You can purchase a standalone Medicare Prescription Drug Part D plan to help pay for your prescription drug costs if you have Original Medicare andor a Medicare Supplement insurance plan. Medicare Supplement Plan D.

Medigap Plan D Tupelo Ms Bobby Brock Insurance

Medigap Plan D Tupelo Ms Bobby Brock Insurance

This is the best Medicare Part D plan option for seniors as it mixes low co-pays with competitive premiums and has a network of preferred providers.

Plan d supplement. But Plans A and B for example do not cover skilled nursing facility SNF care. Thorne is a trusted supplement brand certified by the Therapeutic Goods Association TGA a regulatory agency run by the Australian Department of Health. Enrollment in SilverScript depends on contract renewal.

Medicare Supplement Plan D is a plan designed to help you cover the gaps from Medicare Part A B. AARP Medicare Rx with services provided by United Healthcare is an excellent all-round provider of Medicare Part D plans and is the only range of plans backed by AARP. Medicare Supplement Plan D is one of 10 lettered Medicare Supplement insurance options that you can choose from when purchasing Supplemental health insurance.

Note that it is different from Medicare Part D the portion of Medicare that provides prescription drug coverage Supplemental insurance policies are sometimes called Medigap plans. Medicare Part D is a collection of prescription drug plans while Medigap Plan D or Medicare Supplement Plan D is a plan that covers some of Medicares out-of-pocket expenses. For a 90-day supply you may pay even less.

Medicare Supplement Plan D is provides shoppers a balanced amount of coverage. Thornes liquid vitamin D supplement. Plan D is found to be between the other plans offering the.

Medicare Supplement Plan D is for people who want to cover as many contingencies as possible including SNF care. Part D Medicare drug coverage helps cover cost of prescription drugs may lower your costs and protect against higher costs. Plan D covers the Part A deductible.

SilverScript is a Prescription Drug Plan with a Medicare contract marketed through Aetna Medicare. Medigap Plan D is a Medicare Supplement policy that helps supplement Original Medicare. This is one of the biggest things beneficiaries need to look for when considering a policy.

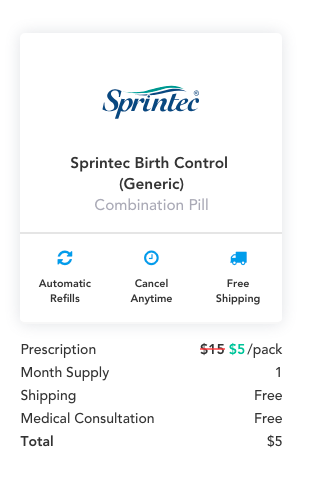

Plan D doesnt have the most benefits and isnt the most comprehensive plan. Medigap Plan D Coverage. Youll pay a 0 copay for Tier 1 drugs and a 2 copay for Tier 2 drugs on a 30-day supply.

If youre looking for an option with middle-of-the-road monthly premiums and benefits Medicare Supplement Plan D deserves some consideration. Plan D will cover some costs which are not fully covered by your Medicare health insurance coverage. Plan D provides beneficiaries with a decent amount of coverage.

Medigap Plans do not cover Part D Prescription Drug plan benefits so if you are enrolling into a Medicare supplement you will also need to purchase a separate Part D plan as well. Do not confuse your Medicare Supplement Plan D insurance coverage with Medicare Part D prescription drug coverage. Plan D is supplementary insurance that fills some coverage gaps in Original Medicare while Part D is the Medicare prescription drug benefit available through Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans.

The Medicare Supplement Plan D is only one of 10 different supplemental insurance plans. SilverScript Plus PDP. Other plans also offer much of this coverage.

Medicare Supplement Plan D and Medicare Part D Differences Provides prescription drug coverage to Medicare beneficiaries A standalone Part D plan works with Original Medicare but prescription drug coverage can be included in a Medicare. Medicare Advantage Part C Plans Most Medicare Advantage Part C plans from UnitedHealthcare include prescription drug coverage. Medicare Supplement Plan D Costs Coverage and Benefits.

Youll also enjoy other extras such as vitamin and mineral supplements. Plan D is one of ten supplemental insurance plans you can purchase while on Medicare. Medicare Supplement Plan D Medigap Plan D is NOT the same asMedicare Part D Here are the differences.

However it provides adequate coverage and their premiums are typically less expensive compared to Medigap plans with more benefits. Medicare Supplement plans Medigap plans are sold by private insurance companies to supplement Original Medicare Part A and Part B coverage. Can have either Part A or Part B to enroll.

The plan pays 80 of emergency medical expenses while out of the country after a 250 deductible. This enhanced plan includes gap coverage and a 0 deductible for all tiers.

:max_bytes(150000):strip_icc()/cigna-logo-wallpaper-e1474921230453-634b8d2d06db4376ab7e0fb3715ada8f.jpg)