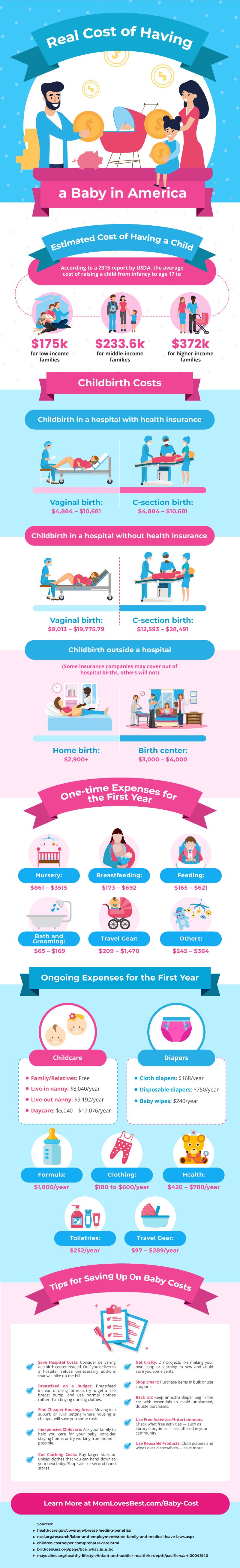

DEMOCRATS PUSH 36B SUBSIDY FOR OBAMACARE IN MONSTER SPENDING BILL Understanding how the tax credit is calculated requires knowing two numbers. About the 2020 2021 Obamacare Subsidy Calculator The purpose of this subsidy calculator is to provide Americans with the ability to quickly determine if they are eligible for subsidized health insurance under the Affordable Care Act.

Aca Open Enrollment What If You Make Too Much For A Subsidy The New York Times

Aca Open Enrollment What If You Make Too Much For A Subsidy The New York Times

Get ready to apply for 2021 coverage.

Obamacare subsidy calculator. Use this checklist PDF 160 MB to gather documents youll need. First of all it is not a subsidy in the technical sense of the term it is a federal tax credit that may have to be repaid under certain circumstances. The discount on your monthly health insurance payment is also known as a premium tax credit.

Including the right people in your household Count yourself your spouse if youre married plus everyone youll claim as a tax dependent including those. The Health Insurance Marketplace Calculator provides estimates of health insurance premiums and subsidies for people purchasing insurance on their own in health insurance exchanges or. In 2021 Obamacare subsidies begin if your health plan cost is greater than 85 of your household income towards the cost of the benchmark plan or a less expensive plan the benchmark plan is the second-lowest silver plan.

I will show you how this spreadsheet can help calculate the effect of Roth conversion or long-term capital gains when you receive subsidy for health insurance from ACA. Use this quick health insurance tax credit guide to help you understand the process. ACA Premium Calculator Healthcare Open Enrollment should be simple and easy.

Here are some ways to get ready. Fast free quotes on health insurance that fits your needs and your budget. Use our income calculator to make your best estimate.

I used version 1113 released on July 20 2018. See if youll save on health insurance coverage. I dont know the author of this spreadsheet.

Enter the required information into the fields below then calculate your results. It can be a mystery as to how the Affordable Care Act also known as Obamacare subsidy to reduce the monthly cost of health insurance for individuals and families is calculated. In fact Obamacare subsidies are designed to help lower- and middle-class Americans living between 100 and 400 of the federal poverty level FPL.

The subsidy calculator below uses the currently available levels to give you an idea of 2021 subsidy amounts. Visit our Find Local Help page and search by. Learn how to estimate your income for your application.

Learn more about estimating income and see what to include. Obamacare subsidy calculator This tool provides ACA premium subsidy estimates based on your household income. 2021 ObamaCare Subsidy Calculator Use the following subsidy calculator to find out if you qualify for 2021 assistance now.

In 2020 for example thats a family of four with an income between 26200 and 104800 a year. This calculator is a helpful start. Premiums displayed in the calculators results are based on actual exchange premiums in 2021.

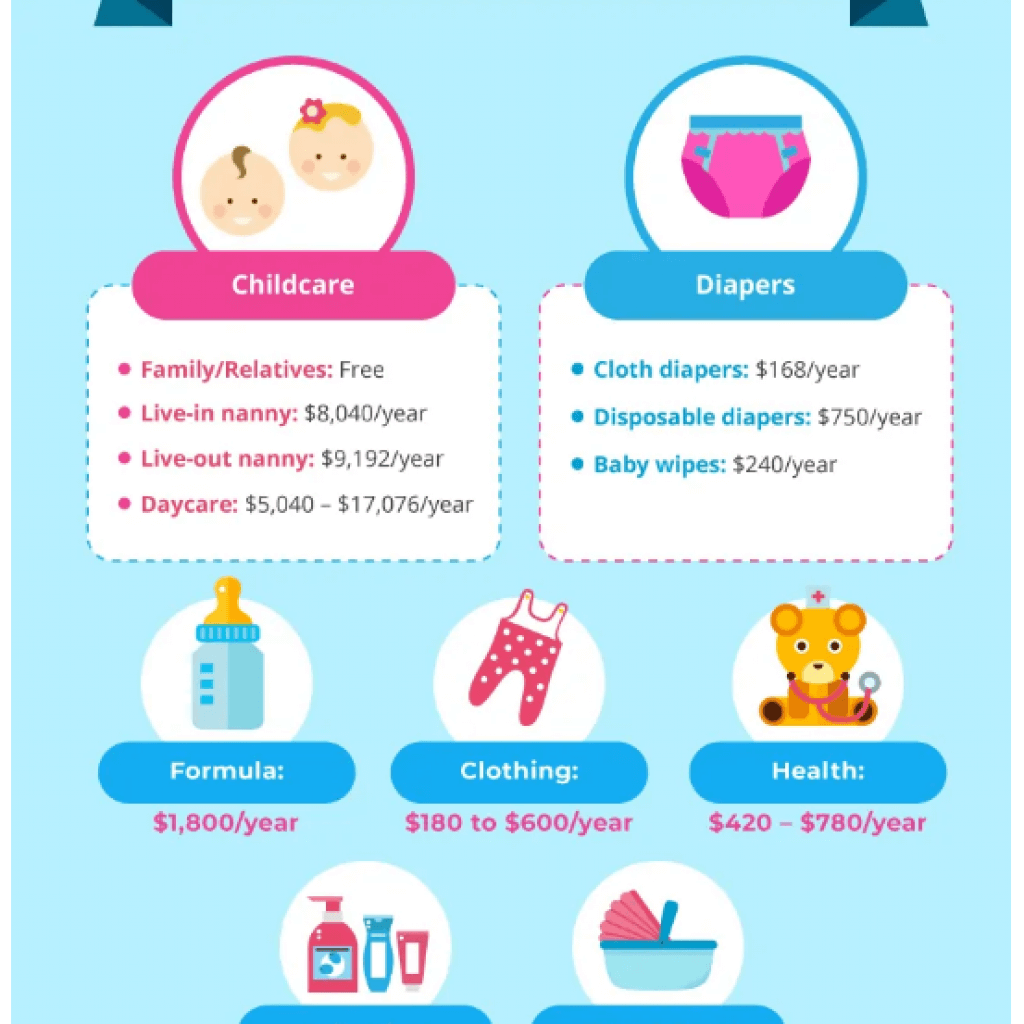

The amount of subsidies your household may receive is dependent upon the number of people in your household and your household income as it relates to the federal poverty level. 2020 Subsidy Tax Penalty Calculator For 2020 if you earn less than 47080 as an individual or 97000 for a family of 4 youll receive a tax subsidy to help you pay for some or all of your insurance. Get a quick overview of the Health Insurance Marketplace.

Use our calculator to see how much youll be eligible for. I assume its reasonably accurate because it looks like the author put a lot. This subsidy calculator is provided by My1HR a licensed Web Based Entity WBE which is certified by the Centers for Medicare and Medicaid Services CMS to connect consumers directly with the federal health insurance Exchange at HealthCaregov.

The first is the amount of income that Obamacare. Understanding the relationship between Income Health Insurance Premiums and ACA subsidies is important in navigating the insurance marketplace and making wise and beneficial choices. Our ObamaCare calculator will help you calculate tax credits and subsidies for health insurance sold on the Health Insurance Marketplace.

Nor did I verify its accuracy. Or just use one of the ObamaCare subsidy calculators found below for a quick estimate on marketplace cost assistance. The calculator includes subsidy increases for 2021 in the American Rescue Plan Act ARP of 2021.