The 2020 deductible amount for high deductible Plan G is 2340. People new to Medicare are those who turn 65 on or after January 1 2020 and those who first become eligible for Medicare benefits due to age disability or ESRD on or after January 1 2020.

High Deductible Plan G Medigap Insurance Carriers Your Medicare Enrollment Experts

High Deductible Plan G Medigap Insurance Carriers Your Medicare Enrollment Experts

What Does Medigap High-Deductible Plan G Cover.

Plan g deductible 2020. To help you find the best Medicare Supplement Plan G provider we compared and ranked the top plans taking into consideration price discounts. Once this deductible is met the plan pays 100 of covered services for the rest of the calendar year. High deductible G is available to individuals who are new to Medicare on or after 112020.

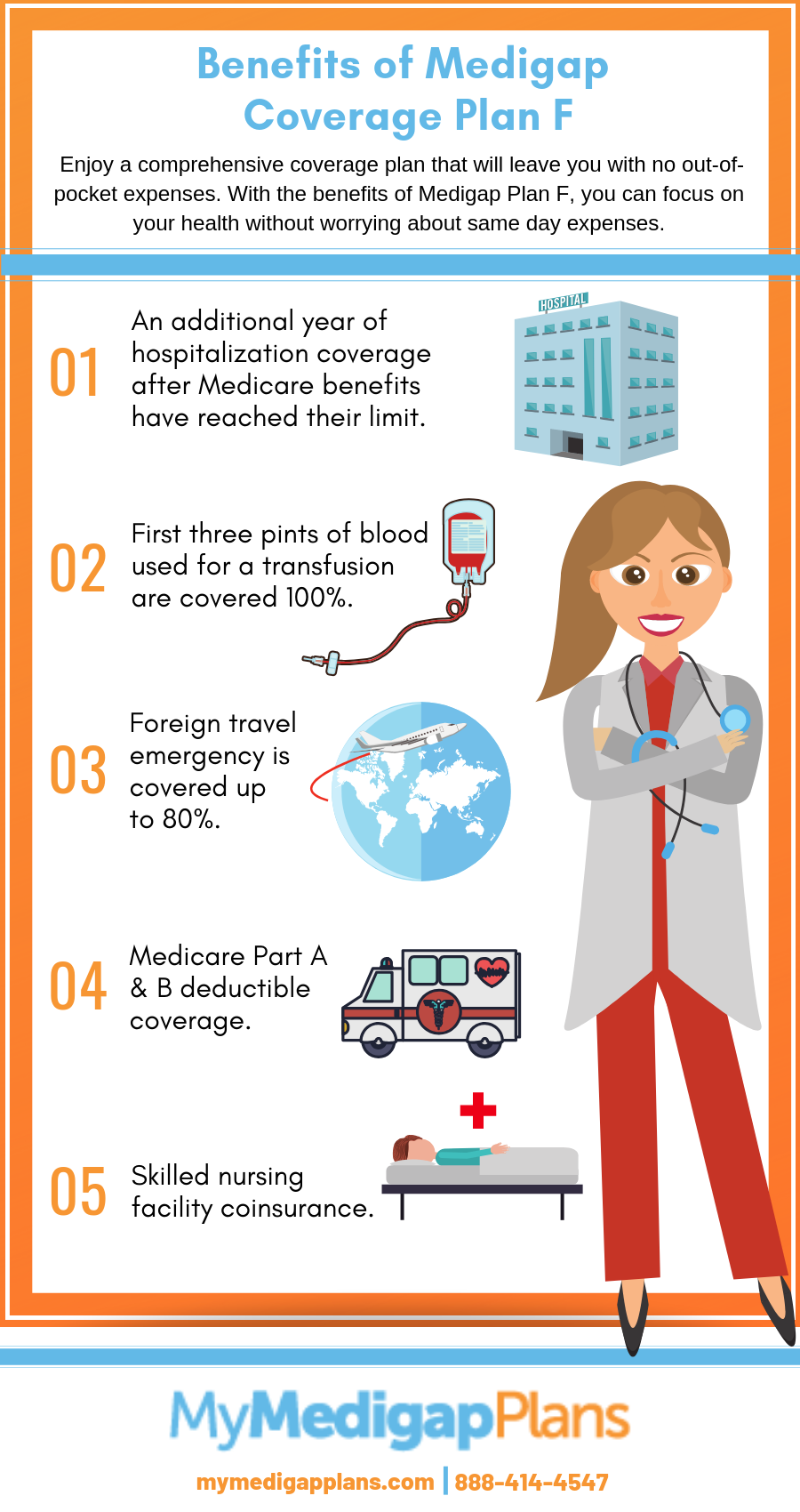

Plan F covers the Plan B deductible and Plan G does not but Plan F was phased out as of January 1 2020. Before June 1 2010 Medigap Plan J could also be sold with a high deductible. You will still pay your Part B deductible 198 in 2020 2 in addition to 20 of any emergency care you receive abroad.

This plan will be like the High Deductible Plan F. Medicare Plan G also called Medigap Plan G is an increasingly popular Supplement for several reasons. High Deductible Plan G became available January 1 2020.

Deductible Amount for Medigap High Deductible Options FG J for Calendar Year 2020 Summary. With Plan G you will need to pay your Medicare Part B deductible. In 2020 the deductible for High Deductible Medicare supplements is 2340.

Beneficiaries reaching this deductible is what keeps the premiums low for this plan. Are there plans that cover the Part B deductible. Out-of-pocket expenses for this deductible are expenses for the Part B deductible and expenses that would normally be paid by the contract.

In addition tonormal Plan G with no deductible a high-deductible option is also available. However the premiums for Plan G tend to be considerably less than that of Plan F. Medicare Supplement G Plans have stepped up as the leader in having the lowest out-of-pocket costs covering everything F plans do with the exception of the Part B deductible 198 in 2020.

Plan G covers everything listed on the benefits chart with the exception of the Part B deductible. Alternatively if youre more comfortable with higher. This does not include the.

Benefits from the High Deductible Plan G will not begin until out of pocket expenses are 2340. Medicare Supplement Plan G - 2020 Updates. With Plan G you pay your premiums and little else.

However it will not cover your Part B deductible. Coverage and Deductible - YouTube. When you have a Plan G policy it covers your share of all Medicare-approved healthcare services except for your outpatient deductible.

Compare High Deductible Plan G 2020. Almost all of your out-of-pocket costs are covered with two exceptions. The high deductible version of Plan F is only available to those who are not new to.

This can be different for Plan G. The Plan G deductible is standardized by the federal government and will be consistent no matter where the policy is sold or by whom. Learn more about this new policy how it affects you in 2021.

People who value simplicity and convenience. It may also be a good alternative for regular Plan G subscribers because of its potential for great costs savings. High Deductible Plan G 2020 is a great choice for seniors who are transitioning away from Plan F or High Deductible Plan F.

Coverage with Medicare Supplement Plan G includes. But it isnt exactly the same as Plan F Plan F High-Deductible or Plan C. The deductible for High Deductible Plan G is 2370.

Medicare Plan G or as its officially known Medicare Supplement Plan G High-Deductible will be introduced on January 1 2020. With Plan G youll only be responsible for the annual Part B deductible of 203 outside. Medicare supplemental Medigap Plans F and G can be sold with a high deductible option.

Medicare Supplement Plan G - 2020 Updates. With Medicare Supplement companies there are some differences between Plan F and Plan G. The Part B deductible for 2021 is 203.

Plan G is meant to replace the supplement plans that are disappearing in 2020. So for the convenience of a single monthly premium youre fully covered for all of your major medical expenses once youve paid the 198 deductible 2020 rate. The plan deductible will be 2370.

For beneficiaries who became eligible for Medicare on or after January 1 2020 a High Deductible Plan G option will be available. The only plans that cover the Medicare Part B deductible are Medigap Plan C and Medigap Plan F. This applies to both the High Deductible Plan G and High Deductible Plan F.

In their initial research phase many people compare Plan G to Plan F which covers the Part B deductible. First Plan G covers each of the gaps in Medicare except.