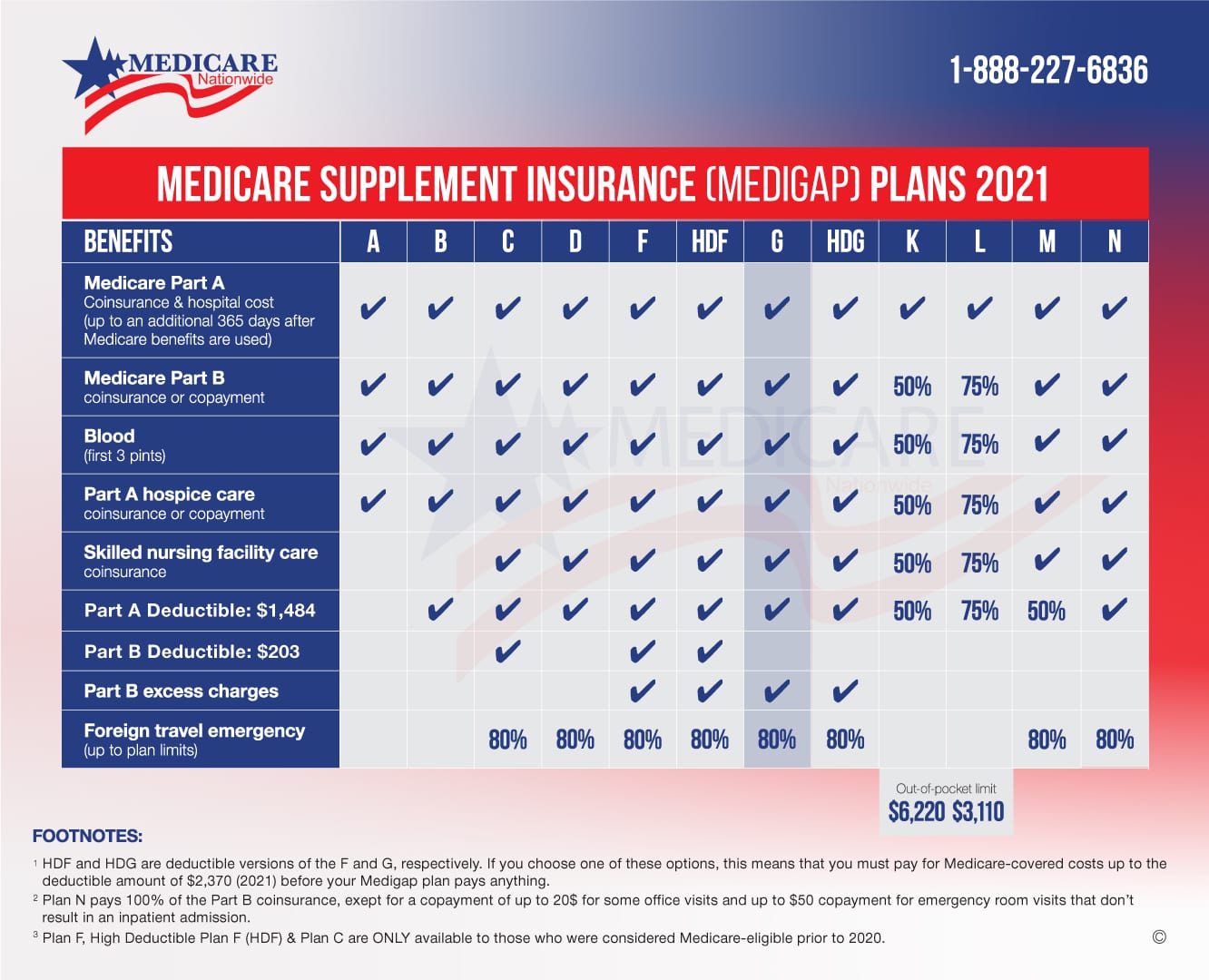

A High Deductible Medicare Supplement Plan G version also exists and has a 2370 per year deductible in 2021 Comparison of standard Medicare Plan G vs High Deductible Plan G. 21 Zeilen Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 14346 per month and.

Medicare Plan G Medicare Part G Medicare Plan Finder

Medicare Plan G Medicare Part G Medicare Plan Finder

Plan N is another one you should be looking at if you are interested in Plan G and what it covers.

Medicare supplement plan g cost comparison. If you have a Plan G policy you wont be responsible for these costs. They are also set based on whether youd like a high-deductible plan or a low-deductible plan. This means that you will have to pay 183 annually before Plan G begins to cover anything.

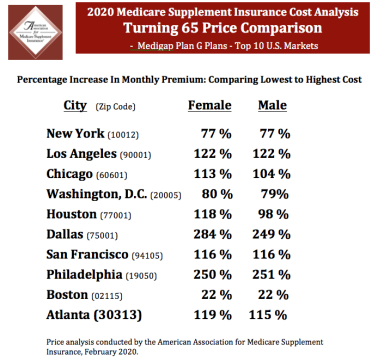

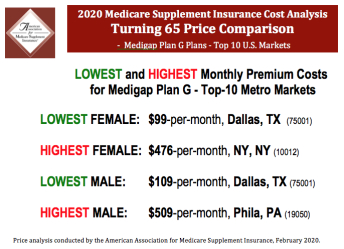

According to the Associations 2020 Turning 65 Price Comparison a woman in Dallas could pay as little as 99-a-month for Medicare Plan G coverage or as much as 381-per-month. Even though Plan G doesnt cover the Part B deductible some Plan F options could have high enough premiums that the cost difference between Plan F vs. Medicare Supplement G Plans have stepped up as the leader in having the lowest out-of-pocket costs covering everything F plans do with the exception of the Part B deductible 198 in 2020.

12 Zeilen Plans F and G also offer a high-deductible plan in some states. The HIGHEST price is S381-per-month female age 65. Medicare Supplement Plan G Comparison Chart How Much Does Medicare Plan G Cost in 2021.

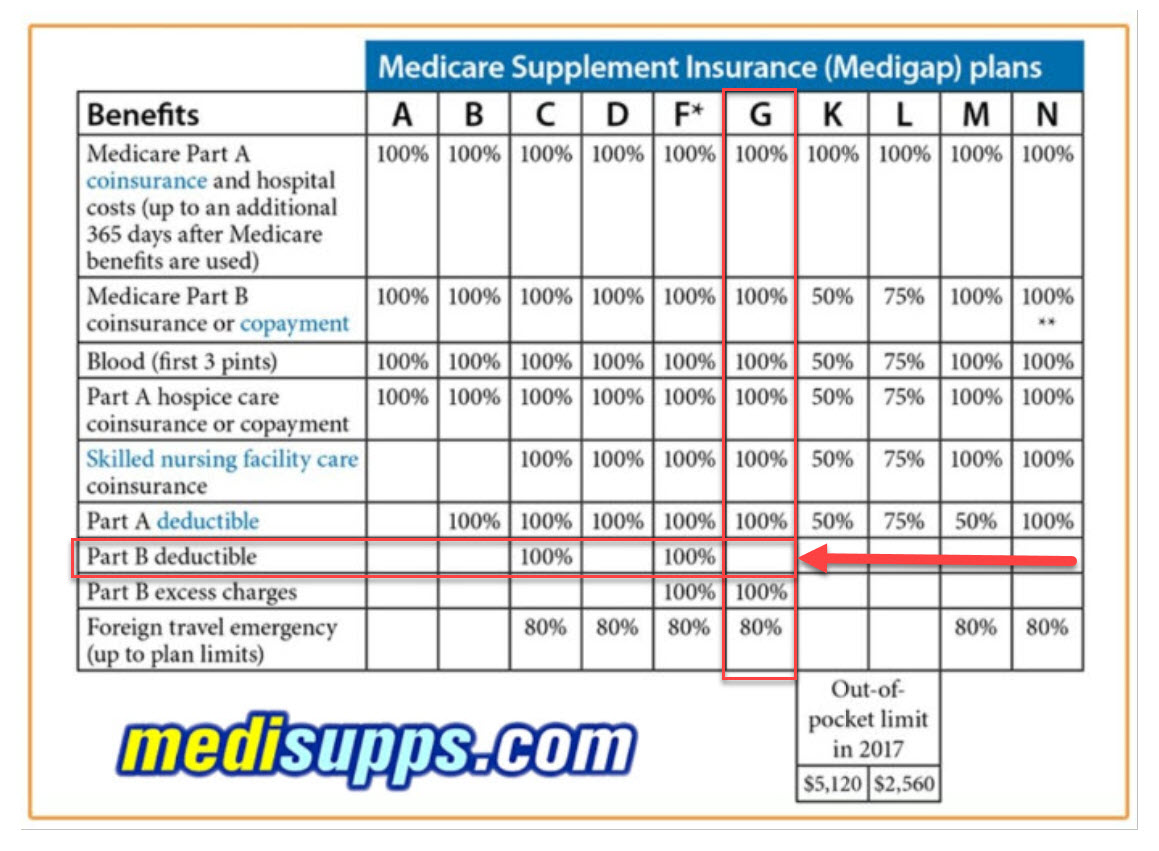

Part F is also only available to those who were eligible for Medicare before January 1 2020 or who had already enrolled in the plan before that date. With a standard Medicare Supplement Plan G there is a small deductible per year 203 in 2021 and 203 is the total out-of-pocket cost for the entire year. The organization compared pricing for.

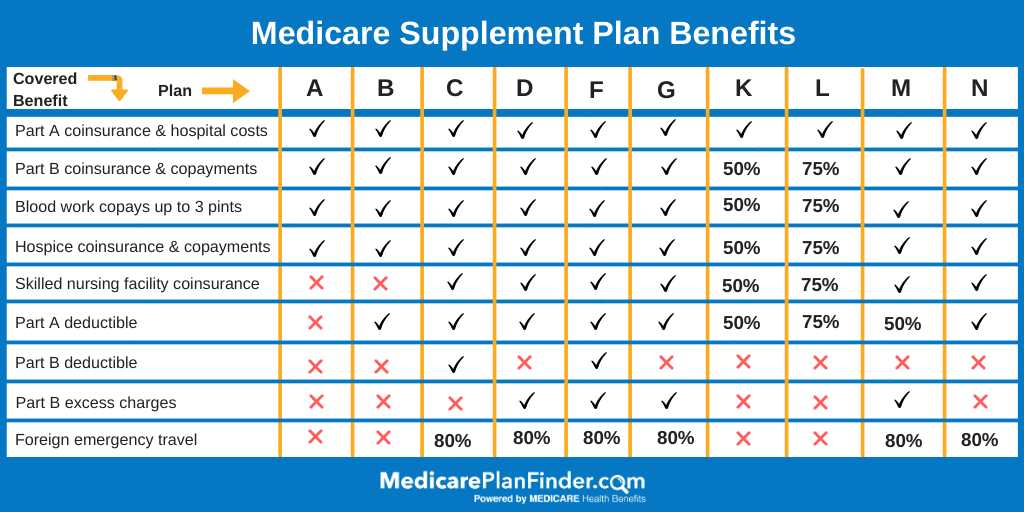

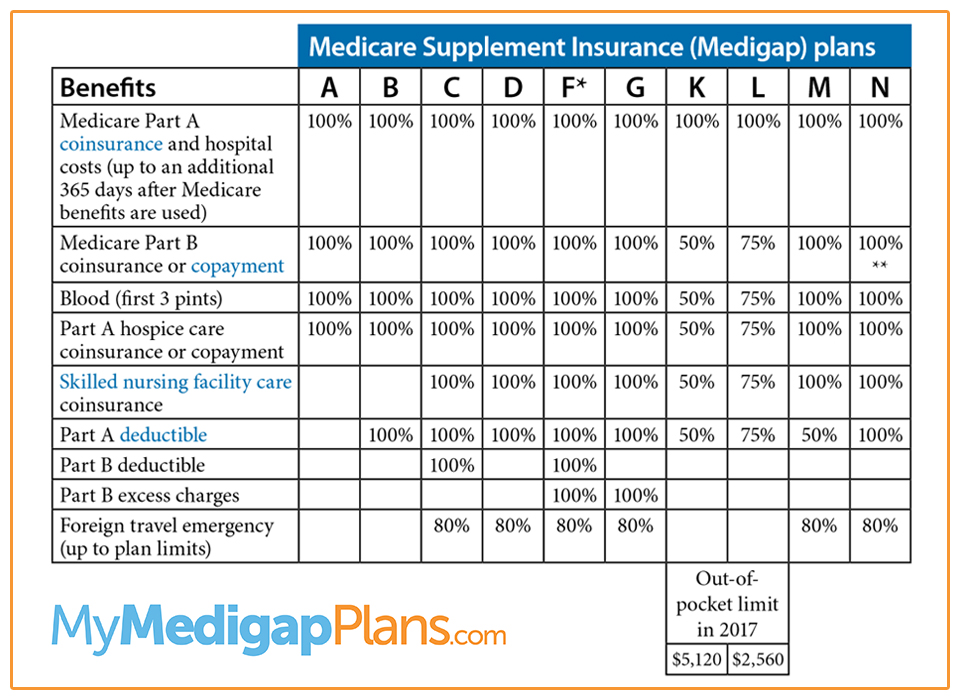

Medicare Supplement Plan Comparison The ten Medicare Supplement Plans offer benefits that might overlap with each other to ensure your health. If a Plan F option includes premiums that cost more in a year than the price of a Plan G policy plus the Medicare. A discount is given if you sign up via its online portal.

So how would you know which one is the right plan for youWell with Scott Sims Insurance we have made this decision-making process much simpler. Its the one Supplement plan to offer full coverage and there is good reason why many seniors go for this plan over all the others. Plan G would be higher than the Part B deductible itself.

Plan N will cover you almost as much as Plan G does but it cuts off a bit more. The only benefit Plan F offers that Plan G doesnt is coverage for the Medicare Part B deductible. Medicare supplement plans G and F are virtually identical aside from the fact that Plan F covers a Part B deductible.

The average premium cost for a Medicare Supplement Insurance plan in 2018 was 152 per month1 The average cost of each type of Medigap plan can vary quite a bit from one plan type to another. With Medicare Supplement plans the companies are allowed to determine what they charge for their plans although the coverage is Federally-standardized. Part G can be purchased by anyone who became eligible for Medicare after January 1 2020.

Plan G does not cover the Part B deductible the Part B deductible for 2018 is 183. Overall Medicare Supplement Plan G monthly premiums vary depending on what part of the country you live in your age and your gender. Medicare Supplement Plan G covers most of the out-of-pocket.

Medicare Supplement Plan G. Medicare Supplement Plans F and G are identical with the exception of one thing. This means that plan availability and plan premiums may vary.

Plan G covers copays and coinsurance associated with Medicare parts A and B. Another popular supplement to your Medicare is going to be Plan G. The average cost of Medigap Plan G is around 100-200 per month.

In addition Medigap Plan G prices can vary within the same geographical area by as much as 100month with different insurance companies although the coverage is completely identical. The short answer is that the monthly premium for Medicare Plan G can start around 100. To help you find the best Medicare Supplement Plan G provider we compared and ranked the top plans taking into consideration price discounts geographic coverage user.

Medicare Supplement Insurance plan premiums are sold by private insurance companies. Now Plan Ga new option for new Medicare enrollees beginning January 1 2020offers the closest available coverage to what was Plan F. Humana offered us 16958 per month for Plan G with an online discount and a high-deductible Plan G was 6314 with an online discount.

That is a significant monthly difference. It will cover everything Plan F does except for the Part B annual deductible which in 2021 is 203. In every city we looked at there is a significant difference between the lowest available price and the highest shares Jesse Slome AAMSIs director.

Medicare Supplement Plan G also offers a lot of peace of. The LOWEST cost for Medicare Plan G is 99 per-month female age 65. Plan F is very close in coverage to Plan G and it costs a bit more and covers a bit more.

Typically the monthly premium for MediGap plan G is much more cost-efficient than Plan F even with the Part B deductible. The quote estimates we were given from the Medicare plan finder were 135 to 491 for Plan G and 47 to 110 for the high-deductible plan.

Medicare Plan G What You Need To Know Ensurem

Medicare Plan G What You Need To Know Ensurem

Ultimate Guide To Selling Medicare Supplements Senior Market Advisors

Ultimate Guide To Selling Medicare Supplements Senior Market Advisors

Complete Medicare Supplement Plans Comparsion Chart For 2021

Complete Medicare Supplement Plans Comparsion Chart For 2021

Medicare Supplement Plans Comparison Chart 2021 What S New

Medicare Supplement Plans Comparison Chart 2021 What S New

Medicare Plan G Costs Best Medigap Plan G Plans

Medicare Plan G Costs Best Medigap Plan G Plans

Essay Writing Www Badeloft Com

Essay Writing Www Badeloft Com

Medicare Plan G Review Medicare Nationwide

Medicare Plan G Review Medicare Nationwide

Medicare Supplement Plans 2021 The 3 Best Plans

Medicare Supplement Plans 2021 The 3 Best Plans

Medicare Supplement Plans Comparison Chart Compare Medicare Plans

Medicare Supplement Plans Comparison Chart Compare Medicare Plans

Comparison Chart Of All 10 Medicare Supplement Plans Policies

Comparison Chart Of All 10 Medicare Supplement Plans Policies

Medicare Plan G Costs Best Medigap Plan G Plans

Medicare Plan G Costs Best Medigap Plan G Plans

Medicare Supplement Plans Comparison Chart 2021

Best Medicare Supplement Plans Online Plan F G Changes

Best Medicare Supplement Plans Online Plan F G Changes

Compare Plans Empower Medicare Supplements

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.