This means that if you currently have a plan Medigap F you are able to keep it. If you choose this option you have to pay a deductible of 2240 for 2018 before the plan pays anything.

Complete Medicare Supplement Plans Comparsion Chart For 2021

Complete Medicare Supplement Plans Comparsion Chart For 2021

Plan F covers that for you.

Plan f 2020. Medicare Supplement Plan F 2020 is now in a closed pool. However you can still find that many private insurance companies are selling it. Unfortunately people who are new to Medicare from January 1 2020 and onward will not be able to buy Plan F.

If you are not enrolled in Plan F in 2020. Recent Medigap Plan F. Changes to Medigap Plan F in 2020.

Medigap Plan F is retiring for new-to-Medicare enrollees. If you have purchased one of these three plans before 2020 you can keep your coverage. Plan F coverage also includes your other doctor visits for illnesses and injuries.

If you became eligible for Medicare in 2019 or earlier however you can still enroll in Plan F in 2020. It covers supplemental expenses to make it the most beneficial policy for many seniors. This is the theory behind higher rate increases with Plan F in the future.

Medicare Supplement F was once a popular health insurance plan from Medicare. Youll also be able to shop for a new Plan F C or HD Plan F. The bill prevents Medigap plans specifically Plan F and Plan C from covering Part B deductibles.

The Medicare Part B deductible that refers to the deductible amount involved in the MACRA legislation changes every year. This change specifically impacts plans that pay for the Medicare Part B deductible like Medicare Supplement Plan F. Some doctors charge a 15 excess charge beyond what Medicare pays.

Plan G is similar to Medicare Supplement Plan F except Plan G does not cover the Part B deductible. You can still buy coverage from another provider. People who were eligible for Medicare before January 1 2020 can still purchase Plan F or Plan C.

Medicare Part B first pays 80. In 2019 it was 185. This basically means that only people who have Plan F right now can get it in 2020.

Plan F also pays the 20 for a long list of other Part B services. In most states the most comprehensive Medicare Supplement insurance plan available will be Plan G. If you were eligible for Medicare on or after January 1 2020 you will generally not have the option to buy a Medicare Supplement Plan F.

The Innovative Plan F policy is catching our attention and for a good reason. One of the most significant changes is to Plan F. The Medicare Supplements available in 2020 are a bit different from what they have been in past years.

By the year 2025 the youngest person in Plan F will be 70 years old. If you turned 65 after Jan 1 2020 then you wont be able to purchase Plan F. But its price tag was discouraging and most seniors could not afford it.

You can join Plan F when you retire or when you lose employee provided. Medicare Supplement Insurance Plan F premiums in 2020 are lowest for beneficiaries at age 65 18493 per month and highest for beneficiaries at age 85 29929 per month. Plan F also has a high-deductible option.

What to Expect. Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 14346 per month and highest for beneficiaries at age 85 23587 per month. If you already had Plan F before January 1 2020 youll be able to keep it.

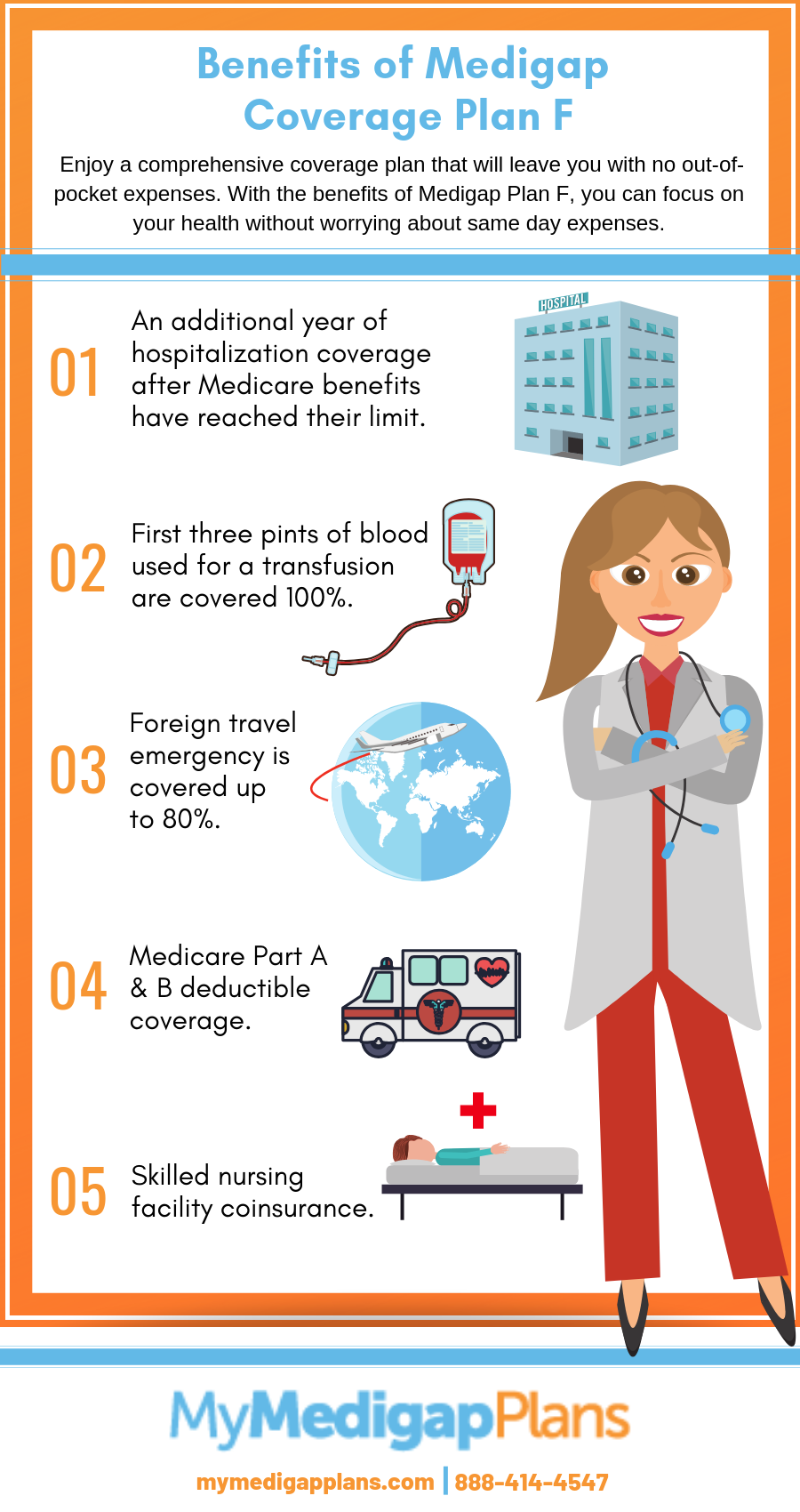

Because the plan also covers costs in excess of Medicare-approved amounts you may have no out-of-pocket costs for hospital and doctors office care with this plan. For that reason Medicare ended Supplement Plan F 2020. If you are eligible for Medicare before 2020 but delay enrollment because of employer coverage.

This amount can go up each year. If you are already enrolled in Plan F in 2020. There will be no new 65 year olds in Plan F in the year 2020.

Plan F covers the most standardized Medigap benefits and is the most popular Medigap plan. You will not be kicked off your plan. Medigap Plan F will have limited availability.

Certain Medicare Supplement plans also known as Medigap will no longer be offered to newly eligible enrollees after January 1 2020. If you turned 65 before 2020 then you will be able to keep your Plan F or enroll in it for the first time. This legislation means that Plan F Plan C and High Deductible Plan F will no longer be fore offered to those who are new to Medicare in 2020.

Then your Plan F supplement pays your deductible and the other 20. Medigap Plan F is one of the 10 standardized Medicare Supplement Insurance plan options sold in most states. Plan F will not be available for sale to Medicare beneficiaries who become eligible for Medicare after January 1 2020.

These plans would no longer be available for purchase on or after the 1st January 2020. Additionally anyone enrolled in Plan F or C prior to 2020 will be able to keep their plan. As we get older we generally have more medical expenses thus higher claims costs and thus higher premiums are required.

The same goes for high deductible Plan F. Beginning in 2020 Plans F and C which cover the Part B deductible are no longer available to people newly eligible to Medicare after January 1 2020. In fact 55 of Medigap beneficiaries in 2017 were enrolled in Plan F.

You will not be able to join as a new enrollee. The Innovative Plan F is Plan F with extra benefits. Anyone who becomes eligible for Medicare on January 1 2020 or later wont be able to purchase Plan F and high.

.png)