The Kaiser plan has a 1500 deductible and then a 20 co-insurance. HSAs are confusing as is but in California they can be even more complex.

California And New Jersey Hsa Tax Return Special Considerations

California And New Jersey Hsa Tax Return Special Considerations

Next the Internal Revenue Service confirmed individuals have until May 17 2021 to make 2020 contributions to Health Savings Accounts and Archer Medical Savings Accounts.

Hsa california 2020. An HSA is tax-favored savings account that is used in conjunction with a high-deductible HSA-compatible health insurance plan to make healthcare more affordable and to save for retirement. The confusion is rooted in how the IRS uses the terminologyand TurboTax has to follow that terminology. The rules are different for the IRS and for the Franchise Tax Board.

Kaiser CA Silver HSA 150020. March 16 2020 653 AM In California on the screen with the heading Heres the income that California handles differently scroll down to the subheading Investments and click on Start for Health Savings Accounts HSA earnings. IRS Announces HSA Limits for 2020 California Benefits Advisors.

In the screen that follows enter your interest dividends and capital gains in your HSA. A California resident for the entire year. The Covered California Bronze 60 HSA plan does not include a separate Rx deductible.

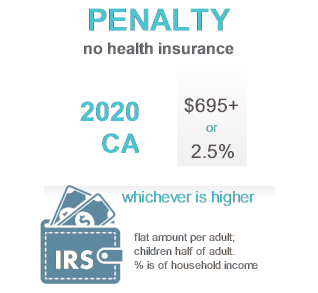

So in order for coverage to kick in the plan deductible 4500 for individuals 9000 for families must first be met. Beginning January 1 2020 California employers may face additional notice requirements when offering a flexible spending account to employees. Since California does not allow the exclusion of HSA contributions from state income the amount is added back to your federal income for purposes of the state.

Maximum HSA contribution limit in 2020 and 2021 The maximum HSA contribution limit can change from year to year and varies depending on whether you have self-only individual coverage or a family. It is estimated that employer contributions on behalf of. HSA Contribution Limit for 2020 Employee Employer 3550.

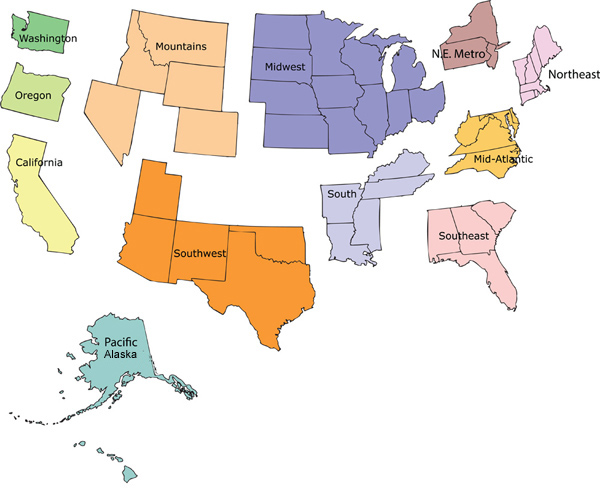

This amount was grown to reflect changes in the economy over time resulting in an estimated 600 million HSA deduction in taxable year 2020. California residents can pay for qualified medical expenses with pre-tax dollars and save for retirement on a tax-deferred basis. Lets take a look at how it works.

The maximum the IRS allows one to deposit into an HSA account each year is not related to the calendar year HSA-compatible health plan deductible. Once the plan deductible is met the member will have a copay of 40. Recently Californias Governor signed into law Assembly Bill No.

Those earnings are still taxable by California. Rather the medical deductible applies to all Rx regardless of tier. You have to go into the HSA account statements and tally up all the earnings during the year.

For family coverage two or more people the 2019 annual HSA limit is 7000 and 7100 in 2020. If using an HSA for your pregnancy is what you want to do then the best HSA health insurance plan for maternity coverage is. Tax Treatment of Health Savings Accounts HSA 2020 February 25 2019.

Advertentie Zoek naar de juiste California uit 2020 voor jou. What is an HSA. 1554 which requires employers to.

On May 28 2019 the Internal Revenue Service IRS released Revenue Procedure 2019-25 announcing the annual inflation-adjusted limits for health savings accounts HSAs for calendar year 2020. Tax Treatment of Health Savings Accounts HSAs in California. A business can allow employees to open a California HSA account only after the employee has enrolled in a qualified high deductible medical insurance plan.

An HSA is a tax-exempt savings account that employees can use to pay for qualified health. Because the HSA earnings are tax-free at the federal level the HSA provider wont send any 1099 for the earnings. As a result of the extension to the 2020 HSA contribution deadline individuals can expect to receive form 5498-SA by June 30 2021.

Using FTB data it was determined that California taxpayers contributed 450 million to Health Savings Accounts HSAs in 2017. Health Savings Accounts HSAs allow enrollees to save money on a tax favored basis to pay for medical expenses. Betrouwbaar aanbod van California uit 2020 occassions bij AutoTrack.

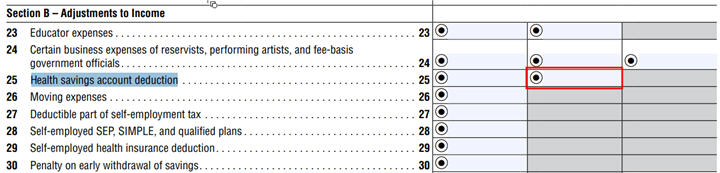

Claiming educator expenses on your federal return that do not exceed 250 500 if filing jointly You are subject to the Individual Shared Responsibility Penalty. In 2019 the annual contribution limit for self-only coverage is 3500 and 3550 for 2020. Advertentie Zoek naar de juiste California uit 2020 voor jou.

This plans will result in the lowest out-of-pocket cost. Betrouwbaar aanbod van California uit 2020 occassions bij AutoTrack. Learn more on HSA contribution limits.

Claiming 10 or fewer dependents. Filing an original 2020 return. This includes all interest and dividends paid inside the HSA.

On November 8 2019. You qualify to claim the Premium Assistance Subsidy PAS. 7100 HSA Catch-Up Contributions for 2020 Age 55 and Older 1000 1000.

For a 10000 delivery cost you would pay 3200. California Adopts FSA Notification Requirements for 2020.

Why Do California And New Jersey Tax Hsas Impersonal Finances

Why Do California And New Jersey Tax Hsas Impersonal Finances

Tax Treatment Of Health Savings Accounts Hsa 2020

Tax Treatment Of Health Savings Accounts Hsa 2020

New Hsa And Hdhp Limits For 2021 The Liberty Company

New Hsa And Hdhp Limits For 2021 The Liberty Company

California Health Savings Account

California Health Savings Account

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

California And New Jersey Hsa Tax Return Special Considerations

California And New Jersey Hsa Tax Return Special Considerations

2020 Hsa Contribution Limits And Rules Ramseysolutions Com

2020 Hsa Contribution Limits And Rules Ramseysolutions Com

California And New Jersey Hsa Tax Return Special Considerations

California And New Jersey Hsa Tax Return Special Considerations

2020 Hsa Limits Rise Modestly Irs Says

2020 Hsa Limits Rise Modestly Irs Says

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

California Health Savings Account

California Health Savings Account

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

Irs Announces Hsa Limits For 2020 California Benefits Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Irs Announces Hsa Limits For 2020 California Benefits Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.