Its a type of health plan that gives you more control of your health care expenses. More than 800000 doctors and 6000 hospitals contracting with Blue Cross and Blue Shield plans nationwide.

What Is A Consumer Driven Health Plan For Small Business Ehealth

What Is A Consumer Driven Health Plan For Small Business Ehealth

An HSA is a savings account that lets you use pre-tax dollars to pay for a wide range of qualified health care costs including dental and vision.

Bcbs consumer driven health plan. For example with a PPO and an HMO you typically have a copay when you visit a doctor. CDHPs include flexible spending arrangements health reimbursement arrangements and medical savings accounts. Our consumer driven health plans offer potential savings for both members and employers while still providing reliable coverage.

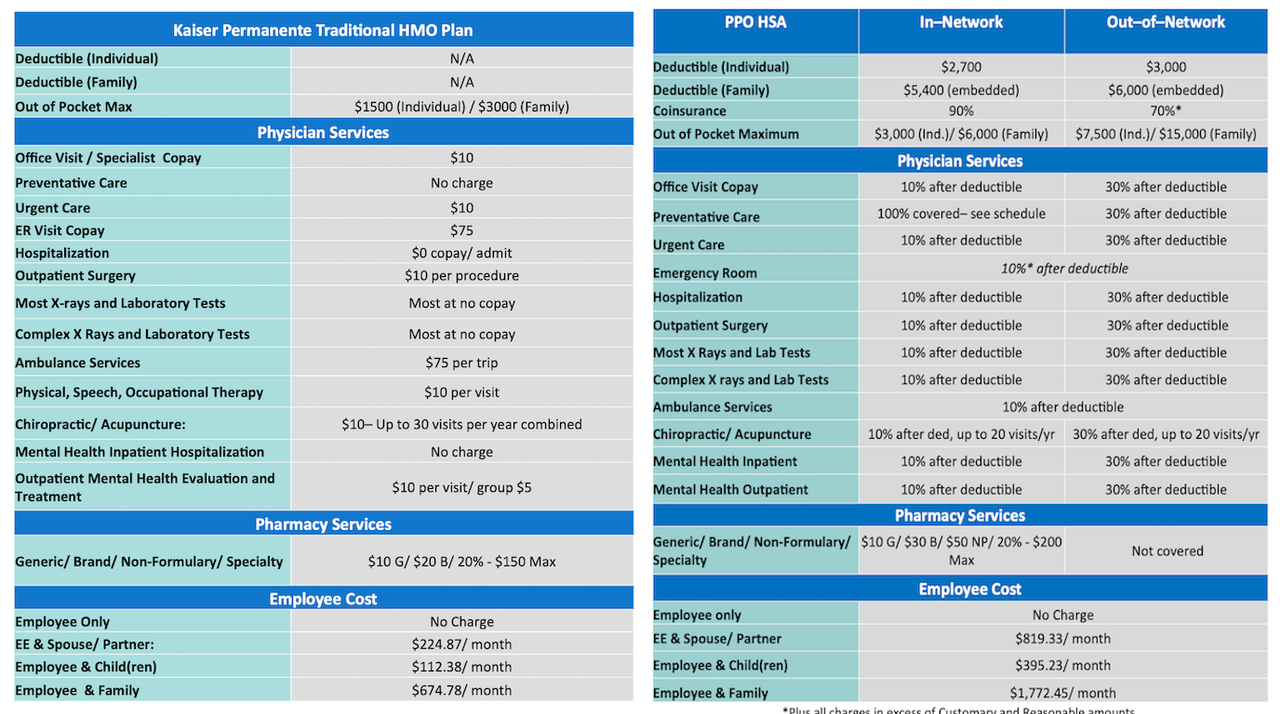

Costs are shared from the time coverage starts with other health plans such as a Preferred Provider Organization PPO or a Health Maintenance Organization HMO. Consumer-driven health plan CDHP7 In terms of payment methods CDHPs are often referred to as three-tier payment systems consisting of a savings account out-of-pocket payments and an insurance plan8 The first tier is a pretax account that allows employees to pay for services using pretax dollars. 500 Exchange Street Providence RI 02903-2699 Blue Cross Blue Shield of Rhode Island is an independent licensee of the Blue Cross and Blue Shield Association.

Consumer Choice HMO Plan The HMO Consumer Choice Plan provides benefits only when services are received from providers in the HMO Blue Texas network when prescribed directed or authorized by the members Primary Care Physician PCP or the HMO. Comprehensive health coverage 2. 100 deductible does not apply 60.

What are Consumer Driven Health Plans. Consumer-directed health plans combine high-deductible medical insurance with financial accounts designed to encourage responsible health care purchasing by your employees. Consumer Driven Health plan members also receive the tools knowledge and support they need to become better health care consumers including.

A CDHP most often pairs a Health Savings Account HSA or some other tax-advantaged account. To learn more about our consumer-driven health plans and how they can complement your benefit strategy please talk to your BCBSRI account representative or broker. Carefully read all Claims Administrator Preferred Medical Plan materials immediately after you are enrolled so you understand how to use your Benefits and how to minimize your out-of-pocket costs.

Employees enrolled in consumer-directed health plans are more likely to participate in wellness. With a consumer-driven or consumer-directed health plan CDHP you are required to pay your medical costs before your health plan does. PLANS ORIGINAL EFFECTIVE DATE PLANS ANNIVERSARYDATE January 1 2013 January 1.

These plans are customized solutions designed to empower you to make educated decisions about your health care. Consumer health care coverage can be combined with consumer driven accounts some of. Includes all wellness benefits.

The Preferred Health Plan Participant Responsibilities As a CDHP Participant you have the responsibility to. OGB CONSUMER DRIVEN HEALTH PLAN CDHP SCHEDULE OF BENEFITS. Routine mammograms pap smears prostate exams digital rectal exams and colorectal cancer screenings.

PLAN NAME PLAN NUMBER State of Louisiana Office of Group Benefits ST222ERC. Consumer driven plans include. Consumer-directed health plans combine financial engagement and comprehensive support to move employees toward becoming empowered consumers of health care services BCBS.

This approach gives you a powerful and sustainable solution to rising costs. Ask questions when necessary. The account may be funded by the employer.

Physicals immunizations routine sigmoidoscopy colonoscopy routine x-ray and lab. Funding accounts Plans with lower premiums and higher deductibles Preventive services covered in full. With a consumer-driven or consumer-directed health plan CDHP you must pay your medical costs before your health plan does.

A Consumer-Driven Health Plan CDHP is a plan that enables you to make decisions about your health care and how you pay for care. With consumer driven health care your employees regular health plan coverage combines with a funding account to cover medical expenses with tax-free dollars. BENEFIT PLAN FORM NUMBER 40HR1697 R0114.

CDHP stands for Consumer Directed Health Plan. A CDHP is a Consumer Directed Health Plan. Quality data and care comparisons to.

CDHPs are a combination of a high-deductible health insurance plan with savings accounts for health care like a health savings account HSA health reimbursement account HRA or flexible spending account FSA. Direct access to health care dollar balances. Members electing the HMO are required to choose a PCP from a network of contracting doctors in the HMO Blue.

For example you have a choice to 1 either pay more up front in premiums from your paycheck and less when you actually receive care lower deductible or 2 less up front in premiums from your paycheck and more when you actually receive care higher deductible. With other health plans such as a Health Maintenance Organization or a Preferred Provider Organization costs are shared at the onset of coverage. Trusted health information and decision support.

CDHPs use a high deductible paired with a tax-advantages health spending account or HAS to increase the amount of accountability that is in place for personalized health care spending.