This includes a qualified health plan purchased on healthcaregov or through a State Marketplace. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

Https Www Irs Gov Pub Irs Prior I8962 2016 Pdf

Copy of the social security card with the cards personal number SSN.

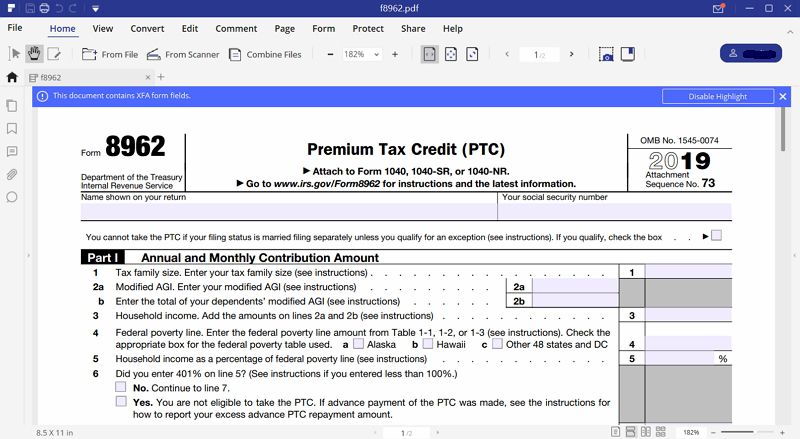

Form 8962 instructions. You may be able to enter information on forms before saving or printing. Enter a term in the Find Box. Form 8962 is to calculate and claim the Premium Tax Credit PTC.

The PTC is a refundable tax credit that you can claim by eligible tax payers and families earning and falling between the zero to moderate incomes. Instructions for Form 8962 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. To start the form utilize the Fill Sign Online button or tick the preview image of the form.

The IRS helps taxpayers learn how to fill out this form. Click on column heading to sort the list. Click on column heading to sort the list.

For instance lets say you paid one hundred monthly after the Premium Tax Credit score subsidy on your medical health insurance for a self-employed health insurance deduction of 1200. Use Get Form or simply click on the template preview to open it in the editor. The advanced tools of the editor will guide you through the editable PDF template.

Complete Form 8962 only for health insurance coverage in a qualified health plan described later purchased through a Health Insurance Marketplace also known as an Exchange. IRS Form 8962 If you are claimed as somebodys dependent then you arent eligible for the premium tax credit and you do not file according to instructions for 8962 tax form. This is to aid the taxpayers afford and benefit from the health insurances purchased through the HealthCaregov.

As noted above you may also need to file additional 1040 forms like a Schedule 2 used for repaying excess tax credits due to the. Add your own info and speak to data. If you want to delete an individual form please follow these instructions.

Use your indications to submit established track record areas. Enter a term in the Find Box. Form 8962 is used to calculate the amount of premium tax credit youre eligible to claim if you paid premiums for health insurance purchased through the.

Citizen or resident alien he or she must. Reporting your Premium Tax Credits on your 1040. While in your return click on Tax Tools Tools in the black bar at the side of your screen.

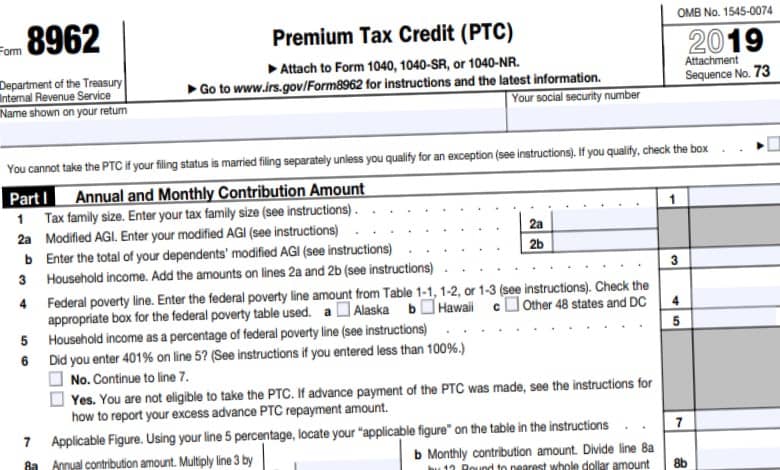

Youll need the instructions for Form 8962 to calculate the numbers for the first 3 lines of Form 8962. Complete Form 8962 and attach it to your 1040. Select a category column heading in the drop down.

Federal Form 8962 Instructions. For the most part taxpayers will use the IRS Interactive Tax Assistant to file form 8962 to the nearest IRS. With form 8962 for 2021 the applicant has to submit the following documents.

Click on the product number in each row to viewdownload. Quick steps to complete and e-sign Instructions For Form 8962 online. Start completing the fillable fields and carefully type in required information.

Select a category column heading in the drop down. How to complete any Form Instructions 8962 online. Form 8962 instructions 2019 is a form you need to file together with your federal revenue tax return for a year for those who obtained a sophisticated premium tax credit score by way of the Market during that year.

Purpose of Form Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC. Taxpayers must fill form 8962 with instructions to figure out how much of the cost of their health care coverage has been taken before calculating their tax. If the applicant is a US.

Click on the product number in each row to viewdownload. The way to fill out the Form 8962 2018 on the web. On the site with all the document click on Begin immediately along with complete for the editor.

It is titled as Premium Tax Credit score. Form 8962 Premium Tax Credit is required when someone on your tax return had health insurance in 2020 through Healthcaregov or a state marketplace and took the Advance Premium Tax Credit to lower their monthly premium. Enter your official contact and identification details.

2 Calculate your household income as a percentage of the federal poverty. You can delete Form 8962 and then it will repopulate from the information your entered from your 1095-A. Slightly its the person who claims you as a dependent who would file Form 8962 for the purpose of calculating any premium tax credit score and if crucial repaying any excess advance premium.

You may be able to enter information on forms before saving or printing.