Whats the Difference Between Individual and Family Deductibles. Your deductible is the amount of money you pay out-of-pocket for covered health care services before your insurance company pays anything.

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Thanks to the Affordable Care Act also known as the ACA or Obamacare certain preventive services usually are not subject to a deductible.

What is individual deductible. Co-pay coinsurance and cost of services may vary according to plan type. Here are some of the basics of insurance deductibles. 1 How can I check my plan deductible.

There is a caveat. Deductions can reduce the amount of your income before you calculate the tax you owe. Whats the Difference Between Family and Individual Deductibles.

Once youve reached your out-of-pocket maximum your plan covers 100 of costs for the rest of the year. The family deductible can be reached without any members on a family plan meeting their individual deductible. The term non-comprehensive deductible is a very common condition in many policies and can.

Under the new rules that took effect in 2016 a health plan cant require any individual to pay a deductible that is higher than the federal limit for the out-of-pocket maximum for individual coverage even if that person is covered under an aggregate family deductible for 2020 its 8150. All individual deductibles funnel. Learn what they are how they work and how much they cost.

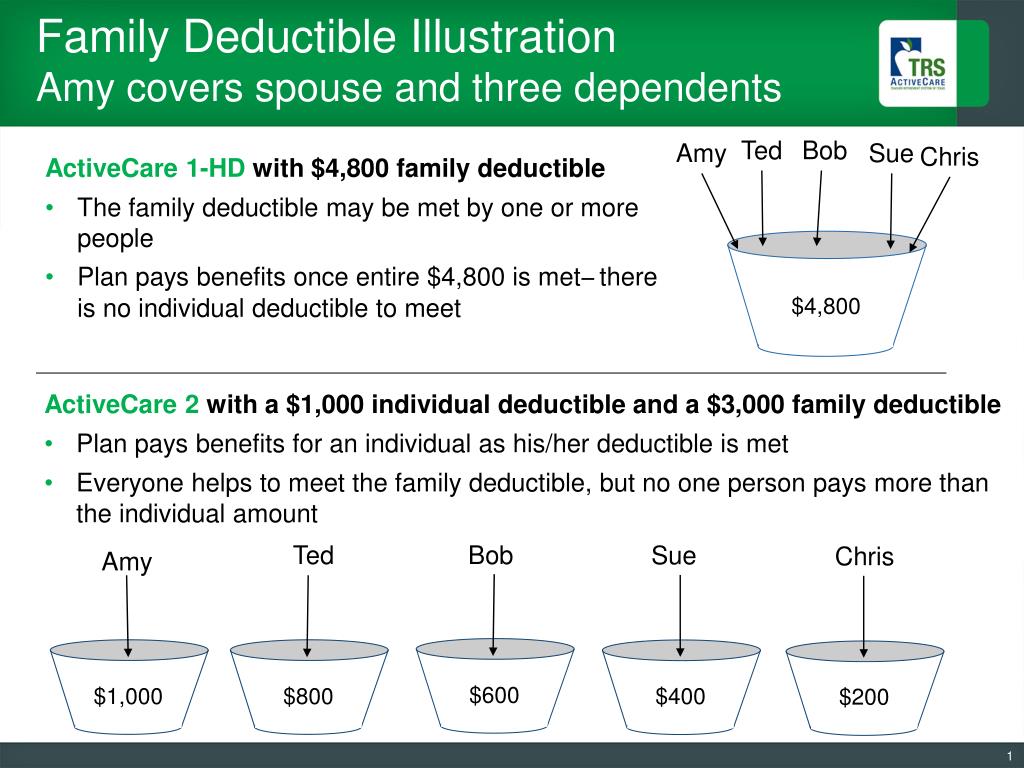

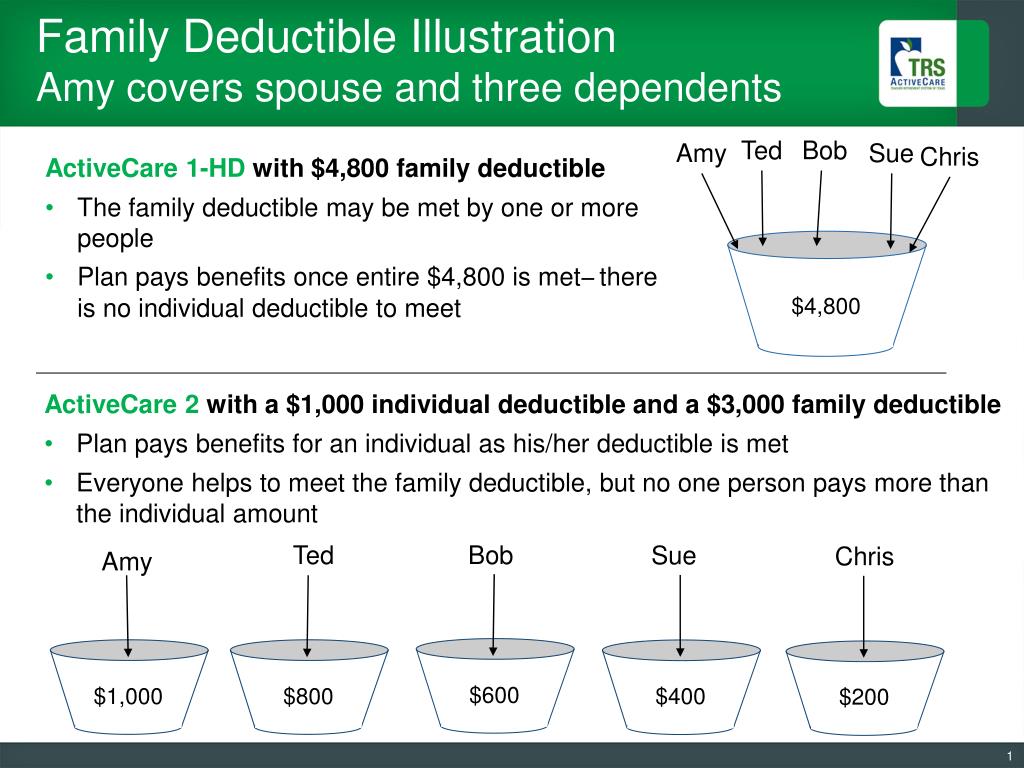

Generally plans with lower monthly premiums have higher deductibles. If the plan uses embedded deductibles a single member of the family would have met the. As an example consider a plan with a 4000 individual deductible and an 8000 family deductible.

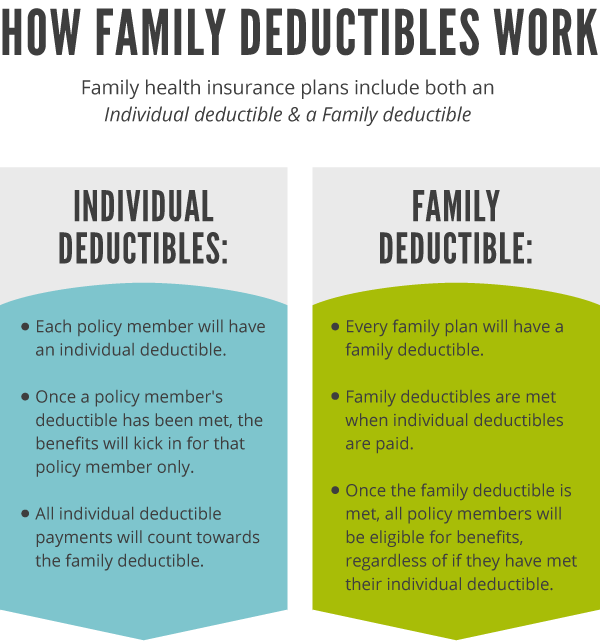

When a family has coverage under one health plan there is an individual deductible for each family member and family deductible that applies to everyone. The individual deductible is a separate per-person deductible. A health insurance deductible is the amount an individual must pay for healthcare expenses before insurance or a self-insured company covers the costs.

An insurance deductible is the amount of money you will pay on an insurance claim before the coverage kicks in and pays the rest. Deductibles might range anywhere from 0 to 8550 for an individual or. Family plans often have both an individual deductible which applies to each person and a family deductible which applies to all family members.

The family has a deductible too. Your annual deductible is the amount you need to pay out of pocket for health care expenses before your insurer starts to cover some of your costs. What Is an Insurance Deductible.

In this case the individual deductible applies per person only until the family deductible is exhausted. Some plans have separate deductibles for certain services like prescription drugs. This example uses a sample plan.

The family deductible bucket is a fixed amount the entire family must pay before. What is a deductible. As an example you have a 500 deductible and have your first doctors visit of the year.

In a health plan with an embedded deductible no single individual on a family plan will have to pay a deductible higher than the individual deductible amount. The Family Deductible Bucket. The single most common plan design is a family deductible thats equal to.

Often insurance plans are based on yearly deductible amounts. The Individual Deductible Bucket. It is one deductible.

How Credits and Deductions Work Tax credits and deductions can change the amount of tax you owe so you pay less. 5500 The maximum amount of money you pay. This type of family deductible system is known as an embedded deductible because individual deductibles are embedded within and count toward the larger family deductible.

To understand individual and family deductibles youll first need to understand how insurance. Generally Delta Dental PPO TM and Delta Dental Premier plans have deductibles but DeltaCare USA our prepaid fixed copayment plan does not. The amount you owe for health services before your plan begins to help pay.

For example the family deductible might be 2000 and each individual deductible might be 350. 3 Different Types of Health Insurance Deductibles Comprehensive Deductible. For example lets say your family plans individual deductible is 50 and the family deductible is 100.

Family dental insurance plans typically involve both an individual deductible and a family deductible. How Does an Individual or Family Deductible Work. Credits can reduce the amount of tax you owe.

This is the amount that you must. The comprehensive deductible is the easiest deductible to understand. It is a fixed amount of.

If your health plan covers you along with other dependents you may have an individual deductible which applies to each person and a family deductible which applies to the whole family. Each family member has an individual deductible. Most medical insurance plans specify an individual deductible.

A deductible is the amount you pay out-of-pocket each year before your plan begins to pay for covered dental treatment costs.

25 Images What Is Individual Deductible In Health Insurance

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

Ppt Family Deductible Illustration Amy Covers Spouse And Three Dependents Powerpoint Presentation Id 5810534

Ppt Family Deductible Illustration Amy Covers Spouse And Three Dependents Powerpoint Presentation Id 5810534

Embedded Deductibles Source Of Consumer Confusion Center On Health Insurance Reforms

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What S The Difference Between Family And Individual Deductibles

What S The Difference Between Family And Individual Deductibles

25 Images What Is Individual Deductible In Health Insurance

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

Https Www Heritagegrp Com Uploads Embedded 20v 20non Embedded 20deductibles Pdf

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

Find Affordable Health Insurance And Compare Quotes

Find Affordable Health Insurance And Compare Quotes

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.