This is usually your earned income entered above plus any interest dividends or capital gains. Help with California earnings Go to next link for details Required Field What is your filing status.

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

Visit IRS Earned Income Tax Credit for more information.

California earned income tax credit calculator. The EITC is not a fixed amount. The California Earned Income Tax Credit CalEITC is a refundable cash back tax credit for qualified low-to-moderate income Californians. State Earned Income Tax Credits.

The Earned Income Credit EIC is a refundable tax credit available to working individuals with low to moderate incomes. This qualifies you for the California Young Child Tax Credit YCTC Estimate my EITC. Golden State Stimulus If you qualify for the CalEITC you likely qualify for the Golden State Stimulus.

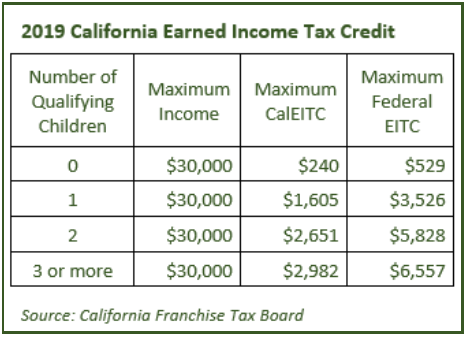

For taxpayers without children the credit is less generous. This means extra cash in your pocket. The California Earned Income Tax Credit CalEITC and the Young Child Tax Credit YCTC are state tax credits for working Californians.

How Income Taxes Are Calculated. You can use this EIC Calculator to calculate your Earned Income Credit based on the number of qualifying children total earned income and filing status. Earned Income Tax Credit.

Whole dollars no commas. The EIC reduces the amount of taxes owed and may also give a refund. The Federal and California Earned Income Tax Credits EITCs are special tax breaks for people who work part time or full time.

For tax year 2020 The CAA allows taxpayers to use their 2019 earned income if it was higher than their 2020 earned income in calculating the Additional Child Tax Credit ACTC as well as the Earned Income Tax Credit EITC. The credit could cancel out any. If you qualify you may see a reduced tax bill or a bigger refund.

If you are eligible for the Earned Income Tax Credit or made 57000 or less in 2020 have a disability or are a limited. See the Earned Income Tax Credit table or calculator below to see the maximum amount of the EITC allowed. If your adjusted gross income is greater than your earned income your Earned Income Credit is calculated with your adjusted gross income and compared to the amount you would have received with your earned income.

Find out how much you could get back Required Field Required Field Language Select language Required Field How much did you earn from your California jobs in 2020. Also we separately calculate the federal income taxes you will owe in the 2019 - 2020 filing season based on the Trump Tax Plan. How much did you earn from your California jobs in 2020.

You may be subject to a 500 penalty if you dont comply with CalEITC requirements. The EIC calculator helps eligible tax filers estimate how much credit they will receive on their tax return. Use this calculator to see if you qualify.

Paid Preparers California Earned Income Tax Credit Checklist FTB 3596 CalEITC worksheet. First we calculate your adjusted gross income. The amount of CalEITC you may be eligible for depends on how much money you earn from work.

If you have work income you can file and claim your EITC refunds even if you dont owe any income tax. Your adjusted gross income. 600 in one-time relief payments to households with incomes below 30000 that receive the California Earned Income Tax Credit for 2020.

Without the federal and state EITCs 840000 more Californians including 376000 children would be in poverty according to the California Poverty Measure which accounts for benefits from safety net programsIn addition 275600 more Californians including 112400 children would be in deep poverty with less than half the. 2020 and 2021 credit calculations. Be sure to check both state and federal.

In addition to CalEITC you may qualify for the federal EITC. You may also be eligible if you. California residents who made less than 30000 may be eligible for up to 3027 depending on income and family size.

Are over age 18. This includes wages salaries tips and other employee compensation if. State of California Franchise Tax Board Corporate Logo.

ITIN FILERS NOW ELIGIBLE FOR CALEITC. Your adjusted gross income. 600 one-time payments to taxpayers who were unable to receive federal relief payments by filing with Individual Tax Identification Numbers ITINs.

Ready to file your taxes for free. The IRS defines earned income as the compensation you receive from employment and self-employment. In 2021 more hard-working individuals and families are eligible than ever including Californians that file their taxes.

Claiming your EITC is easy. The maximum credit is 506 and the income limit is 14880 for singles and 20430 for married couples. This is usually your earned income entered above plus any interest dividends or capital gains.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Just file your state and or federal tax returns. Earned Income Tax Credits help alleviate poverty across the state.

The Personal Income Tax Law beginning on or after January 1 2015 in modified conformity with federal income tax laws allows an earned income tax credit against personal income tax and a payment from the Tax Relief and Refund Account for an allowable credit in excess of tax liability to an eligible individual that. It varies for each taxpayer and that is why its important to view the updated Earned Income Tax Credit table. The amount of CalEITC you may be eligible for depends on how much money you earn from work.

The maximum eligibility level for a family with three or more children is 47955 if the head of household is single and 53505 if married. If your adjusted gross income is greater than your earned income. Specifically excluded from this.

The expanded California Earned Income Tax Credit CalEITC the new Young Child Tax Credit YCTC and the federal EITC can combine to put hundreds or even thousands of extra dollars in your pocket. The Californian FTB outlines the eligibility requirements for the CalEITC programme on their website along with a handy EITC Calculator. Use our calculator to find out how much money you could get back.

Your household income location filing status and number of personal exemptions.

Publication 596 2020 Earned Income Credit Eic Internal Revenue Service

Publication 596 2020 Earned Income Credit Eic Internal Revenue Service

Earned Income Tax Credit Parameters 1975 2000 Dollar Amounts Download Table

Earned Income Tax Credit Parameters 1975 2000 Dollar Amounts Download Table

Do You Qualify For The 2020 2021 Earned Income Tax Credit Or Eitc

Do You Qualify For The 2020 2021 Earned Income Tax Credit Or Eitc

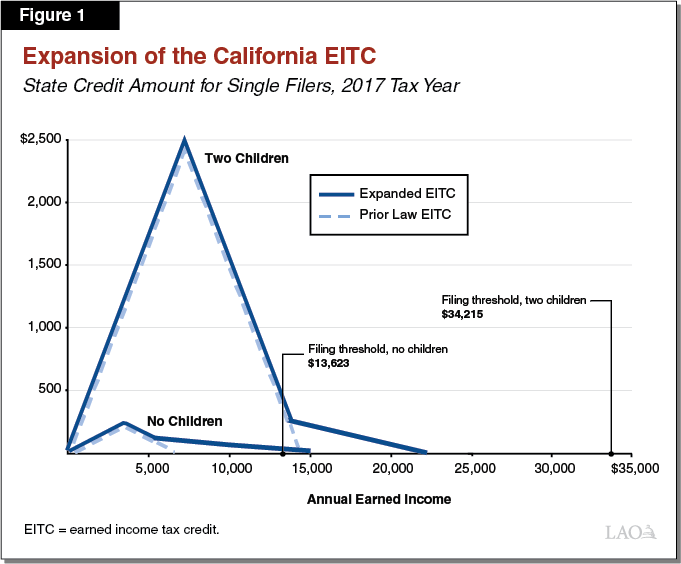

Expanded Caleitc Is A Major Advance For Working Families California Budget Policy Center

Expanded Caleitc Is A Major Advance For Working Families California Budget Policy Center

Earned Income Tax Credit Estimator Get It Back Tax Credits For People Who Work

Earned Income Tax Credit Estimator Get It Back Tax Credits For People Who Work

Golden State Stimulus California Earned Income Tax Credit

Golden State Stimulus California Earned Income Tax Credit

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

The 2018 19 Budget California Earned Income Tax Credit Education And Outreach

The 2018 19 Budget California Earned Income Tax Credit Education And Outreach

Caleitc4me Calculator Caleitc4me

Caleitc4me Calculator Caleitc4me

Earned Income Tax Credits In California Public Policy Institute Of California

Earned Income Tax Credits In California Public Policy Institute Of California

California State Controller S Office 2020 02summary

California State Controller S Office 2020 02summary

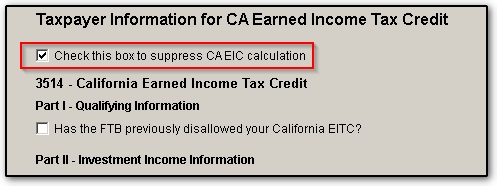

Ca Earned Income Credit Checklist And Ef Messages

Ca Earned Income Credit Checklist And Ef Messages

Earned Income Tax Credit La Cooperativa Campesina De California

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.