The PPO typically has a lower maximum out-of-pocket cost than an HDHP. With an HDHP you pay the full cost for services until your annual deductible is met for services other than in-network preventive care services which are covered 100.

Hdhp Vs Ppo What S The Difference

Hdhp Vs Ppo What S The Difference

HDHP vs PPO.

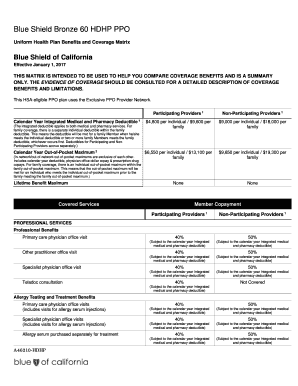

Blue shield hdhp vs ppo. PPO Group Number 007000285-0014 0015 3 of 8. Need to stay in network Need a referral to see a specialist. Do I need a Primary Care Physician.

An HDHP plan is typically about 10 cheaper than a traditional preferred provider organization PPO plan and is usually associated with a company funded tax-advantaged health savings account HSA that is meant to fund some of your medical expenses. Here is a quick overview of the two plans Note. In the year in full HSA can only possibly cost us 1000 more than PPO if we never buy medications or see the doctor under the PPO which isnt the case.

You do not get to keep that money or. Lower out-of-pocket maximum. You can also choose to receive care outside of your network with a PPO and still have agreed-upon rates.

Exclusive PPO Network Blue Shield PPO plans can provide you with the flexibility and choice you are looking for. Of course the true difference lies between which type of insurance carrier youre looking at and the types of services you need. Costs for covered services are always lowest when using network providers.

Though you may receive more coverage for an in-network provider. And it will likely cost us much less because of the 600 family deductible under the PPO and the copay cost for medications one medication alone ends up being 400yr as there is no generic available. IndividualFamily Plan Type.

The primary difference between a CDHP vs a PPO is that one is a form of health insurance that is largely self-directed while the other is a form of healthcare that requires you to pay less out of pocket but more into monthly premium payments. You can select any doctor you choose but you will pay more for out-of-network care. But overall PPO networks span large areas.

Blue Cross Blue Shield HSA-Advantage High Deductible Health Plan HDHP Coverage Period. If maintaining a relationship with your current doctor is important to you the HDHP plan lets. For instance one HDHP could be very similar to an HMO while another could look more like a PPO.

Out-ofnetwork care is allowed but staying in your plans network will be far less expensive. Blue Cross and Blue Shield of Alabama Preferred Blue HDHP Plan 800 Plan 820 Plan 860 Healthy Blue 851 Plan and 879 Plan Preferred Blue HDHP Plan BlueCard PPO New Plan Effective 712010 800 Plan 820 Plan 860 851879 Plan BlueCard PPO INPATIENT HOSPITAL AND PHYSICIAN BENEFITS Includes Mental Health and Substance Abuse. The main downside of a PPO is that youll pay higher monthly premiums.

HDHPs will have lower premiums than PPOs. However PPO plans will even cover some of the cost for many services received from providers who dont participate in our Exclusive PPO Network. High-Deductible Health Plan HDHP Preferred Provider Organization PPO Deductible.

The amount you pay in premiums is gone to the insurance company forever. Beginning on or after 07012020 Medical Prescription Plan Summary of Benefits and Coverage. HDHPs offer a lower premium with a higher annual deductible.

With the HDHP you can receive care from any of the physicians and hospitals in the plans network as well as outside of the network for covered services. Unlike the other plans an HDHP can vary depending on the specific plan. Think of it as a HMO and PPO hybrid.

Employees own the HSA and can use it for current and f. Those who opt for HDHP are usually those who dont go to the doctor often low risk -or- those who go use medical services very often. All of the figures below are for in-network coverage for an employee and spouse.

I have to pick between the BCBS PPO plan vs the high deductible plan. Although this feature can be a big help it can also be a wash financially by the time you pay all of your premiums for the year. A Health Savings Account HSA is a tax-free account that can be funded by both employer and employee.

The Blue Shield high-deductible health plan HDHP is administered by Blue Shield of California. Choosing between PPO and HMO is also a matter of preference PPO are more flexible when it comes to choosing providers and allows you to get better rates for providers that are out of network. The core of these plans relies on the coinsurance that will be an out of pocket expense Is there a place to find out typical costs for office visits etc under a BCBS plan.

Like a PPO you have the freedom to use out-of-network doctors and providers but higher out-of-pocket fees if you dont see a doctor in your plan. Several PPOs tend to carry lower deductibles as opposed to HDHPs. No an HDHP doesnt require a PCP.

What this Plan Covers What You Pay For Covered Services Coverage for. After you meet your deductible you may only be responsible for a small percentage of the costs called a co-insurance.