However Plan G will have one of the highest monthly premiums among all the Medicare supplement policies. You should also consider it if you are living with flatmates who are also into Netflix.

:max_bytes(150000):strip_icc()/ChooseAmongBronzeSilverGoldAndPlatinumHealthPlans2-d91b2944d5494cd8818e76d01230a608.png) Choose Among Bronze Silver Gold And Platinum Health Plans

Choose Among Bronze Silver Gold And Platinum Health Plans

Thats a plan you should consider if you have kids in the house.

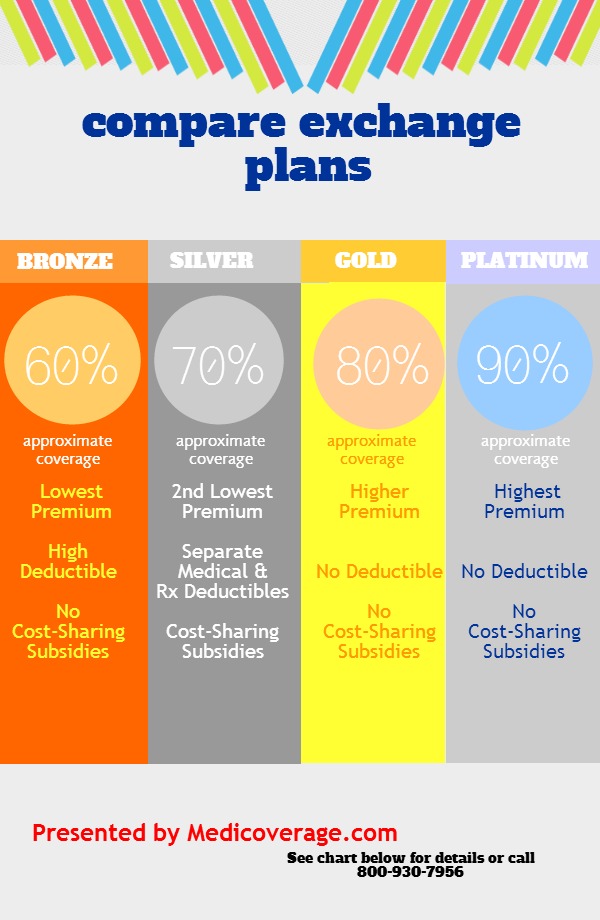

Which plan will have the highest monthly premium. The states PDP plans are similar with a deductible of 36096 being 18 higher than average but having a rate of four star plans that is six points above the national average. High-deductible Plan F. Therefore you should weigh the cost of this monthly premium with your potential medical expenses for the year.

It will cost you 1799 per month but allows streaming content on up to 4 screens simultaneously. This means your plan will start paying for its maximum portion of your healthcare costs sooner. A Platinum insurance plan has the highest monthly premiums and lowest out-of-pocket costs.

If you use a lot of care a Gold plan could be a good value. In the states with lower premiums in 2020 the. The high-deductible version of Medicare Plan F has a lower monthly premium and higher out-of-pocket expenses.

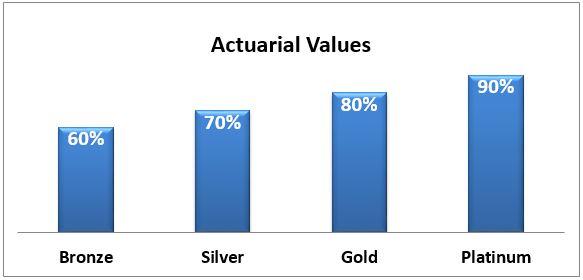

Monthly premium payments Annual premium payments. They have actuarial values of. Hawaiis 20 MAPD plans have some of the highest premiums 4671 and drug deductibles 21479 but also some of the highest quality with 16 of those plans being rated four stars or higher.

Youre willing to pay more each month to have more costs covered when you get medical treatment. Some plans such as LIC monthly income plan monthly income plan SBI or those from other insurance companies may also offer a higher sum that equals a certain factor of the premium paid until date. Someone who can afford to pay a large sum once per year.

These plans can have very low monthly premiums but have high deductibles and pay less of your costs when you need care. The maximum annual carryover amount can be between 1000 and 2500 depending on the plan option. On the other hand it will cover.

If you know youre going to use a lot of care and can. Netflixs Roma won three Oscars last year including best cinematography Image Credit. Gold plans have high monthly premiums but low costs when you actually access healthcare.

You can split the cost four ways allowing you to stream content in the highest. EHealth has been around for 20 years and has over 5 million customers in all 50 states making them a trusted provider. The cost of health insurance plans varies by state with Vermont having the highest average premium in 2020 at 1034 and Massachusetts having the lowest average monthly premium at 398.

Traditional Medicare plus a good Medigap can become your best friends if you have a hospitalization for a serious illness as I had when an infection came out of the blue and kept me in the hospital for four months earlier this year. These may be higher with plans that have a lower monthly premium while plans with a. Deductibles are very low meaning your plan starts paying its share earlier than for other categories of plans.

Someone who finds it easier to budget month-by-month. Lowest costs when you get care. With higher out-of-pocket maximums averaging nearly 6000 you might pay more if.

If you currently have Medicare Supplement Plan F you can switch to high-deductible Plan F by contacting your insurance provider. Plan F has the highest Medicare supplement premiums compared to C G and N. Across the country 36 states saw their average premiums decrease from 2019 to 2020 while just 13 states had higher average premiums in 2020.

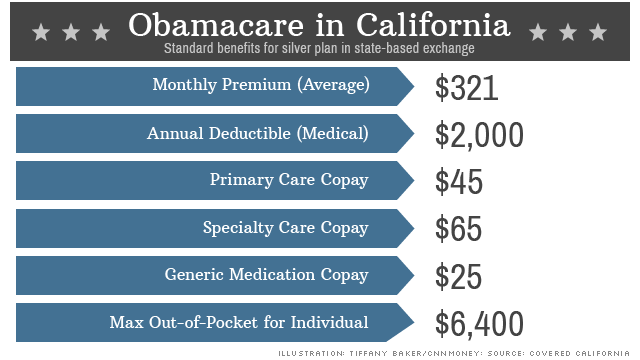

Cigna can be pricey though many of its plans have no or low premiums or deductibles. A copayment copay is an amount that you pay for a service after you have met your deductible. If you qualify for cost-sharing reductions CSRs.

Silver plans may offer good value. Best overall Medicare supplement pre-2020. But you get these extra savings only if you enroll in Silver.

Gold and Platinum plans have the highest monthly payments but also are the most protective if you get sick or need a lot of medical care. Netflix The Premium plan is the most expensive of the three at 1199 1599 AU1799 per month. These cost sharing requirements typically include.

If you qualify your deductible will be lower and youll pay less each time you get care. You pay for Medicare-covered costs up to the 2340 2370 in 2021 before the plan begins to pay for anything. Coinsurance which is the percentage of costs the insurance plan pays for covered services once participants have met the deductible.

The Premium plan is the best of the best that Netflix has to offer. Deductibles or the amount you need to pay for covered services before the insurance plan starts to pay. If you dont qualify for CSRs.

They typically have very low deductibles. Which also means youll start seeing savings sooner too if you access a lot of care in a given year. Some of the insurers also have the option of this insurance cover being paid in instalments if.

Higher carryover amounts require a higher monthly plan cost. For doctor hospital and rehabilitation charges that totaled some 35 million we paid only about 2500 out of pocket.

/ChooseAmongBronzeSilverGoldAndPlatinumHealthPlans2-d91b2944d5494cd8818e76d01230a608.png) Choose Among Bronze Silver Gold And Platinum Health Plans

Choose Among Bronze Silver Gold And Platinum Health Plans

The Health Insurance Tier System Explained Smartfinancial

The Health Insurance Tier System Explained Smartfinancial

How Much Does Individual Health Insurance Cost Ehealth Insurance

How Much Does Individual Health Insurance Cost Ehealth Insurance

How Age Affects Health Insurance Costs Valuepenguin

Comparing Exchange Plans Bronze Silver Gold Platinum Medicoverage Com

Comparing Exchange Plans Bronze Silver Gold Platinum Medicoverage Com

How To Choose Between Bronze Silver Gold And Platinum Health Insurance Plans

How To Choose Between Bronze Silver Gold And Platinum Health Insurance Plans

Obamacare Is A 2 000 Deductible Affordable

Obamacare Is A 2 000 Deductible Affordable

51 Of U S Workforce Enrolled In High Deductible Health Plans Which May Leave Some Underinsured Valuepenguin

Who Has The Cheapest Health Insurance In New Jersey Valuepenguin

Lower Premiums But Higher Out Of Pocket Costs For 2020 Aca Consumers Ehealth

Lower Premiums But Higher Out Of Pocket Costs For 2020 Aca Consumers Ehealth

What Do The Bronze Silver Gold And Platinum Designations Mean Realtors Insurance Place

Health Insurance Premiums And Increases

How Much Does Individual Health Insurance Cost Ehealth

How Much Does Individual Health Insurance Cost Ehealth

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.