POS plans also require you to get a referral from your primary care doctor in order to see a specialist. Typically you will have a higher premium with a PPO because it offers more options.

Hmo Pos Ppo And Hdhp Making Sense Of Different Types Of Health Plans

Hmo Pos Ppo And Hdhp Making Sense Of Different Types Of Health Plans

A point-of-service plan POS is a type of managed-care health insurance plan that provides different benefits depending on whether the policyholder uses in.

Plan type pos. No problem with a PPO plan where you have more flexibility to see the doctors that work best for you although youll likely have to pay more for the cost of care for an out-of-network provider. Like an HMO you pay no deductible and usually only a minimal co-payment when you use a healthcare provider within your network. PPO stands for preferred provider organization.

Point of Service POS. The SBC shows you how you and the plan would share the cost for covered health care services. A type of health plan where you pay less if you use providers in the plans network.

With a POS plan coinsurance costs could kick in if you need out-of-network care or fail to get referrals to see other providers. Like HMOs many POS plans require you to have a PCP referral for all care whether its in or out-of-network. State of Connecticut.

Medicare Advantage Plan Part C CMS Plan ID. This is what you pay monthly for your plan. But for slightly higher premiums than an HMO this plan covers out-of-network doctors though youll pay more than for in-network doctors.

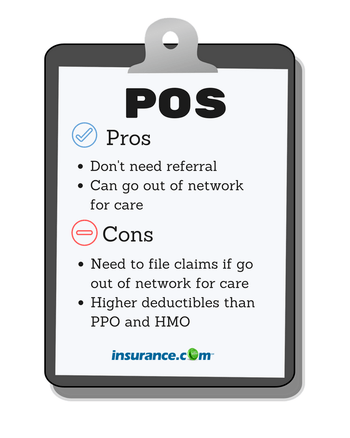

HMO PPO EPO and POS plans are all types of managed care There are pros and cons to each type of health insurance plan While some plan types generally have higher monthly premiums than others the actual differences in cost will ultimately depend on your specific plan and insurance provider. Or use the online chat tool by clicking the Health Navigator button on CareCompassCtGov. POS plans require you to get a referral from your primary care doctor in order to see a specialist.

A point-of-service plan POS is a type of managed care plan that is a hybrid of HMO and PPO plans. POS stands for point of service. In general a Point of Service POS health insurance plan provides access to health care services at a lower overall cost but with fewer choices.

IndividualFamily Plan Type. Cost is a major factor in choosing between plans. Information about the cost of this plan called the premium will be provided separately.

While every plan differs in general the more flexibility a plan offers eg covering some percentage of out-of-network care or allowing patients to see a specialist without a referral the more it will cost in terms of premiums and cost-sharing eg deductibles. BCN Advantage Prime Value HMO-POS Plan Organization Type. Like an HMO participants designate an in-network physician to be their primary care provider.

A Point of Service POS plan is a type of managed healthcare system that combines characteristics of the HMO and the PPO. United Healthcare Point-of-Service POS United Healthcare Point-of-Service POS The United Healthcare UHC POS plan gives you the freedom to see any Physician or other health care professional from a network of providers or if you choose to seek care outside of the network. Point of Service POS Plans A type of plan in which you pay less if you use doctors hospitals and other health care providers that belong to the plans network.

All these plans use a network of doctors and hospitals. Preferred Provider Organization PPO. You can access care from in-network or out-of-network providers and facilities but your level of coverage.

POS Chat with a professional Health Navigator 24 hours a day seven days a week at 866 611-8005. For a PPO plan your coinsurance kicks in once youve met your deductible. Coverage for-All Tiers Plan Type.

Cost of HMO PPO POS and EPO Insurance. POS Medical Benefit Plan Coverage for. An affordable plan with out-of-network coverage As with an HMO a Point of Service POS plan requires that you get a referral from your primary care physician PCP before seeing a specialist.

Plan Doctors Only some exceptions Benefit Type. POS The Summary of Benefits and Coverage SBC document will help you choose a health plan. Premiums tend to be higher with this type of plan which is.

Point of Service POS POS plans resemble HMOs but are less restrictive in that youre allowed under certain circumstances to get care out-of-network as you would with a PPO. This is only a summary. Plans may vary but in general POS plans are considered a combination of HMO and PPO plans.

A type of plan where you pay less if you use doctors hospitals and other health care providers that belong to the plans network. When patients venture out of the network theyll have to pay. But like a PPO patients may go outside of the provider network for health care services.

Ehbs 2016 Section Five Market Shares Of Health Plans 8905 Kff

Ehbs 2016 Section Five Market Shares Of Health Plans 8905 Kff

Health Insurance Plan Types An Image Of A Health Insurance Plan Type Chart Canstock

Health Insurance Plan Types An Image Of A Health Insurance Plan Type Chart Canstock

Employee Benefits Kainos Partners

Employee Benefits Kainos Partners

Section 4 Types Of Plans Offered 9335 Kff

Section 4 Types Of Plans Offered 9335 Kff

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

3 Easy Ways To Compare Health Insurance Plans Wikihow

3 Easy Ways To Compare Health Insurance Plans Wikihow

What Is An Hmo Benefits Cost Comparison How To Enroll

What Is An Hmo Benefits Cost Comparison How To Enroll

Types Of Health Insurance Picshealth

Types Of Health Insurance Picshealth

Point Of Service Pos Health Insurance Plans Medicaid Info Org

Comparing Health Plan Types Kaiser Permanente

Comparing Health Plan Types Kaiser Permanente

Ichra Analysis Where Are Ppo Pos Individual Market Plans Available

Ichra Analysis Where Are Ppo Pos Individual Market Plans Available

Exhibit E Distribution Of Health Plan Enrollment For Covered Workers By Plan Type Note Information Was Not Obtained For Pos Plans In Ppt Download

Exhibit E Distribution Of Health Plan Enrollment For Covered Workers By Plan Type Note Information Was Not Obtained For Pos Plans In Ppt Download

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.