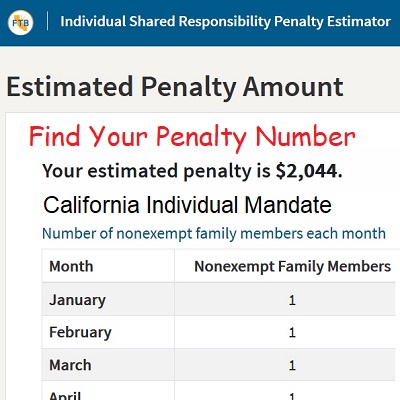

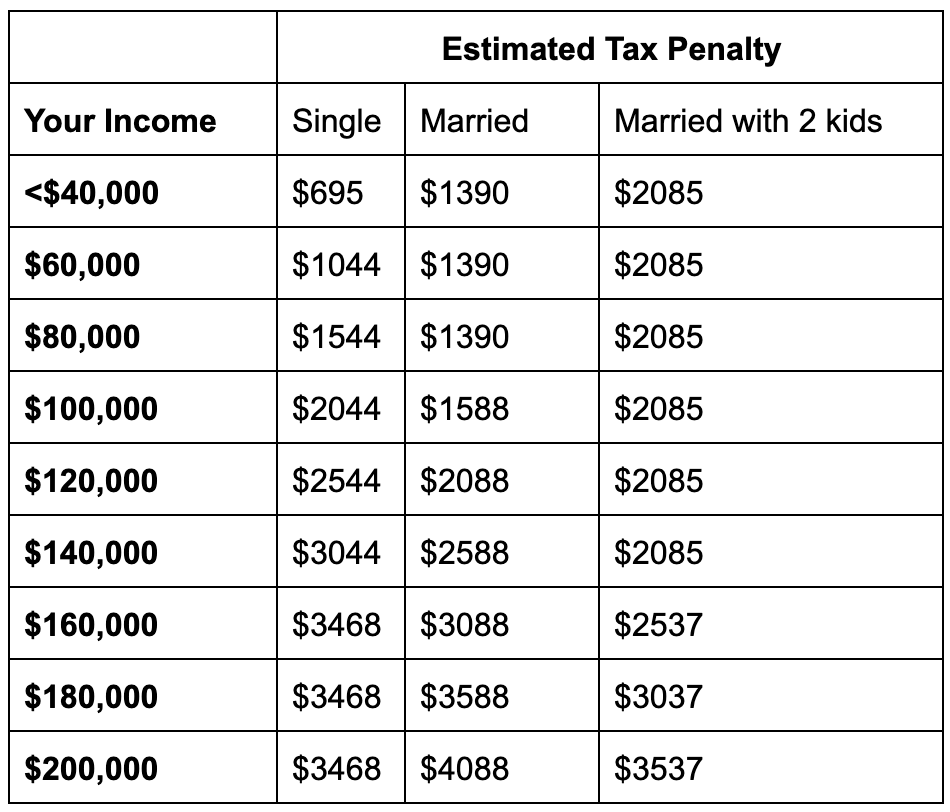

That means that California residents will once again be required to carry health insurance in 2020 or face a penalty when filing their taxes. Sample penalty amounts.

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

Beginning January 1 2020 California residents must either.

California health care penalty 2020. If you dont maintain health care coverage throughout 2020 you will face a tax penalty when filing your state income tax return in 2021. California residents with qualifying health insurance and new penalty estimator. Beginning January 1 2020 all California residents must either.

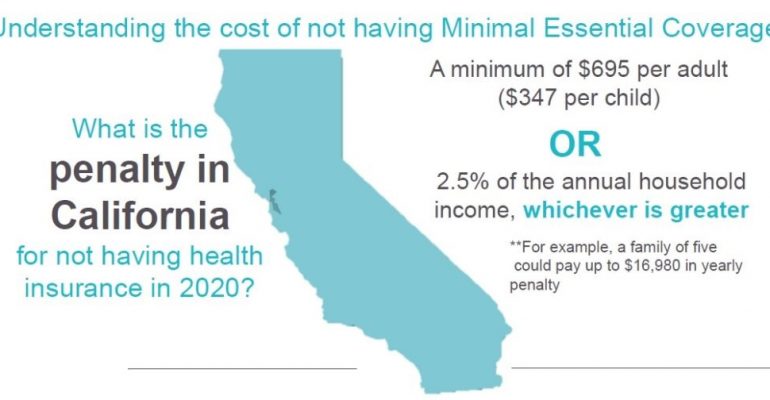

You still have time until March 31 2020 to have your health insurance coverage through Covered California. Gavin Newom signed Senate Bill 78 last summer which requires Californians to have health insurance and. The penalty for not having insurance will mirror the one under the Affordable Care Act which was 695 per adult and 34750 per child.

Everyone must have qualifying health insurance coverage or qualify for an exemption as of Jan. California shook things up for its residents in 2020 at least when it comes to health insurance. The penalty is in effect for the first time in 2020 after Gov.

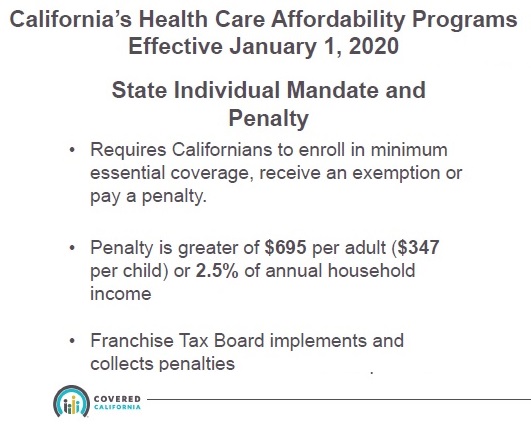

There are several major changes to California health insurance in 2020. Obtain an exemption from the requirement to have coverage. Have qualifying health insurance coverage orPay a penalty when filing a state tax return orGet an exemption from the requirement to have coverageAbout the Penalty Generally speaking the penalty will be 695 or more when you file your 2020 state income tax return in 2021.

Starting in 2020 California has enacted their own individual mandate for the state that requires residents to acquire a healthcare policy or pay a penalty. Have qualifying health insurance coverage Obtain an exemption from the requirement to have coverage Pay a penalty when they file their state tax return. This requirement applies to each resident their spouse or domestic partner and their dependents.

Most exemptions may be claimed on your state income tax return while filing. Starting in 2020 California residents must either. Have qualifying health insurance coverage or Pay a penalty when filing a state tax return or Get an exemption from the requirement to.

You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021. Obtain an exemption from the requirement to have coverage. Have qualifying health insurance coverage.

695 per adult 34750 per child or 25 of annual income. Effective January 1 2020 a new state law requires California residents to maintain qualifying health insurance throughout the year. Get health care coverage now to avoid state penalty later December 02 2019 News Release The Franchise Tax Board FTB urges Californians to get health care coverage now and keep it through 2020 to avoid a penalty when filing state income tax returns in 2021.

Otherwise theyll face a tax penalty. The California health insurance mandate is in effect requiring Californians to have health insurance. Residents whose health insurance costs do not exceed a certain percentage of their income could face a penalty of up to nearly 2100 per family according to Covered California.

Beginning in 2020 California residents must either. Beginning January 1 2020 California residents must either. The California health insurance penalty is reinstated which means most Californians who choose not to buy qualified health insurance will face a tax penalty.

The penalty is based on the previous federal individual mandate penalty which is 965 per uninsured adult or 25 percent of the individuals household income. Family of 4 2 adults 2 children 142000. California Healthcare Mandate Tax Penalty in 2020.

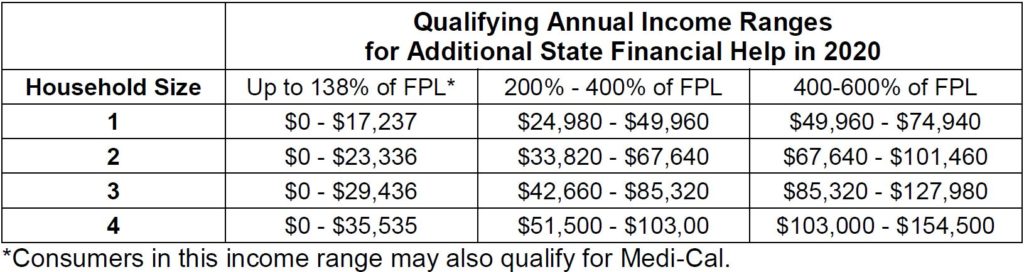

You may qualify for an exemption to the penalty. The new individual mandate for Californians starts in 2020. In addition to changing the income eligibility and rates for Covered California plans California lawmakers have brought back the individual mandate for the upcoming 2020 coverage year.

Household size If you make less than You may pay. Starting January 1 2020 California will tax legal citizens if they dont have health insurance. Have qualifying health insurance coverage.

The state needs to come up with 98000000 to pay for free health insurance f. Pay a penalty when they file their state tax return. Pay a penalty when they file their state tax return.

California Franchise Tax Board Individual Mandate Penalty Flyer

California Franchise Tax Board Individual Mandate Penalty Flyer

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

California Individual Mandate Penalty Cheap Compared To Cost Of Health Insurance

California Individual Mandate Penalty Cheap Compared To Cost Of Health Insurance

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Why Do I Have An Insurance Penalty In 2021 Health For California Insurance Center

Mandate Health Insurance Tax Penalty California Mec Qhp 5000 A

Penalty For No Health Insurance 2020 In California Freeway Insurance

Penalty For No Health Insurance 2020 In California Freeway Insurance

Penalty For No Health Insurance 2020 In California Cost U Less Insurance

Penalty For No Health Insurance 2020 In California Cost U Less Insurance

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

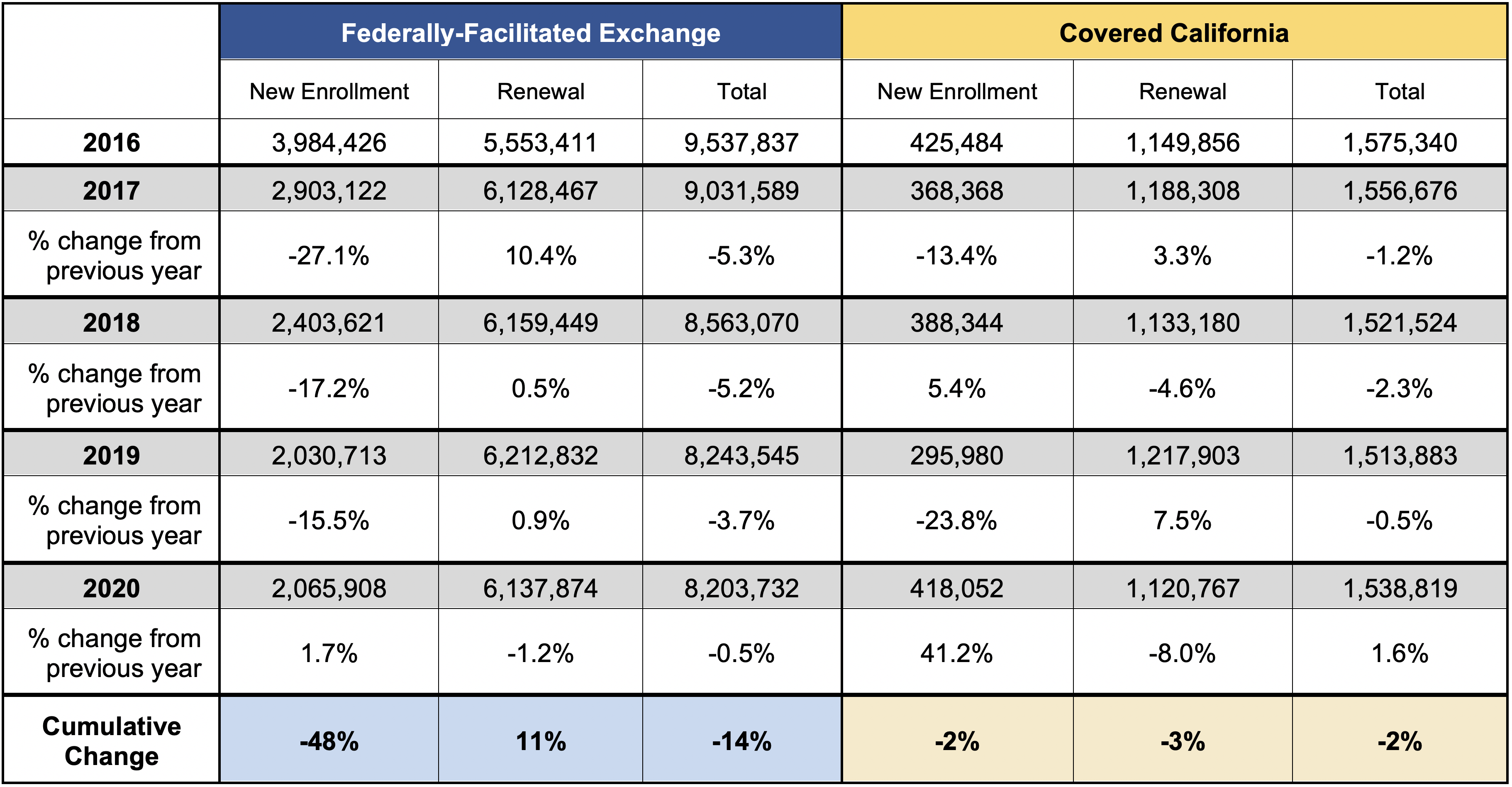

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

Covered California Announces New Law Requiring Health Insurance Susan Polk Insurance Agency Inc San Luis Obispo California

Covered California Announces New Law Requiring Health Insurance Susan Polk Insurance Agency Inc San Luis Obispo California

2020 California Health Insurance Tax Penalty How Much Will You Owe Ask Ariana Healthcare Access

2020 California Health Insurance Tax Penalty How Much Will You Owe Ask Ariana Healthcare Access

California Enacts Individual Mandate For 2020 Core Benefits Insurance Services

California Enacts Individual Mandate For 2020 Core Benefits Insurance Services

The 2020 Changes To California Health Insurance Ehealth

The 2020 Changes To California Health Insurance Ehealth

California Reintroduced Health Insurance Mandate Enforced By New Tax Penalty Solid Health Insurance

California Reintroduced Health Insurance Mandate Enforced By New Tax Penalty Solid Health Insurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.