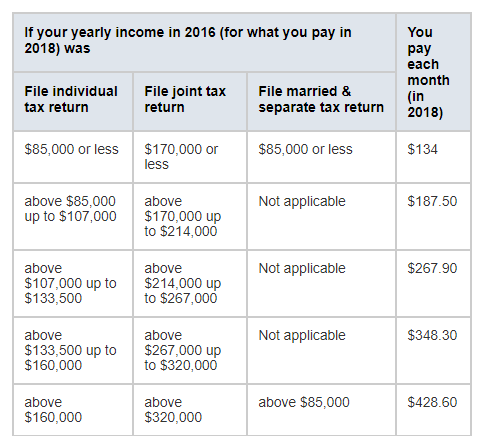

You may need to enroll at different times depending on your age and health. How much Medicare Part B medical insurance costs including Income Related Monthly Adjustment Amount IRMAA and late enrollment penalty.

2018 Medicare Costs The Numbers 65medicare Org

2018 Medicare Costs The Numbers 65medicare Org

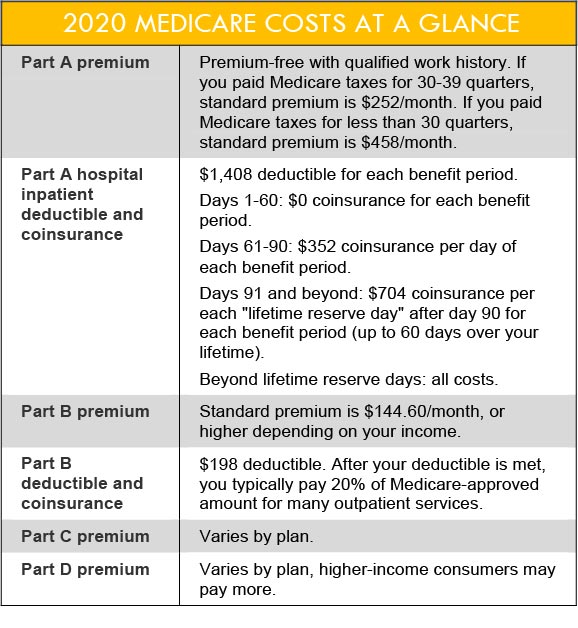

Each provides support for different medical services from hospital stays under Part A to prescription drug coverage under Part D.

How much does medicare cost a month. If you paid Medicare taxes for fewer than 30 quarters your premium will be 471 per month. Medicare Part B helps cover your medical bills. Part B is for your doctor visits tests and other services.

The deductible for Medicare Part A is 1484 per benefit period. The standard monthly premium for Medicare Part B enrollees will be 14850 for 2021 an increase of 390 from 14460 in 2020. Above 176000 up to 222000.

If you paid Medicare taxes for less than 30 quarters the standard Part A premium is 471. Medicare Part B Premiums The Part B standard premium for 2021 is 14850. Lab tests doctor visits and wheelchairs are examples of some services and items that Medicare Part B would help pay for.

Above 111000 up to 138000. While Medicare considers. Medicare Part A Hospital Insurance Costs Part A monthly premium Most people dont pay a Part A premium because they paid Medicare taxes while.

Medicare Part B does have a monthly premium which is 14850 per month. The average Part D plan deductible in 2021 is 34297 per year. As you might know Medicare has four different coverage options- Parts A B C and D.

1 The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. If you buy Part A youll pay up to 471 each month in 2021. This also means husbands wives spouses and partners pay separate Medicare premiums.

The annual deductible for all Medicare Part B beneficiaries is 203 in 2021 an increase of 5 from the annual deductible of 198 in 2020. Advertentie Find affordable quality Medicare insurance plans that meet your needs. People who buy Part A will pay a premium of either 259 or 471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes.

Although they have their differences each Medicare option will include a monthly premium. How much does Medicare cost for a married couple. Medicare has no family plans meaning that you and your spouse must enroll for Medicare benefits separately.

How much do Medicare Parts A-D cost. If youre eligible for Medicare but not other federal benefits youll pay a Part A premium of 259 or 471 each month depending on how long youve paid Medicare taxes. You pay each month in 2021 File individual tax return File joint tax return File married.

If you dont get premium-free Part A you pay up to 471 each month. In 2021 you pay 1484 deductible per benefit period 0 for the first 60 days of each benefit period. If you choose NOT to buy Part A you can still buy Part B.

Advertentie Find affordable quality Medicare insurance plans that meet your needs. As mentioned above the average premium for Medicare Part D plans in 2021 is 4164 per month. Above 138000 up to.

Find your best rate from over 4700 Medicare plans nationwide. Costs for Medicare health plans. For those who have paid the Medicare tax for under 30 quarters the premium cost will come to 471 each month.

If you paid Medicare taxes for 30-39 quarters the standard Part A premium is 259. If you or your spouse have paid the Medicare tax for 30-39 quarters then your monthly premium for Part A will be 259 in 2021. If you paid Medicare taxes for only 30-39 quarters your 2021 Part A premium will be 259 per month.

Find your best rate from over 4700 Medicare plans nationwide. Medicare Part C plans are purchased from a private insurer and a monthly premium depends on the selected plan and where you live. How much does Medicare Part D cost.

Above 88000 up to 111000. Above 222000 up to 276000. On average monthly premiums for these plans can range from 0 a.

2021 Part A deductible. 14460 per month. Each month you pay a premium of 13550.

Learn about what factors contribute to how much you pay out-of-pocket when you have a Medicare Advantage Plan Part C. This monthly premium tends to go up a little bit each year. If your income is higher than 85000.