No insurance will not cover a tummy tuck for post pregnancy changes. Dental insurance typically does not cover orthodontic work for adults but some dental plans do offer some benefits.

Invisalign And Health Insurance What You Need To Know

Invisalign And Health Insurance What You Need To Know

Blue CrossBlue Shield does not mention Invisalign nor orthodontics specifically in its dental plans but it does stipulate that plans do not cover treatments that are cosmetic.

/invisalign-and-dental-insurance-coverage-7565b48f924b43c7b9f7f7431be4dcbe.png)

Does anthem blue cross cover invisalign. Only dental insurance that includes orthodontics will cover invisalign. It was not medically necessary for you to have children their view. Blue CrossBlue Shield does not mention Invisalign nor orthodontics specifically in its dental plans but it does stipulate that plans do not cover treatments that are cosmetic.

Blue CrossBlue Shield does not mention Invisalign nor orthodontics specifically in its dental plans but it does stipulate that plans do not cover treatments that are cosmetic. This means that for many people the answer is yes. How Much Does Blue Cross Blue Shield Cover For Invisalign Lots of people are reluctant to head to the dentist to correct their teeth placement because they do not want to put on dental braces.

Invisalign is a type of orthodontic treatment that helps to straighten. What does dental insurance cost. Registered marks Blue Cross and Blue Shield Association.

Invisalign and other in-office clear aligners are more likely to be covered by a wider range of insurance providers. While full coverage dental plans do not cover 100 of the costs they do cover preventive care and a broader range of basic and major procedures. The company claims that many dental insurance plans cover Invisalign.

Other BCBS members have found that if you are over 18 Invisalign or any type of braces are almost always considered. If you or your employer uses Delta Dental Blue Cross Blue Shield MetLife Aetna Cigna Guardian UnitedHealthCare United Concordia or Humana there will likely be a plan option that offers orthodontic benefits. Is Invisalign considered orthodontic.

Be sure to ask specific. Use the Anthem Blue Cross. Blue CrossBlue Shield does not mention Invisalign nor orthodontics specifically in its dental plans but it does stipulate that plans do not cover treatments that are cosmetic.

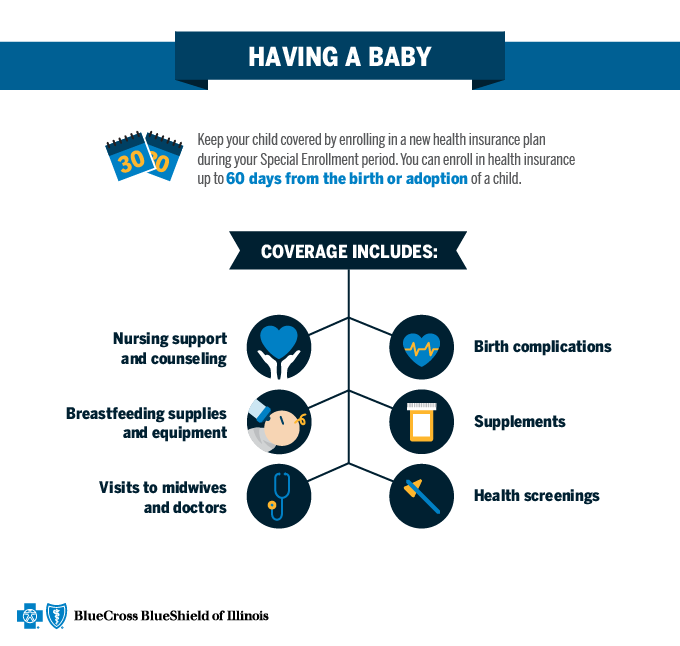

Breast pump supplies are covered with no cost share for female members with the expanded benefit when purchased from an in- network. Crowns root canals and surgical extractions. Many Invisalign insurance plans cover Invisalign just like they do braces.

But many of these policies have a cap limit on maximum yearly benefits. Does Blue Cross cover Invisalign. Braces clear aligners like Invisalign and other orthodontic treatments.

Sedation for dentistry is sometimes a great solution but not usually for orthodontics. No and yes. Some companies such as Aetna state they usually cover Invisalign but your individual employment coverage may be different even if you have an Aetna plan.

Check your plan details or call the number on the back of your card to see what your plan covers. Anthem allows reimbursement of prosthetic and orthotic devices when provided as part of a physicians services or ordered by a physician or other qualified health care provider and used in accepted medical practice unless provider state federal or CMS contracts andor requirements indicate otherwise27 мая 2020. Almost every dental insurance company offers some type of orthodontic benefits with certain plans and most include Invisalign.

Does Anthem Blue Cross Blue Shield cover orthotics. Other BCBS members have found that if you are over 18 Invisalign or any type of braces are almost always considered cosmetic. Does Blue Cross cover Invisalign.

Your insurance will cover treatment with Invisalign or Invisalign Teen. All covered services are subject to the conditions exclusions qualifications limitations terms and provisions of the Anthem Blue Cross and Blue Shield Dental PPO Certificate. These are very much like the mail-order aligners in that they are discreet and removable but your treatment involves regular in-office visits with your dentist or orthodontist.

Discover invisible dental braces. For a covered dental service this coverage will pay the applicable percentage shown in the Coverage Percentage column of the Anthem Blue Cross and Blue Shield Dental maximum allowable. In contrast others dont specifically say whether they cover Invisalign.

Is Invisalign covered by Blue Cross Blue Shield. Call your insurance provider or speak with your dental professional to determine if your insurance will fund the technique. To find doctors and hospitals when you or a covered dependent needs care away from home.

Insurance may cover a tummy tuck if you have lost over 100 pounds and do have some medical issues like. Individual Program NCQA 92011 Page 1 of 5 Anthem HealthKeepers. Does Blue Cross cover.

Anthem Blue Cross Blue Shield Vs. If youre not sure about the specifics of your insurance policy we are more than happy to help you work it out. Does Anthem Blue Cross cover Invisalign.

Other BCBS members have found that if you are over 18 Invisalign or any type of braces are almost always considered cosmetic. This means you are responsible for dental costs including braces that go over this cap. Unclear but probably not.

The good news is a cutting-edge option has actually emerged to straighten the teeth discreetly. Is an independent licensee of the Blue Cross and Blue Shield Association. Dentures dental implants and veneers.

Does insurance cover Invisalign. Sedation for dentistry is sometimes a great solution but not usually for orthodontics.