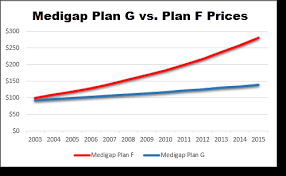

We cant know the future but we anticipate Plan F rates to go down giving. For example if Person A is licensed for the first app subsequent pricing wouldnt apply to Person B.

Plan F Or Plan G Medigap Plans F G 65medicare Org

Plan F Or Plan G Medigap Plans F G 65medicare Org

5859 per month or 70314 per year.

How much is plan f. Medicare Supplement Plan F is the most comprehensive of the standardized Medicare Supplement plans available in most statesThese plans are being phased out starting in 2021. This plan covers everything a regular Plan F does but in 2020 youll be responsible for paying the first 2340 up from 2300 in 2019 of costs out of your own pocket before coverage kicks in. High-deductible plan F Plan F also has a high deductible option.

In fact 55 of Medigap beneficiaries in 2017 were enrolled in Plan F. Plan F Versus Other Plans. Call 833-801-7999 for a free consultation today.

Smith has to pay the Medicare Part B deductible 166 instead of her insurance company incorporating it into the premium. Plan F will not be available for sale to Medicare beneficiaries who become eligible. Subsequent pricing for tenant-based apps applies to any tenant in your organization.

Medicare Supplement Plan F Comparison. The excess charge mentioned above is the difference between the amount a healthcare provider legally can charge for a procedure or treatment and the Medicare-approved amount for it. Up to your plans limits.

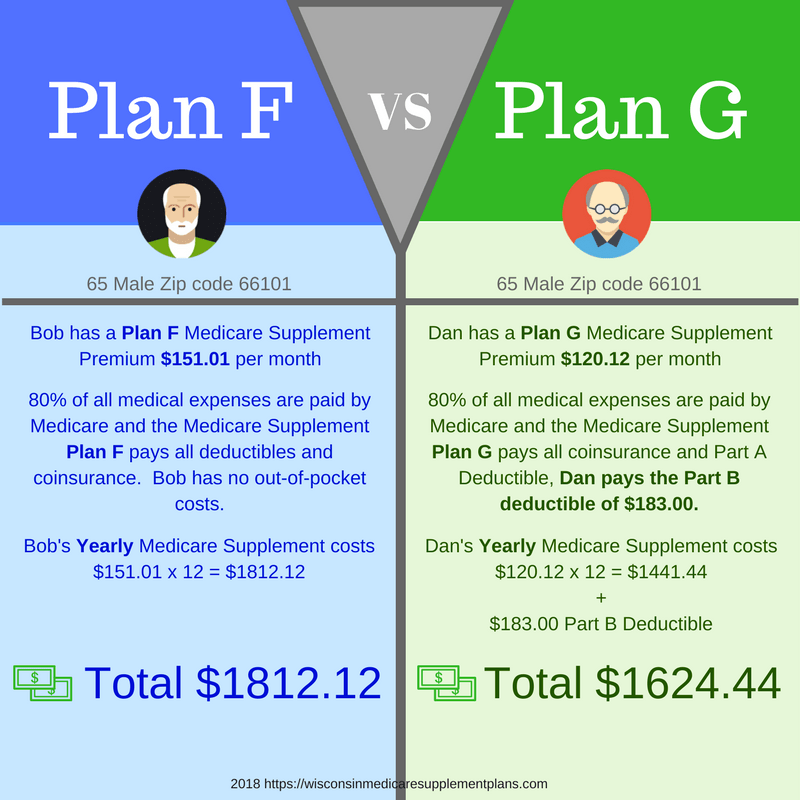

Even after paying the deductible it is a savings of 93 annually for plan G over Medicare supplement insurance plan F. Get Medigap Plan F. Because Medicare supplemental coverage consists of 10 standardized plans and high deductible Plan F is easy to compare supplements onlineand get rates from several companies.

MedSup Plan F also covers 80 of medical care you receive while traveling outside the US. Now if the monthly savings for Plan G had been less then F would have been a better choice. Medicare Part A deductible Medicare Part A coinsurance and hospital costs Medicare Part A skilled nursing facility coinsurance Medicare Part A hospice coinsurance and copays Medicare Part B deductible Medicare Part B coinsurance and copays Medicare.

In return you could pay lower premiums each month. If you bought a Medicare Supplement Plan F before January 2020 you. The bill prevents Medigap plans specifically Plan F and Plan C from covering Part B deductibles.

While monthly premiums for this option may be lower you must pay a deductible before Plan F begins paying for benefits. Medigap Plan F is one of the 10 standardized Medicare Supplement Insurance plan options sold in most states. Plan F with Company A charges a yearly premium of 1800.

Plan F covers the most standardized Medigap benefits and is the most popular Medigap plan. If you currently have Medicare Supplement Plan F you can switch to high-deductible Plan F by contacting your insurance provider. Plan F covers 100 percent of the following costs.

The standard Medicare Part B annual deductible is 203 in 2021. In 2019 it was 185. This includes Medicare Supplement Plan C Medicare Supplement Plan F and the Medicare Supplement High Deductible Plan F.

The Medicare Part B deductible that refers to the deductible amount involved in the MACRA legislation changes every year. If your budget isnt as tight you might like the idea of not having to think about any additional charges. For someone age 70 those cost savings are a little higher.

1 Subsequent pricing for user-based apps applies only to the individual licensed for the first app. The average cost savings between plan F and Plan N for someone age 65 is 4869 per month or 58428 per year. These plans would no longer be available for purchase on or after the 1st January 2020.

You pay for Medicare-covered costs up to the 2340 2370 in 2021 before the plan begins to pay for anything. Only time will tell what might happen to Plan F premiums but in any case our agents will be here to help you keep the most competitive prices for the best coverage. Medicare Supplement Plan F is a specific type of Medicare Supplement plan.

Plan F includes a high deductible option where 2000 is required before benefits are paid. Plan G with Company Z charges a yearly premium of 1400. Remember the only difference with Plan G is that Mrs.

Plan F Vs Plan N What Most People Don T Know Clear Medicare Solutions

Plan F Vs Plan N What Most People Don T Know Clear Medicare Solutions

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Supplement Plan F Wisconsin Medicare Plans

Medicare Supplement Plan F Wisconsin Medicare Plans

Medicare Supplement Plan F Is It Still Available

Medicare Supplement Plan F Is It Still Available

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medigap Plan F Medicare Supplement Plan F Medicarefaq

Medigap Plan F Medicare Supplement Plan F Medicarefaq

Is Plan F Going Away Medigap Plan F Discontinued Boomer Benefits

Is Plan F Going Away Medigap Plan F Discontinued Boomer Benefits

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medigap Plan F Medicare Supplement Plan F Medicarefaq

Medigap Plan F Medicare Supplement Plan F Medicarefaq

Is Plan F Worth The Price Ensurem Life Optimized

Is Plan F Worth The Price Ensurem Life Optimized

Medicare Plan F Vs Plan N Which One Is Right For You

High Deductible Plan F Supplemental Insurance Low Cost Policy

Medicare Supplement Plan F Medigap Plan F Freemedsuppquotes

Medicare Supplement Plan F Medigap Plan F Freemedsuppquotes

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.