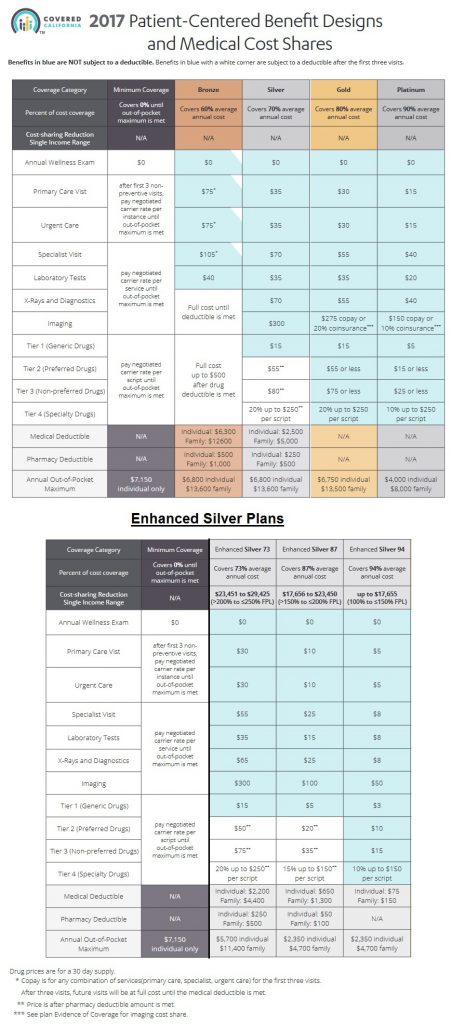

Both the Bronze and the Silver have a 6350 max so they treat the big bill or many medium size bills the same way. PureCare HSP is available through Covered California in Los Angeles Orange and San Diego counties and parts of Kern Riverside and San Bernardino counties.

Covered California Plan Summaries Imk

Covered California Plan Summaries Imk

Again as certified Covered California agents there is.

Covered california bronze plan. The Covered California Silver 70 plans which are almost identical to the off-exchange plans have an additional surcharge of 10 to 15. Doctor Visits Specialist Visits Mental Health Outpatient Visits and Services. Bronze Silver and Gold The out-of-pocket maximum is going up from 7800 to 8200 on the Bronze Silver and Gold Plans.

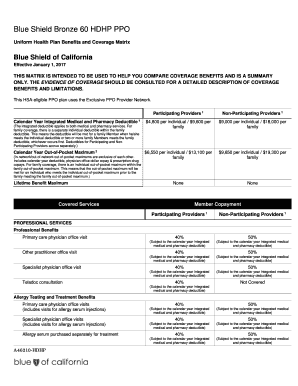

The Bronze Exchange plan is the least expensive option for adults 30 and over. Subsidies are available on the Bronze plan if eligible. For the Bronze 60 HSA the drug deductible is included in the medical deductible which is 48009600.

With the roll-out of health. 40 of bill After Deductible. The Bronze 60 plan has a 5001000 separate drug deductible.

Covered California offers these plans at the Bronze level. You dont need to worry about spending a certain amount before savings kick in. Bronze Plan Benefit Summary.

Before deductible is met Full Cost. No-cost or low-cost coverage check_circle You save. Covered California both Covered California and no-cost or low-cost coverage through Medi-Cal.

The premium price is usually very similar. You may qualify for. Covered California offers two Bronze 60 plans.

These funds roll over to the next year if. After the deductible is met the Bronze 60 offers benefits for a set dollar amount copay and the Bronze 60 HSA offers benefits at 40. Edit Mobile Icon Path.

Be sure to read through all the coverage details and compare your plan options. Also it gives you the peace of mind of knowing you have coverage in the case of a catastrophic event. 500 cap per prescription.

The Bronze 60 plans are the same rates regardless of whether they are purchased through Covered California or direct from the carrier off-exchange. Covered California rates are going up 06 on average and the plan benefits are not changing very much. Bronze plans as low as.

Covered California Bronze 60 Plan Enrolling in the Bronze 60 level Covered California plan is usually recommended for people who have very low expected healthcare costs for the year or prefer to have lower monthly premiums and higher deductibles and copays when they go to the doctor. Full Cost Before Deductible. Lowest-Priced Bronze unweighted 67 57 65 Lowest-Priced Silver unweighted 57 - 43 40 If a consumer switches to the lowest-priced plan in the same tier - - 90 - While the weighted average increase represents the premiums that Covered California negotiated with its 11 health insurance companies consumers traditionally pay less than that amount because they can shop.

Covered Californias Bronze Plan covers 60 of your annual medical services on average and is the least expensive plan available that qualifies for premium assistance. Call us at 800-320-6269 and well go through the pros and cons the plans with you based on your situation. Outside of preventative benefits in-network and potentially 3 primary care visits and 3 urgent care visits you can expect most of your medical expenses to go toward a deductible of 5000 per family member up to two members in a family.

Going to the doctor shouldnt bankrupt you. CALIFORNIA INDIVIDUAL FAMILY PLANS Plan Overview Bronze 60 PureCare HSP The Bronze 60 HSP health plan utilizes the PureCare HSP provider network for covered beneits and services. It can be confusing to compare health plans on your own.

65 Mental Health Outpatient Visits and Services. The bronze plan is essentially a high deductible health plan. Price is for any combination of visits doctor specialist mental health urgent care for the first three visits.

We apologize in advance but the Bronze Age was just too easy not to use. Generally we recommend the standard Bronze 60 plan over the Bronze 60 HSA plan because you will have lower out-of-pocket costs. To review the plan benefits for the HSA Plan see the Bronze 60 HSA Plan.

This plan offers a low monthly premium. See cost savings below. A Bronze plan could work for you but be prepared to possibly spend more than 8000 when you access care.

These services are covered from day one. Its offered to people who have high-deductible health plans HDHP. California health insurance - Covered California Plans - Bronze Health Plan The Coming Bronze Age of California Health Insurance.

After deductible is met Free. Prescriptions fall into four pricing levels known as. People who choose to enroll in one can add funds to their HSA that arent subject to federal income tax when theyre deposited.

Interested in a plan that offers free services and protection in case something goes wrong. No deductible for your first three doctor visits.