The kind you select will affect your choice of dental care providers out-of-pocket costs and how your bills are paid. MetLife Dental Best for Kids.

Supplemental Dental Insurance Finding The Best Coverage

Supplemental Dental Insurance Finding The Best Coverage

And since many health plans do not include dental coverage dental.

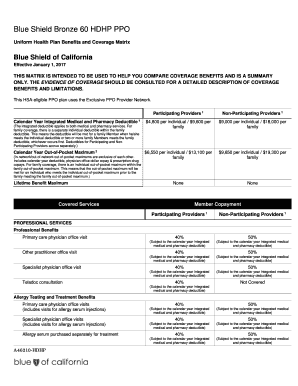

Best supplemental dental insurance. Delta Dental Insurance is the countrys largest dental insurance provider covering 80000 enrollees nationwide. Types of top dental plans Indemnity plans offer a broader selection of dental-care providers than managed-care plans. Most supplemental dental insurance plans are categorized as either indemnity or managed-care plans.

Physicians Mutual provides supplemental dental insurance for both families and individuals. Dental savings plans enable you to save 10-60 on your dental care. There are no annual spending caps waiting periods approval process or restrictions on pre-existing conditions.

Supplemental Insurance Through Dental Savings Plans. Other policies like dental. The 7 Best Dental Insurance for Braces in 2021 Best Overall.

Supplemental Dental Accident Benefit Every BEST Life dental plan includes coverage for injuries to sound natural teeth of up to 1000 per incident. Cigna medical insurance plans support preventive care and also basic and major services with offers like no limit to the maximum benefit and discounts for restorative and orthodontia services. The company has been around since 1954 and now has a robust network of dentists at 156000 dentists.

Founded in 1955 and headquartered in Columbus Aflac provides supplemental insurance coverage for a variety of diagnostic and preventive dental care. How Much Does It Cost. Supplemental dental insurance is an individual or family insurance policy purchased to cover a portion of the dental costs generally up and above or beyond the primary dental plan.

Smart Health Dental Best for Value. With wide availability and affordable rates Cigna is a great supplemental insurance choice for those who qualify for Medicare. Best Place to Shop for Plans.

Best Supplemental Dental Insurance. Supplemental dental insurance will normally not cover the entire dental care procedure. Delta Dental is a remarkable option too.

The advantage of an indemnity plan is the freedom to select any dentist. An individual or family that needs coverage for a particular procedure not covered by their dental plan may choose to purchase supplemental dental insurance to help manage costs. Supplemental dental insurance is a separate plan that enhances your current dental coverage.

Some supplemental dental insurance plans also offer the following. They have over 500000 providers in their network and the plans cover 350 services. This is available through ezHealthMarts dental application below.

A decrease in out-of-pocket payments. Aflac Dental Insurance. With a no-deductible no-maximum basic plan and an attractive no-waiting period added to it this is a good one to consider for purchasing a supplemental dental insurance policy.

There isnt an annual or lifetime maximum. Nowadays researching for an excellent supplemental dental insurance. Gaps in coverage can occur when the primary policys annual spending limit is reached or when a policy doesnt provide coverage for necessary or desired dental treatments.

Humana Individual dental plans are insured or offered by Humana Insurance Company HumanaDental Insurance Company Humana Insurance Company of New York The Dental Concern Inc CompBenefits Insurance Company CompBenefits Company CompBenefits Dental Inc Humana Employers Health Plan of Georgia Inc Humana Health Benefit Plan of Louisiana Inc Discount plans offered by HumanaDental Insurance Company or Humana Insurance Company. If dental coverage isnt provided by your employer dental insurance for individuals will typically run between 20 and 50 each month. Guardian Dental Best for Dental Savings Plans.

For families a typical dental insurance plan can run between 50 and 150 per month. The supplemental dental insurance providers of indemnity dental insurance only reimburse the individual after they have reviewed the dentists bill. Members have the freedom to choose any dental provider of their choice plus get additional cost-savings with access to our national and regional networks.

Theyve earned an A Excellent rating from AM Best and the Better Business Bureau has several regional Delta Dental pages with different. The best supplemental dental insurance plan is the one that fits the needs of you your family and your budget. Insured by Humana Insurance.

If you have a primary dental insurance plan through your or your partners employer review the coverage to identify any gaps or services that you think you will need that are not covered. There have three basic dental plans. The 6 Best Dental Insurance for Seniors on Medicare in 2021 Best Overall.

Are there waiting periods. Supplemental dental insurance is purchased to fill the gaps in a policy holders dental or medical coverage. An indemnity plan allows individuals to select any dentist.

But instead is synchronized or works hand-in-hand with your basic dental policy. This forces individuals to pay for dental treatments in full and then submit a claim. If you have a primary dental insurance plan that you purchased or your employer provided the supplemental dental.

DentalPlans Best for Variety. Best for a Low Deductible. Best Overall Supplemental Insurance.

There are plans that cover all treatments from braces to dentures. No waiting period 3.