If playback doesnt begin shortly try restarting your device. HSAs are a form of medical savings account that must be accompanied by a high-deductible health insurance plan.

Hdhp Vs Ppo What S The Difference

Hdhp Vs Ppo What S The Difference

Use this calculator to help compare a traditional low-deductible health.

Ppo high vs ppo low. Both plans also contain a co-insurance clause in them. These totals do not have any discounts applied. You can opt to see a dentist outside the network but your costs will be higher.

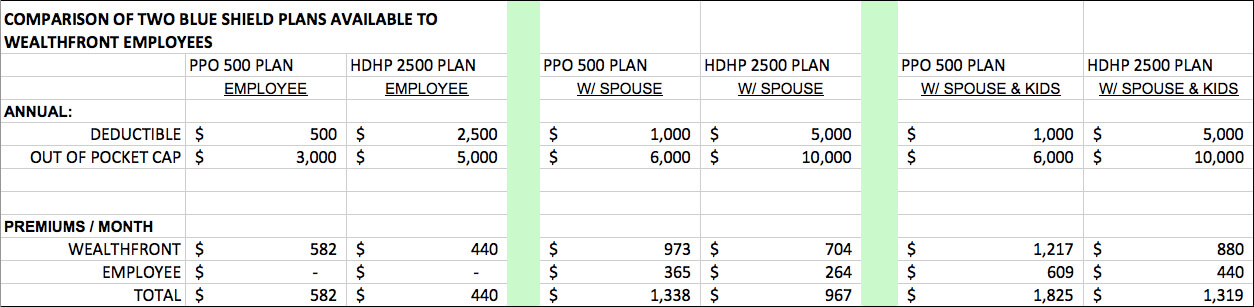

A quick search on Healthcaregov reveals a family of your size in Texas could pay around 620 per month on a bronze-level PPO with a high deductible of 12700. An HDHP plan is typically about 10 cheaper than a traditional preferred provider organization PPO plan and is usually associated with a company funded tax-advantaged health savings account HSA that is meant to fund some of your medical expenses. A PPO comes with higher monthly premiums compared to what youd pay with an HDHP.

Unlike an HDHP there is no HSA associated with a PPO unless your plan qualifies as an HDHP. Making Sense of Different Types of Health Plans June 07 2018 If youre shopping for a new health plan you may hear a lot about HMO POS PPO and HDHP plans but you may not understand the differences between them. A PPO plan is a managed care plan which means the plan is guided by both insurance and medical professionals.

You are not required to choose a primary care dentist. Your monthly premiums will be higher and your copays for office visits will also cost more. PPO coverage typically extends further than that of other common health insurance plans.

7 Differences Between an HMO vs. POS plans is flexibility. Under a PPO plan.

This infographic lays out the key differences between these four popular health plans. HMO POS PPO and HDHP. DPPOs typically have an annual deductible and coinsurance.

In general the biggest difference between PPO vs. A PPO health insurance plan provides more choices when it comes to your healthcare but there will also be higher out-of-pocket costs associated with these plans. When considering a PPO it is important to understand that even if you have the freedom to choose a provider outside of network those rates are often significantly higher because negotiated rates for services arent always established.

Depending on the carrier you enroll with for example it may be able to cover alternative procedures like acupuncture. Just like other PPO plans even a low costing PPO plan is likely to have copays for office visits and prescriptions. POS or Point of Service plans have lower costs but with fewer choices.

Dental PPOs have a network of providers to choose from. HSAs allow individualsemployers to set aside money on a pre-tax or tax-deductible basis and then withdraw the money tax-free to pay qualifying medical expenses. In the PPO if you go to a physician or hospital not in the network you may not pay a higher co-pay but the insurance company might not pay as large a percentage of the bill.

Videos you watch may be added to the TVs watch history and influence TV. The higher the deductible the lower the premium is for that type of plan. Typically the cheapest PPO plan has a higher deductible than a more expensive PPO plan but a lower deductible than a HDHP High Deductible Health Plan.

Yet because of the overall lower in-network costs PPO premiums tend to rise high. What is a Dental PPO plan. But in exchange you get lower co-pays deductibles and out-of-pocket maximums.

Predictable office visit prescription copays. If you know that you have some medical expenses coming up paying more monthly for a lower deductible at the time of service might make more sense. If the alphabet soup of health insurance jargon still has you scratching your head take heart.

Copays You only pay a small copayment for a medical office visit. At the other extreme a gold-level PPO with a low deductible of 1500 for the entire family comes at a premium of nearly 1400 per month. HMOs have lower premiums and out-of-pocket expenses but less flexibility.

This type of plan gives you greater freedom than a traditional health. Lets take a look at some of the most common differences between these two types of health insurance plans. A PPO or Preferred Provider Organization offers a lot of flexibility to see the doctors you want at a higher cost.

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

The Pros And Cons Of High Deductible Health Plans Hdhps

The Pros And Cons Of High Deductible Health Plans Hdhps

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Pros And Cons Of Most Common Health Insurance Plans Health Insurance Plans High Deductible Health Plan Health Insurance

Pros And Cons Of Most Common Health Insurance Plans Health Insurance Plans High Deductible Health Plan Health Insurance

How To Pick A Health Insurance Plan High Deductible Ppo Epo

Comparing Health Plan Types Kaiser Permanente

High Deductible Plans More Common But So Are Choices

High Deductible Plans More Common But So Are Choices

Hdhp Vs Ppo Which Is Right For You Ramseysolutions Com

Hdhp Vs Ppo Which Is Right For You Ramseysolutions Com

Comparing Health Plan Types Kaiser Permanente

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

Dismissing High Deductible Hsa Plans Is A Costly Mistake Resource Planning Group

Think Carefully Before Signing Up For A High Deductible Health Plan

Think Carefully Before Signing Up For A High Deductible Health Plan

Personal Finance Ep 84 How To Pick A Good Health Insurance Plan Dollars Ense La

Personal Finance Ep 84 How To Pick A Good Health Insurance Plan Dollars Ense La

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.