Use HealthCaregov as a resource to learn more about health insurance products and services for your employees. Based on your companys specific needs you can alter what is included in a BOP.

Small Business Health Insurance Requirements 2021 Ehealth

Small Business Health Insurance Requirements 2021 Ehealth

Association health plans.

Small company insurance plans. Our flexible affordable options will help keep your employees healthy while also controlling your costs. Here are the most common types of small business liability insurance plans. However almost all businesses need general liability insurance.

There is a total of six plan options with varying costs by. Annons Health Insurance Plans Designed for Expats Living Working in Sweden. The insurance that you need for your small business depends on what type of business you have and your specific risks.

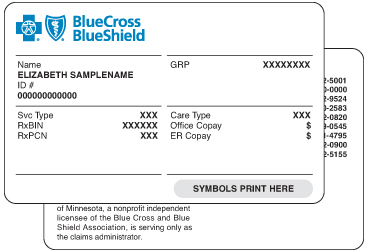

Annons Health Insurance Plans Designed for Expats Living Working in Sweden. 13 Types of Insurance a Small Business Owner Should Have. Small Group Insurance 2-50 Employees Small businesses can get comprehensive coverage from CareFirst BlueCross BlueShield.

While most Insurance companies limit the benefit to 50000 some would provide as high as 100000. And crime insurance. Just tell us a little about yourself your business and the level of cover you require and well put together a list.

Generally companies provide a higher sum assured for Caesarean delivery. Compare insurance quotes for your small business. An average eHealth small business plan covers 5 people and costs 1432 per month in premiums - or 286 per person.

Comparing business insurance quotes with MoneySuperMarket and our preferred partner SimplyBusiness is the easiest way to find a better insurance deal for your small business. General liability insurance also protects you against liability if you or your employees. Small businesses can join with other small companies to buy large-group health insurance which is reserved for companies with.

It can help attract and retain better employees improve productivity by keeping everyone healthy and. For a small business health insurance is a critical factor in retaining and recruiting employees as well as maintaining productivity and employee satisfaction. How much does small business health insurance cost.

In Maryland Washington DC. Choosing the right plan for your business and employees will depend on your priorities and preferences in relation to cost coverage and choice in care providers. UnitedHealthcare offers a wide range of group health insurance options designed to help your small business save.

Group insurance plans for young group offers maternity benefits. And Northern Virginia over 70 of small businesses offering health insurance choose. Kaisers small business insurance plans focus on companies with two to 100 employees.

Sometimes referred to as a Business Owners Policy BOP general Liability insurance plans protect your company from the infamous slip and fall cases. You can qualify if you meet the following requirements. Small business life insurance can help ensure the continuation of your business when you are gone and help make this time of transition run more smoothly.

Health insurance for your business and employees Offering health benefits is a major decision for businesses. Health insurance is one factor in retaining and recruiting. The market average is to provide 25000 as the sum assured for Normal and 35000 for C-Sec delivery.

To qualify you must purchase a plan through the Small Business Health Options Program SHOP Exchange which is an insurance portal created by the Affordable Care Act. But small business health insurance is a must if youre looking to grow. Small business health insurance with Humana Our health insurance plans for small businesses companies with 2 to 50 employees helps you save money and help keep your employees healthy.

Small business group health insurance comes in a wide range of plan types including HMOs PPOs HMOs EPOs and HSAs. Have fewer than 25 full-time employees or.