Depending on your plan you may also have a deductible copayments and coinsurance. 6 Aon Dental Solutions.

Dental Insurance That Covers Dental Implants With No Waiting Periods

Dental Insurance That Covers Dental Implants With No Waiting Periods

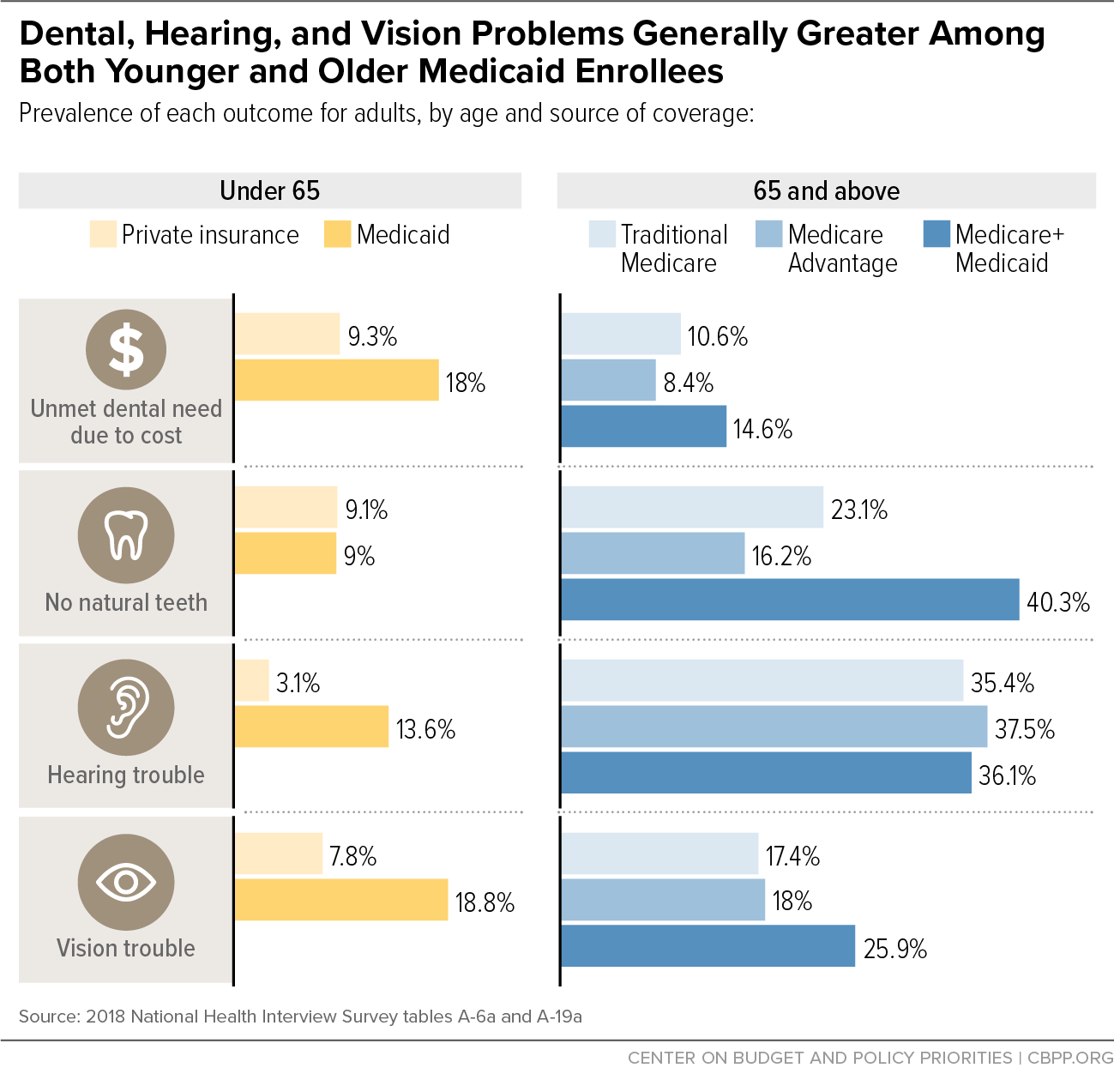

Medicaid often pays for dental implants for low-income adults when medically necessary as with private coverage.

What type of insurance covers dental implants. Every company offers different coverage though and most plans wont cover the full cost of dental implants. Your health insurance might pay for medically necessary dental implants which are appropriate to evaluating and treating a disease condition illness or injury and is consistent with the applicable standard of care. Spirit Dental Vision offers coverage that includes dental implants as well as other major services.

Is Paying for Dental Implant Insurance Worth It. Aon Dental Solutions has a small network of dentists around 15000 with discount plans starting at 125 per year for individuals and 180 per year for families. Here are the dental care procedures that insurance may cover.

However Medicaid also covers dental work for adults in some regions when not connected to an accident or illness. Includes routine office visits and professional dental cleaning. If your dental insurance allows you to pay for your implants and then file for reimbursement what youre looking at is called Indemnity Dental Insurance a form of traditional dental insurance.

For example included implants could involve replacing teeth lost during a covered accident or illness. Most dental insurance companies consider dental implants to be a cosmetic procedure which isnt covered by most policies. The short answer is it depends.

Dental insurance. With indemnity dental insurance you can visit any dentist there are no networks or approved providers. Your dental implant insurance coverage could be 50 of the cost meaning your insurance covers half of the procedure.

Are Dental Implants Covered by Insurance. Even if your dental insurance covers dental implants youll almost certainly reach. Youll need to look into cosmetic dental procedure coverage which covers a portion of dental implants.

Or Humana Health Benefit Plan of Louisiana Inc. Humana Individual dental and vision plans are insured or offered by Humana Insurance Company HumanaDental Insurance Company Humana Insurance Company of New York The Dental Concern Inc CompBenefits Insurance Company CompBenefits Company CompBenefits Dental Inc Humana Employers Health Plan of Georgia Inc. It might also cover orthodontics periodontics and prosthodontics such as.

Dental implant cover Millions of people have dentures or no teeth at all. Indemnity insurance is as close as youre likely to come to getting dental insurance that covers everything. This process takes time and having the best dental implant insurance or plan is very important.

A dental insurance plan for an individual with 1200 in coverage the first year 2500 in. Dental implants provide a base for replacement teeth that look and function like natural teeth. Unless the patient and dentist can show the insurance company that the implants meet a medical need the patient may be.

As insurance companies always have conditions and restriction in their fine print its always best to make sure that your insurance policy covers dental implants. For dental treatments like fillings and crowns. So what are dental implants.

A great benefit of getting a dental implant is that they have a success rate of up to 98 and with proper care they can last a lifetime. There are also other things that you should be thinking about before signing off on the surgical procedure. What is Dental Implant Insurance.

Tooth extractions tissue biopsy. Basic dental insurance policies dont typically cover a dental implant procedure. If this is the kind of insurance plan you have you can have your dentist set up a payment plan that suits your budget.

Additionally dental insurance policies have annual limits which typically range from 1000 to 1500. However your Aetna policy may cover costs related to dentures crowns or related procedures. This is a policy that will fully cover any cost incurred by a dental implant surgery.

If your company offers access to a comprehensive group dental insurance policy it may be worth it. THE SIMPLY INSURANCE WAY. Dental implants can offer a welcome alternative for those who want to regain their smile.

When insurance may not pay for implants. Services they cover include dental implants dentures braces X-Rays root. Most dental plans wont cover implant surgery although it is often available as an additional policy for an inflated premium.

Cigna offers dental insurance that covers implants and dentures but only as group. 4 Zeilen Cigna. Traditionally many dental plans have not covered implants for patients who get them for purely cosmetic reasons.

Dont get caught in a trap thinking that youre covered for cosmetic dentistry but you find out that its an exclusion to your policy. Dental insurance generally covers a portion of the cost of range of dental services from routine preventive care to dental surgery including oral exams cleanings X-rays filings extractions oral surgery root canals crowns and implants. Medicaid is a public health insurance program jointly run by federal and state governments.

Discount plans offered by HumanaDental Insurance Company or Humana Insurance.