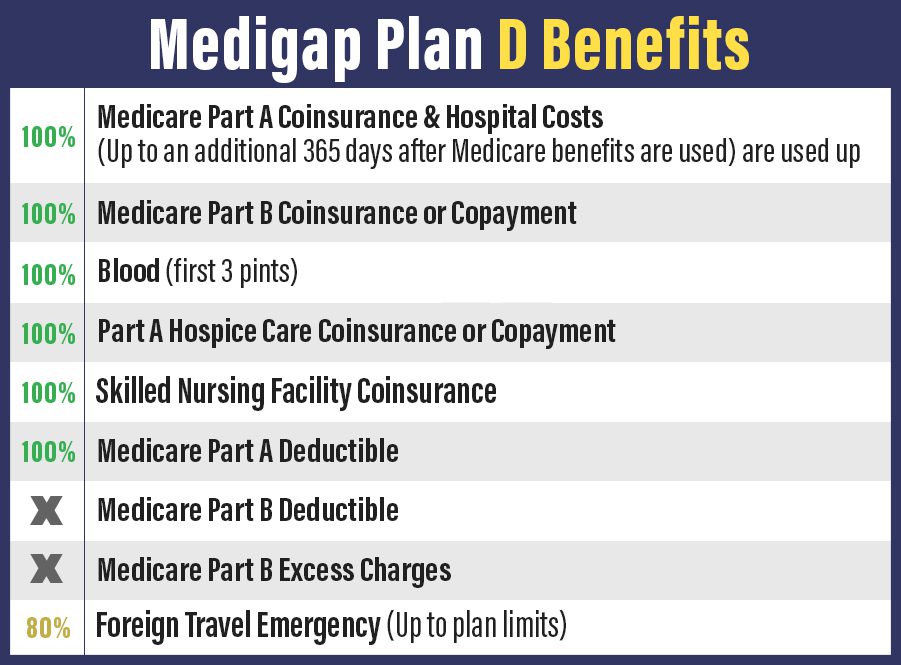

But because the company does offer all 10 plans well outline what those plans cover since again coverage is standardized at the federal level in all but three states. The open enrollment period for a Medigap. Medicare Supplement Plans in Fort Myers Tampa Bonita Springs FL Blue Cross Blue Shield Medicare Supplement Plans and Group Health Insurance Serving Fort Myers Lakeland Sarasota and all of West Central and Southwest Florida 800-330-7124.

39610 21420 30400 35590 36620 NOTE. You must first enroll in Medicare Part A and Part B before joining a Medigap Medicare Supplement plan. Premium amounts are available for bi-monthly quarterly semi-annual or annual payment modes.

Blue Cross Blue Shield BCBS is among the leading health insurance carriers in the US. Plus the benefits for Medicare Supplement insurance plans in Florida are identical. Coverage can begin as early as April 1 2021.

HMO coverage is offered by Florida Blue Medicare Inc DBA Florida Blue Medicare. If you live in Minnesota Massachusetts. To find out about premiums and terms for these and other insurance options how to apply for coverage and for much more information contact your local Blue Cross Blue Shield company.

Florida Blue Medicare Supplement Insurance As a Florida senior youre eligible for Medicare and thats a good thing. Medicare Supplement Insurance plans can help cover of the out-of-pocket expenses that Original Medicare Part A and B doesnt cover. Anthem Blue Cross and Blue Shield offers a Medicare Supplement Plan also called Medigap which pays for out-of-pocket expenses youll have with Original Medicare.

And provides a wide selection of Medicare Supplement Insurancealso called Medigap plans. Enrollment in Florida Blue or Florida Blue Medicare depends on contract renewal. Under Plans K and L you must satisfy the.

The best Medicare Supplement plan in Florida. These companies are Independent Licensees of the Blue Cross and Blue. Medicare Supplement plans are designed to pay for expenses not covered by Original Medicare Medicare Part A and Part B.

These companies are affiliates of Blue Cross and Blue Shield of Florida Inc and Independent Licensees of the Blue Cross and Blue Shield Association. Each Blue Cross Blue Shield company is responsible for the information that it provides. These policies help with Medicare out.

Health coverage is offered by Blue Cross and Blue Shield of Florida Inc DBA Florida Blue. Contact your local Blue Cross Blue Shield company for help choosing a Medigap Medicare Supplement plan and getting enrolled.