Out-of-pocket maximum of 5000. Effective immediately Blue Cross and Blue Shield of Vermont Blue Cross will waive out-of-pocket costs for members who need in-patient treatment for COVID-19.

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

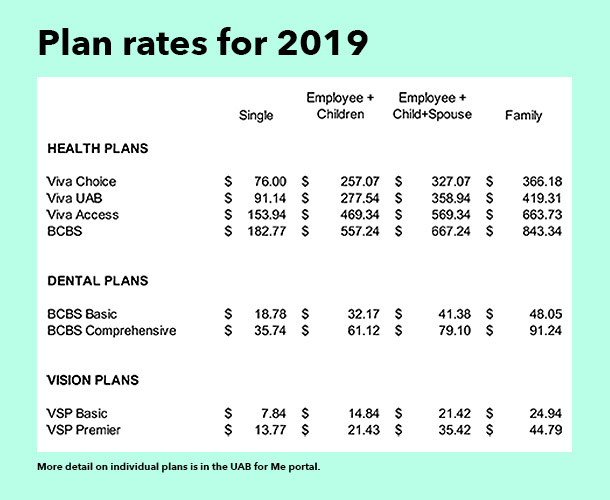

The OOPM is different for every type of plan.

Out of pocket blue cross blue shield. You must pay 4000 toward your covered medical costs before your health plan begins to cover costs. 150 per day for air or sea ambulance. The test you received must be approved by the Food and Drug Administration.

Reversing course Blue Cross Blue Shield of Rhode Island extends waiver of out-of-pocket costs for COVID-19 treatment After discussions with Governor McKee and the states health insurance. April 6th 2020. The maximum amount you would pay out-of-pocket for covered healthcare services each year including deductible copays and coinsurance.

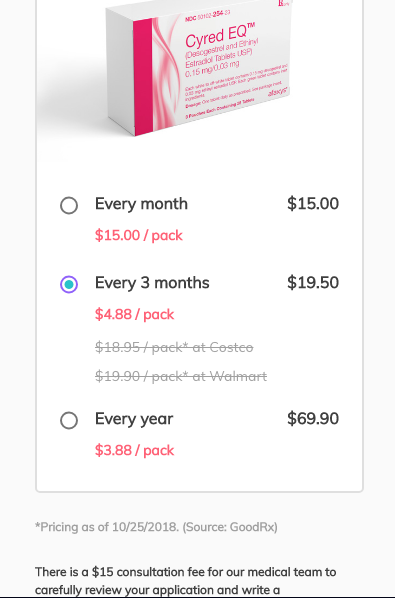

The out-of-pocket maximum also called OOPM is the most you will have to pay out of your own pocket for expenses under your health insurance plan during the year. Have paid for out of your own pocket. COVID-19 screenings or evaluations done.

It typically includes your deductible coinsurance and copays but this can vary by plan. You were exposed to someone. Member pays copayscoinsurance toward out-of-pocket maximum.

100 per day for ground ambulance. 7000 Individual 7000 Family Member 14000 Family Total. By eliminating cost share for those with COVID-19 Blue Cross members will be able to get the treatment they need without copays coinsurance or deductibles.

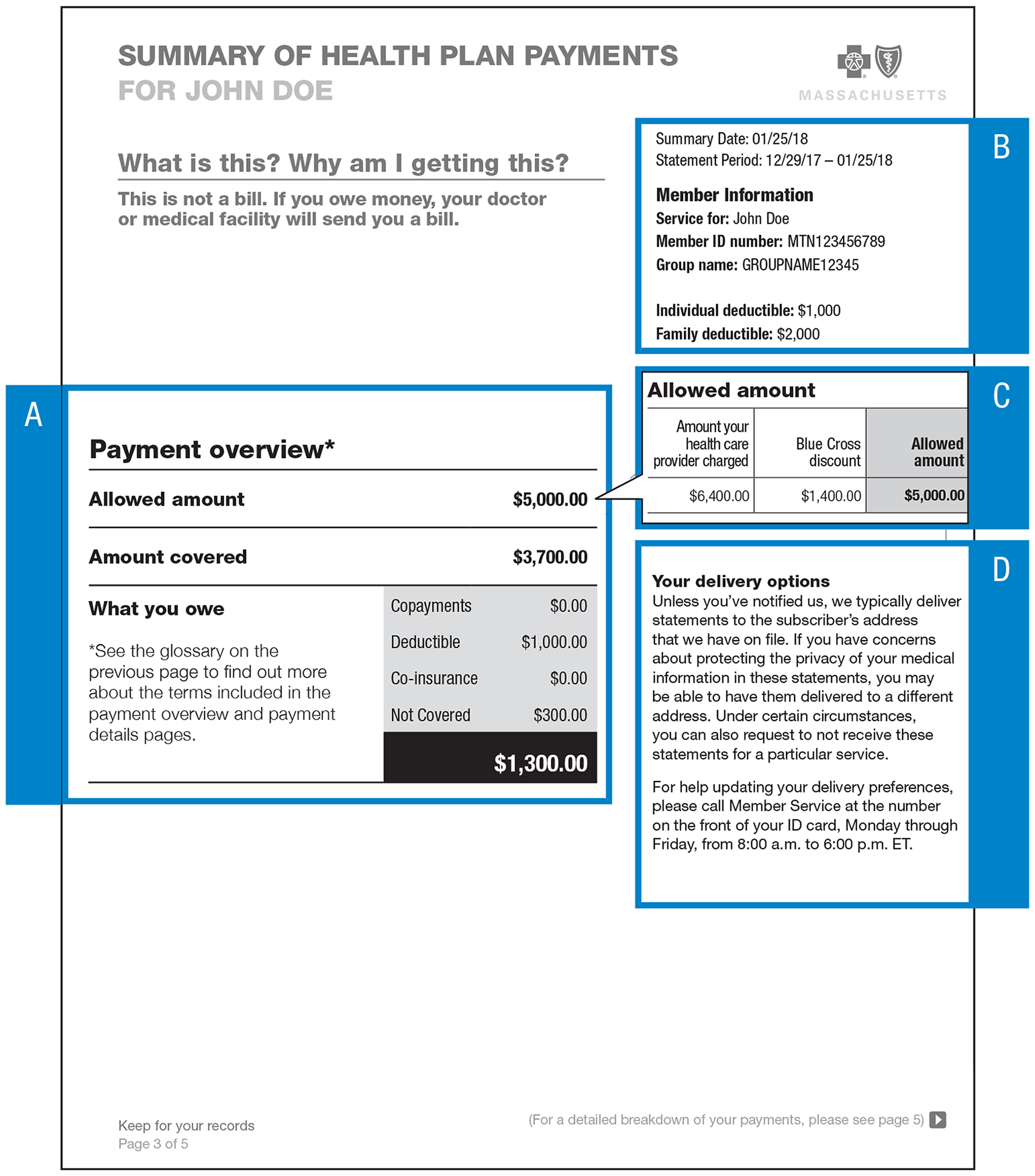

When our members need to know how much money has been applied to their deductibles and out-of-pocket. The out-of-pocket maximum is the most you could pay for covered medical services andor prescriptions each year. The test was medically necessary.

The out-of-pocket limit is the most you could pay in ayear for covered services. Take a look at your recent. Blue Cross Premier PPO Gold.

175 copayment for emergency room care. The out-of-pocket maximum also called OOPM is the most you will have to pay out of your own pocket for expenses under your health insurance plan during the year. In a hospital including emergency room.

Lower out-of-pocket costs when using the Horizon Managed Care Network or the BlueCard PPO Network nationwide and Blue Cross Blue Shield Global Core abroad NJ DIRECT HD1500 and NJ DIRECT HD4000 are High Deductible Health Plans HDHPs that combine a high deductible health plan with a health savings account HSA. If you are a current BCBSOK member you can see what your plans OOPM is within Blue Access for Members. After you pay the 4000 deductible your health plan covers 70 of the costs and you pay the other 30.

What is the out-of- pocket limit for this plan. If you have other family members in this plan the overall family out-of-pocket limit must be met. You may not reach that yearly limit so how can you gauge your out-of-pocket costs.

During the federal public health emergency Blue Shield will continue to waive out-of-pocket costs for copays coinsurance and deductibles for. The OOPM is different for every type of plan. After the out-of-pocket is met in-network covered services are paid at 100 by Blue Cross Blue Shield.

The out-of-pocket maximum does not include your monthly premiums. Health plan pays 100 of all medical expenses moving forward. Blue Cross Blue Shield of Michigan.

You have a monthly premium and other out-of-pocket costs. Virtually using telehealth In a doctors office At an urgent care center or. 35 copayment for urgent care.

Once you reach your out-of-pocket max your plan pays 100 percent of the allowed amount for covered services. You pay all charges for care in settings other than the emergency room. If your plan covers more than one person you may have a family out-of-pocket max and individual out-of-pocket maximums.

Check the FDA-approved test list. Thanks to out-of-pocket maximums there is a limit on what youll spend in a year. To be eligible for reimbursement the following must apply.

Our Member Online Services tools make it easy for them to get much of the health coverage information they need when they need it. You must provide documentation that the test was ordered or performed by a health care provider. If you go out of your network for services those expenses may not count toward your OOPM so you could have to pay more.

Depending on your plan costs could include copays coinsurance and deductibles for medical services and prescriptions. 175 copayment for emergency room care. Deductible and Maximum Out-of-pocket Information are Now Available Online Horizon Blue Cross Blue Shield of New Jersey is improving the way we provide our members with access to their information.

What you pay toward your plans deductible coinsurance and copays are all applied to your out-of-pocket max.