Find your Form 1095-A. What should I do if I am expecting a Form 1095-A but did not receive one.

Corrected Tax Form 1095 A Katz Insurance Group

Call the Health Connector at 1-877-623-6765.

How to get your 1095 a form. Provide this information to the IRS and to the recipient of the statement as soon as possible after discovering that the statement was sent in error. Step 1 Click the Get 1095-A Form button. Contact Your Insurer Directly Theres only one place where you can get a copy of your 1095 tax form.

If you had insurance through the Health Insurance Marketplace in 2020 then you will need your 1095-A form to complete your taxes. First you must be able to log into your Mass Health Connector online account. This form may also be available online in your HealthCaregov account.

To find forms customized for your benefits log in to your member account. How to find your Form 1095-A online 2. Select Tax Forms from the menu on the left.

How to find your 1095-A online Log in to your HealthCaregov account. Get screen-by-screen directions with pictures PDF or follow the steps below. Get a step-by-step guide to.

Click the green Start a new application or update an existing one button. STEP 2 Under Your Existing Applications select your 2020 application not your 2021 application. To reconcile youll compare the amount of premium tax credit you used in advance during 2020 against the premium tax.

If the taxpayer expects to receive Form 1095-A from the Marketplace you should wait to file the taxpayers Individual Income Tax Return until after Form 1095-A has been received. Contact them directly ONLY your insurer will have access to it and can provide you with a copy. If you have not yet received your 1095-A you can obtain the form the Marketplace online or by phone.

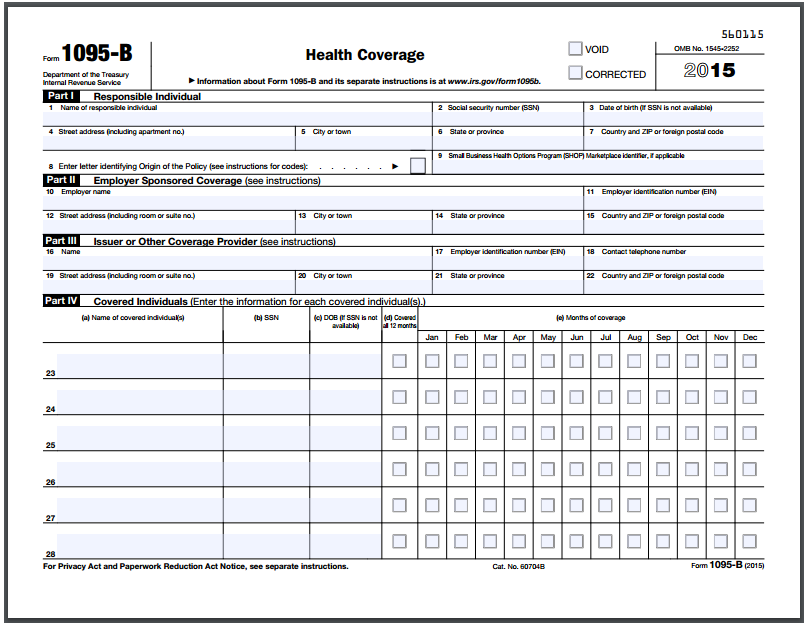

Click the green Start a new application or update an existing one button. Forms 1095-B and 1095-C or other documentation used to determine healthcare coverage should not be attached to the return but should be kept for your records. We can help for FREE.

If a Form 1095-A was sent for a policy that shouldnt be reported on a Form 1095-A such as a stand-alone dental plan or a catastrophic health plan send a duplicate of that Form 1095-A and check the void box at the top of the form. Information to populate Form. Individuals who dont receive their forms or see.

How to find Form 1095-A online. If you have questions about Form 1095-A Minimum Essential Coverage PTC or the SLCSP table call Community Health Advocates Helpline at 1-888-614-5400. Data Entry Accounting CS.

Find the forms and documents you need Medical dental vision claim forms. The Form 1095-A is used to reconcile Advance Premium Tax Credits APTC and to claim Premium Tax Credits PTC on your federal tax returns. Log into your Marketplace account.

If you misplaced a 1095-A you can find it online. How to use Form 1095-A If your form is accurate youll use it to reconcile your premium tax credit. Click your name in the top right and select My applications coverage from the dropdown.

Click here if you purchased your plan via healthcaregov. If there are errors contact the Call. Download all 1095-As shown on the screen.

Under Your Existing Applications select your 2020 application not your 2021 application. STEP 3 Select Tax Forms from the menu on the left. If you have questions about which forms are meant for your use call the toll-free number on the back of your member ID card.

You can also find the information on your 1095 yourself or request another copy from the Marketplace. If you receive a Form 1095-A that appears inconsistent with your payment records you should contact the Marketplace to issue you a corrected form. You must contact your Marketplace and confirm you should have a 1095-A.

Log into your Marketplace account at httpswwwhealthcaregov. How to find your 1095-A online. Log in to your HealthCaregov account.

If you dont have your user name and password. Heres how to find IRS Form 1095-A on the Massachusetts Health Connector website. Taxpayers should receive a Form 1095-A by mid-January of the year following the coverage year either by mail or in their HealthCaregov accounts.

/1095b-741f9631132347ab8f1d83647278c783.jpg) Form 1095 B Health Coverage Definition

Form 1095 B Health Coverage Definition

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

:max_bytes(150000):strip_icc()/1095b-741f9631132347ab8f1d83647278c783.jpg) Form 1095 B Health Coverage Definition

Form 1095 B Health Coverage Definition

New Irs Form 1095 A Among Tax Docs That Are On Their Way Don T Mess With Taxes

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Understanding Your Form 1095 A Youtube

Understanding Your Form 1095 A Youtube

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.