Small business group health insurance plans generally work like the group health insurance plans offered by larger companies. Thats why weve built plans with the total person in mind.

Who Is Eligible For Group Health Insurance

Who Is Eligible For Group Health Insurance

It is geared toward businesses with less than 50 full time employees everywhere except four states where it applies to businesses with up to 10 employees.

Small business group health insurance. An average eHealth small business plan covers 5 people and costs 1432 per month in premiums - or 286 per person. Use HealthCaregov as a resource to learn more about health insurance products and services for your employees. Trusted International Health Network with Perfectly Tailored Plans from Cigna Global.

Anthem Blue Cross and Blue Shield understands you need a plan as unique as your business and your employees. Annons Health Insurance Plans Designed for Expats Living Working in Sweden. Small Business Health Insurance Our small business plans offer a full range of health insurance options for groups with 2 to 50 employees and 2 to 100 employees in Colorado.

For a small business health insurance is a critical factor in retaining and recruiting employees as well as maintaining productivity and employee satisfaction. How much does small business health insurance cost. In Maryland Washington DC.

And Northern Virginia over 70 of small businesses offering health insurance choose CareFirst. Anthem Blue Cross and Blue Shield group health plans are designed to cover both the everyday and unexpected health needs of your employees and bring everyone peace of mind. Annons Health Insurance Designed For Individuals Living Outside Their Home Country.

Annons Health Insurance Designed For Individuals Living Outside Their Home Country. All in one offering specially designed with your small business in mind. Generally group plans require to have at least two members but in some states a group of one is allowed.

Trusted International Health Network with Perfectly Tailored Plans from Cigna Global. Group coverage is insurance purchased by a business and offers to eligible employees and their dependents. UnitedHealthcare offers a wide range of group health insurance options designed to help your small business save money and support your employees health and wellbeing.

Small businesses can avail of the group insurance plan that has more advantages than an individual health plan. Monthly premiums are typically shared between the employer and employees and dependents can usually be added to the policy as well. Additionally the state that your business operates in can also have an impact on the cost.

Simply put group health insurance is a health insurance plan you extend to your businesss staff and perhaps their dependents. Small businesses can get comprehensive coverage from CareFirst BlueCross BlueShield. Group coverage is insurance that businesses purchase and offer to eligible employees and their dependents.

You can get the benefits typical for larger groups like surplus sharing fewer taxes and fees and high-cost claims protection. Our flexible affordable options will help keep your employees healthy while also controlling your costs. Small businesses that have fewer than 50 full-time employees or the equivalent in part-time workers do not have to provide health insurance under.

Small business health insurance premiums depend on a variety of factors including the number of employees you have the type of insurance plans you want to offer the deductible and the co-pay. Small Business Health Options Program HealthCaregov Health insurance for your business and employees Offering health benefits is a major decision for businesses. How Many Employees Do You Need to Qualify for a Small Business Health Insurance.

Annons Health Insurance Plans Designed for Expats Living Working in Sweden. An individual health plan offers coverage just for yourself or for your family. Small Business Health Plans Choosing small group health insurance for your employees is not an easy decision for any small business owner.

Self-insured funding built for small businesses Control rising health care costs with Aetna Funding Advantage SM health plans. Historically speaking small-group insuranceor fully-funded insurancehas been the primary option for many small employers who are looking to offer health benefits for their employees. With a group health insurance program small business owners pay either all or part of the cost of the monthly premiums for their employees but typically reap certain tax benefits as a result.

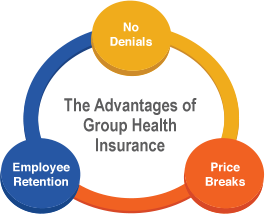

Group health insurance plans for small businesses have certain advantages over an individual health plan.

Why Group Health Insurance Isn T Ideal For Small Businesses Infographic Small Business Infographic Social Media Infographic Job Hunting

Why Group Health Insurance Isn T Ideal For Small Businesses Infographic Small Business Infographic Social Media Infographic Job Hunting

Group Health Insurance Small Business

Group Health Insurance Small Business

2018 Small Business Group Health Insurance Update

2018 Small Business Group Health Insurance Update

Covered California Small Business Health Options Program Shop Health For California Insurance Center

Covered California Small Business Health Options Program Shop Health For California Insurance Center

Group Health Insurance For Small Business Get A Quote

Group Health Insurance For Small Business Get A Quote

Group Health Insurance For Small Business Owners Ixsolutions

Group Health Insurance For Small Business Owners Ixsolutions

How To Save On Small Business Health Insurance

How To Save On Small Business Health Insurance

Affordable Medical Offices Insurance Guide For Your Small Business Ehealth

Affordable Medical Offices Insurance Guide For Your Small Business Ehealth

Chamber Helps Smbs Grow By Offering Group Benefits

Chamber Helps Smbs Grow By Offering Group Benefits

Questions For Small Business Group Health Insurance Nc

Questions For Small Business Group Health Insurance Nc

10 Group Health Benefits Small Businesses Need

10 Group Health Benefits Small Businesses Need

![]() Group Health Insurance Coverage Group Health Organization

Group Health Insurance Coverage Group Health Organization

5 Reasons To Consider Small Group Health Insurance

5 Reasons To Consider Small Group Health Insurance

Small Business Group Health Insurance Plans For Owners And Employers At Matrix Insurance Agency Cal Health Insurance Plans Group Health Insurance Group Health

Small Business Group Health Insurance Plans For Owners And Employers At Matrix Insurance Agency Cal Health Insurance Plans Group Health Insurance Group Health

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.