Instructions for Form 8962 Premium Tax Credit PTC 2020 12142020. The figures depend on the size of your tax family.

How To Fill Out Irs Form 8962 Correctly

How To Fill Out Irs Form 8962 Correctly

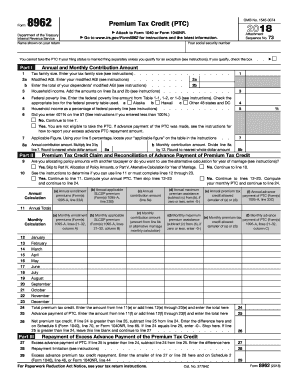

15 Zeilen Instructions for Form 8962 Premium Tax Credit PTC 2018 Form 8962.

Irs 8962 instructions. Instructions for Form 8971 and Schedule A 092016 Instructions for Form 8971 and Schedule A 092016 i8971pdf. Name shown on your return. We discuss Form 8962 Premium Tax Credit Forms 1095-A 1095-B and 1095.

If APTC was paid on your behalf or if APTC was not paid on your behalf but you wish to take the PTC you must file Form 8962 and attach it to your tax return Form 1040 1040-SR or 1040-NR. See the Instructions for Form 8962 for more information. IRS Form 8962 If you are claimed as somebodys dependent then you arent eligible for the premium tax credit and you do not file according to instructions for 8962 tax form.

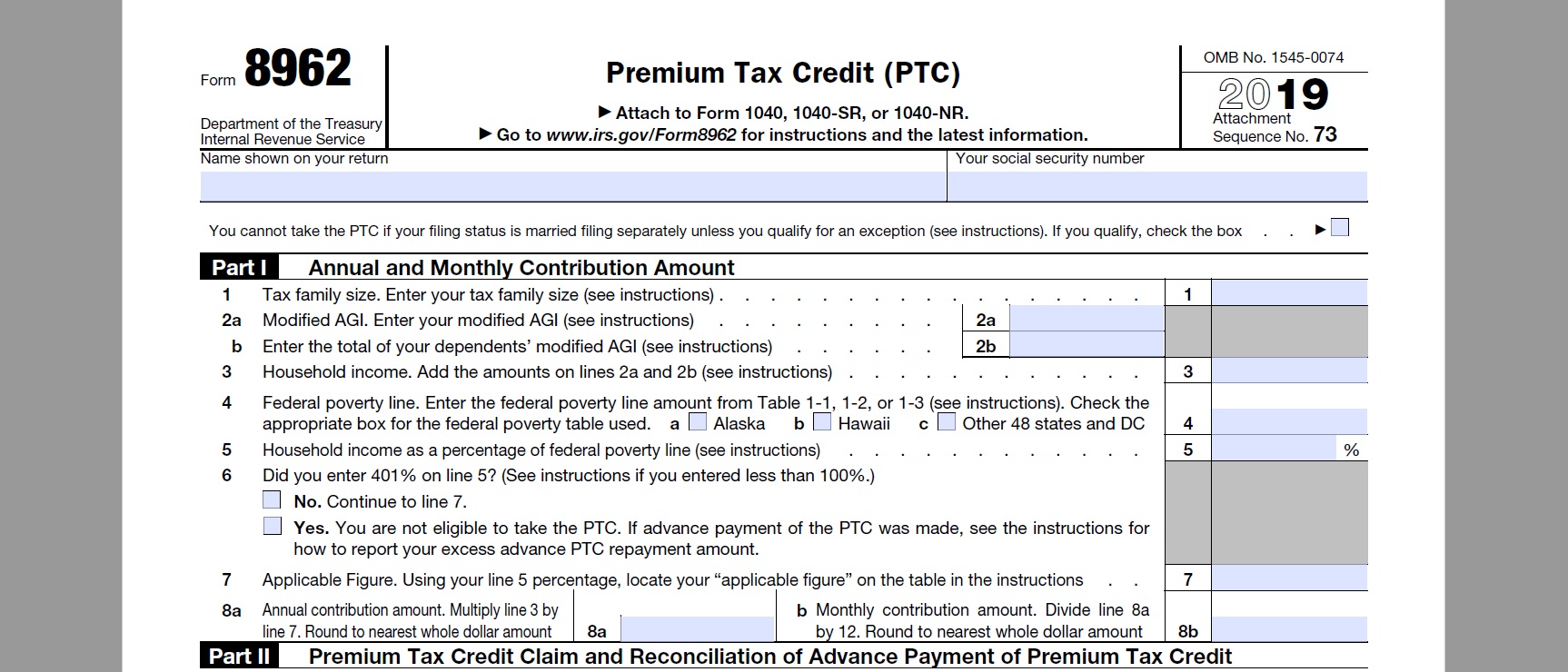

Go to wwwirsgovForm8962 for instructions and the latest information. Purpose of Form Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC. Instructions for Form 8962 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted.

Form 8962 is available on the IRS website. We discuss Form 8962 Premium Tax. 3 Form 8962 is a two-page form broken into five parts.

Use the federal poverty lines provided in the instructions for Form 8962. Use Get Form or simply click on the template preview to open it in the editor. Quick steps to complete and e-sign Form 8962 Instructions online.

The IRS will reduce the excess APTC repayment amount to zero with no further action needed by the taxpayer. The instruction contains three poverty line tables for Alaska Hawaii and the 48 Contiguous states and the DC. See the Form 1040 instructions for information on reporting full-year coverage or exempt.

The data you should consider is printed in the instruction that comes along with the Form 8962 printable. Form 8962 Premium Tax Credit is required when someone on your tax return had health insurance in 2020 through Healthcaregov or a state marketplace and took the Advance Premium Tax Credit to lower their monthly premium. Compare that number to the number you.

Copy of the social security card with the cards personal number SSN. Instructions for Form 8963 012020 Instructions for Form 8963 012020 i8963pdf. How to Fill out Form 8962 Step by Step.

Premium Tax Credit PTC 2020 11172020 Inst 8962. Instructions for Form 8962 2020 Instructions for Form 8962 2020 i8962pdf. Slightly its the person who claims you as a dependent who would file Form 8962 for the purpose of calculating any premium tax credit score and if crucial repaying any excess advance premium.

Use the Cross or Check marks in the top toolbar to select your answers in the list boxes. At enrollment the Marketplace may have referred to APTC as your subsidy or tax credit or advance payment. Taxpayers who have already filed their 2020 tax return and who have excess APTC for 2020 do not need to file an amended tax return or contact the IRS.

2018 Instructions for Form 8965Health Coverage Exemptions and Instructions for Figuring Your Shared Responsibility Payment OR Have Health Coverage or a Coverage Exemption Make a Shared Responsibility Payment OR For each month you must either. Your social security number. 8962 Department of the Treasury Internal Revenue Service Premium Tax Credit PTC Attach to Form 1040 1040-SR or 1040-NR.

Taxpayers claiming a net PTC should respond to an IRS notice asking for more information to finish processing their tax return. Then multiply the federal poverty line you used by 40. Form 8962 Instructions With form 8962 for 2021 the applicant has to submit the following documents.

If the applicant is a US. Citizen or resident alien he or she must. Part I is where you record annual and monthly.

For the most part taxpayers will use the IRS Interactive Tax Assistant to file form 8962 to the nearest IRS. The IRS helps taxpayers learn how to fill out this form. Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to.

Taxpayers must fill form 8962 with instructions to figure out how much of the cost of their health care coverage has been taken before calculating their tax. Instructions for Form 8966 2020 Instructions for Form 8966 2020 i8966pdf. IRS Form 8962 Line-by-Line Instructions 2021.

Start completing the fillable fields and carefully type in required information. Information about Form 8962 Premium Tax Credit including recent updates related forms and instructions on how to file.

Https Www Irs Gov Pub Irs Prior F8962 2016 Pdf

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

Form 8962 Fill Out And Sign Printable Pdf Template Signnow

Form 8962 Fill Out And Sign Printable Pdf Template Signnow

How To Fill Out Form 8962 Step By Step Premium Tax Credit Ptc Sample Example Completed Youtube

How To Fill Out Form 8962 Step By Step Premium Tax Credit Ptc Sample Example Completed Youtube

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

Irs 2019 Health Insurance Subsidy Tax Credit Reconciliation

Irs 2019 Health Insurance Subsidy Tax Credit Reconciliation

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Premium Tax Credit Form 8962 And Instructions

Premium Tax Credit Form 8962 And Instructions

How To Fill Out Obama Care 8962 Premium Tax Credit Forms If Single Youtube

How To Fill Out Obama Care 8962 Premium Tax Credit Forms If Single Youtube

Irs Form 8962 Free Download Create Edit Fill Print Wondershare Document Cloud

Irs Form 8962 Free Download Create Edit Fill Print Wondershare Document Cloud

Https Www Irs Gov Pub Irs Prior I8962 2016 Pdf

Https Www Irs Gov Pub Irs Prior F8962 2014 Pdf

How To Fill Out Irs Form 8962 Accounts Confidant

How To Fill Out Irs Form 8962 Accounts Confidant

8962 Form 2021 Irs Forms Zrivo

8962 Form 2021 Irs Forms Zrivo

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.