If your deductible is 1000 and you file a. Lentreprise a lobligation de collecter la TVA au profit de lÉtat sur les ventes ou prestations imposables quelle réalise.

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

1000 2500 or even 5000.

0 dollar deductible. A 0 deductible means your insurance should cover such costs so you are responsible for 0 of these bills. The deductible might be anywhere from 500 to 1500 if youre an individual or 1000 to 3000 if youre a family. Your insurance company will cover your allowable claims right away.

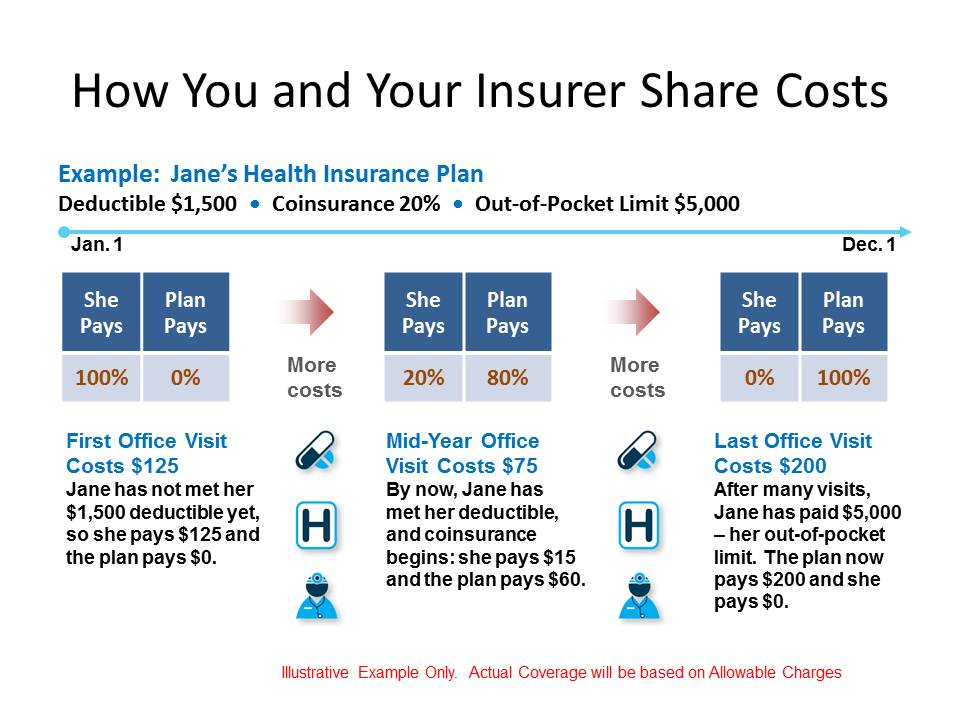

For homeowners insurance having a high deductible can mean annual savings since. Your deductible is the amount you pay for health care out of pocket before your health insurance kicks in and starts covering the costs. A zero deductible can mean different things for different types of insurances.

Ive always had 0 deductible plans when insured through my employer. In some states youll have the option to select a 0 deductible on your policys comprehensive coverage. Zero Dollar Deductible for Brokers.

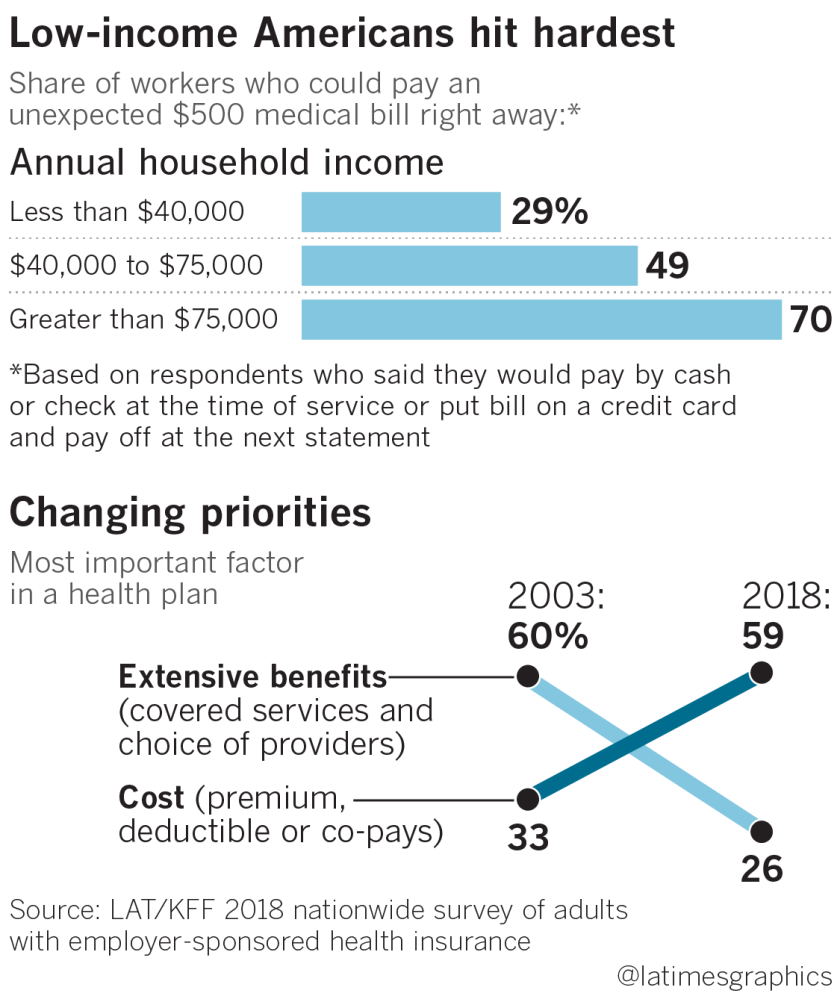

In the first scenario youd be on the hook for your entire 12000 deductible plus your premium costs. Zero-deductible plans typically come with higher premiums whereas high-deductible plans come with lower monthly premiums. When a claim happens is it even the agents fault.

A copayment or coinsurance is the amount that you must pay for medical services doctor visits medical equipment or prescription drugs after your deductible is met. Heres my understanding of selected health insurance terms. Visit specialist visit rx hospital stay.

A zero deductible plan means that you dont have to pay for any costs upfront before receiving your benefits. Deductible- what you have to pay for services before any coverage kicks in Copay- flat amount you pay out of pocket for certain services dr. A standard homeowners insurance policy deductible is usually in the range of 500 to 2000 although lower and higher deductible home insurance plans are also common.

Dollar amount deductibles work like this. Call 1-866-749-7436 or quote online. In some cases drivers might enjoy a deductible of 0.

You have free repairs on glass claims. After the new policy period starts youll be responsible for paying your. Because a no deductible health insurance plan can cost almost twice as much per month they are recommended for people who do not expect to need medical care in the near future.

People who do not have children are recommended to pay for insurance with higher deductibles. However this only means you pay a higher monthly premium. That said keep in mind that certain preventative services may be covered by your health.

0 premium Medicare Advantage plans may feature certain cost-sharing measures such as copayments a flat fee or coinsurance a percentage of the cost of services or equipment. Do note that deductibles are separate from coinsurance. This is the standard fixed-dollar amount deductible that you pay out of pocket when you file a claim for a covered loss.

At Progressive in most states if we can repair instead of replace any glass breakage you wont have to pay your deductible. E O Deductibles can be expensive. For example you might be charged 15 for each doctors visit 10 for each prescription and 25 for specified laboratory procedures.

Zero-deductible health insurance plans typically employ two cost-sharing techniques to mitigate the companys responsibility for your healthcare costs. Over 90 of E O Claims have something to do with property conditions. When You Should Consider A Zero Deductible Plan.

Yes a zero-deductible plan means that you do not have to meet a minimum balance before the health insurance company will contribute to your health care expenses. The longer a driver goes without a claim the lower the deductible can go. Several car insurance companies offer this type of feature including 3 of the 10 largest auto insurers nationally.

Some expenses like an annual check-up or doctors visit might not be subject to the deductible depending on your plan. Choose your deductible and get coverage from Progressive New Progressive customers. En contrepartie elle doit déduire la TVA de ses dépenses de.

Most policy periods are 1 year long. A vanishing deductible is a car insurance program where safe drivers pay a recurring fee in exchange for lower deductibles in the event of an accident. Your deductible automatically resets to 0 at the beginning of your policy period.

First dollar coverage is a type of insurance policy with no deductible where the insurer assumes payment once an insurable event occurs. Co-payments are flat fees applied to certain routine medical expenses. The deductible reflects the amount you must pay for health coverage essentially the dollar amount of medical bills you accumulate before your insurance starts to cover the costs.

Health Insurance Basics How To Understand Coverage

Health Insurance Basics How To Understand Coverage

What S The Transformation Among Cover Deductible Coinsurance Along With Copay 50 Dollar Copay Then You Pay 0 After Deductible

What S The Transformation Among Cover Deductible Coinsurance Along With Copay 50 Dollar Copay Then You Pay 0 After Deductible

What S The Transformation Among Cover Deductible Coinsurance Along With Copay 50 Dollar Copay Then You Pay 0 After Deductible

What S The Transformation Among Cover Deductible Coinsurance Along With Copay 50 Dollar Copay Then You Pay 0 After Deductible

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Oop Out Of Pocket Maximum Deductible Co Pay Participating Providers

Oop Out Of Pocket Maximum Deductible Co Pay Participating Providers

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Illinois

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Illinois

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Deductible Vs Out Of Pocket Limit What S The Difference

Deductible Vs Out Of Pocket Limit What S The Difference

Deductible Vs Out Of Pocket Maximum What S The Difference

Deductible Vs Out Of Pocket Maximum What S The Difference

What To Know About No Deductible Health Insurance Plans

What To Know About No Deductible Health Insurance Plans

What Is An Insurance Deductible Forbes Advisor

What Is An Insurance Deductible Forbes Advisor

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.