The tax subsidy program serves to help lower the cost of health insurance for low and middle-income Californians. The penalty will amount to 695 for an adult and half that much for dependent children.

Mandate Health Insurance Tax Penalty California Mec Qhp 5000 A

Have qualifying health insurance coverage or.

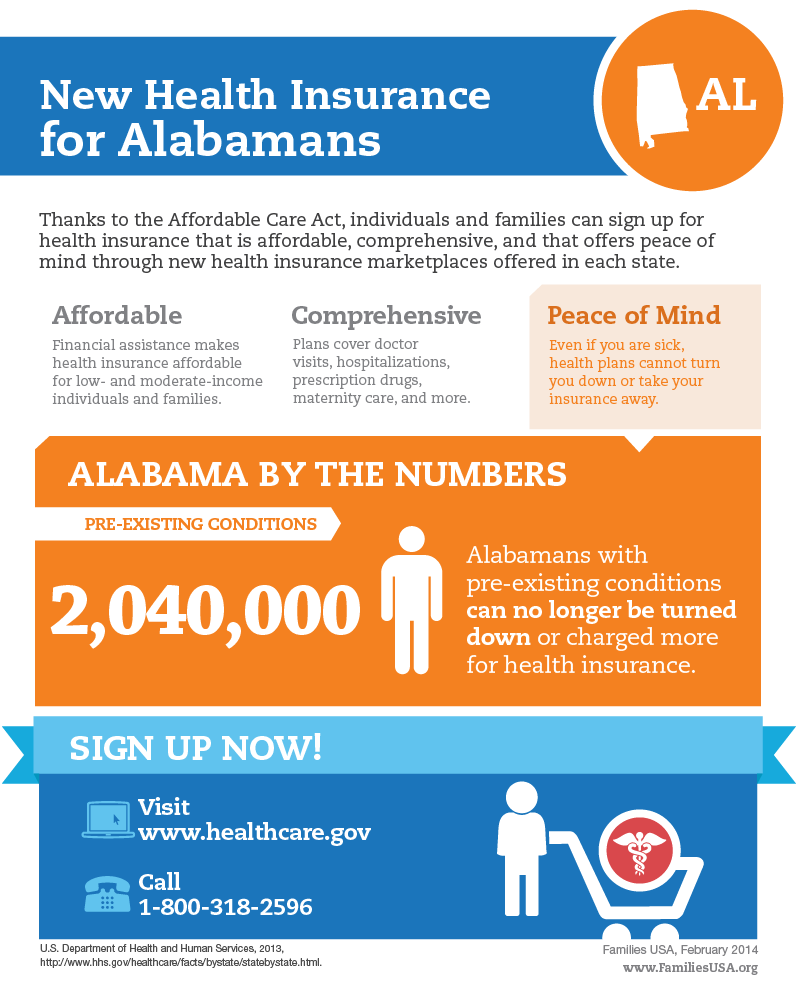

California tax health insurance. Tax Penalty for No Health Insurance 2020. This meant that all taxpayers across the country were required to obtain health insurance coverage or pay a tax penalty. Obtain an exemption from the requirement to have coverage.

And Health Net Life Insurance Company Health Net. Form 1095-B Individuals who enroll in health insurance through Medi-Cal Medicare and other insurance companies or coverage providers will receive this form. How much is the 2020 California Tax Penalty for no health insurance.

Pay a penalty when they file their state tax return. The tax penalty was eliminated in 2017 by the Trump administration but the state of California has reinstated it for 2020. What is the penalty for not having health insurance.

This penalty revenue will be used to fund health insurance subsidies to encourage more people to purchase health insurance and. The tax imposed on insurers by. See the table below or use the Estimator Tool which will take you away from our page to the State of California Franchise Tax Board.

A penalty for an uninsured family of three earning 150000 could be about 2522 according to the California Franchise Tax Board website. Health insurance tax penalties were introduced at the federal level with the Affordable Care Act or Obamacare. What is the tax credit for health insurance.

The penalty for a full twelve months of no minimum essential health insurance coverage will either be a flat amount of 750 per adult 375 per dependent or 25 percent of the gross income that exceeds the filing threshold whichever. Read our blog to learn more. Pay a penalty when filing a state tax return or.

Have qualifying health insurance coverage. Form 1095-A Individuals who enroll in health insurance through Covered California or the Federal Marketplace will get this form. Have qualifying health insurance coverage.

All insurance companies are subject to a tax on gross premiums. Insurance companies that have received authority from the Department of Insurance CDI to transact insurance business in California are called admitted insurers and may be subject to as many as three insurance taxes in California. The federal law was repealed and coverage was not mandatory in the state of California in 2019.

Most of them qualify for premium assistance. By Katy Grimes June 25 2019 640 am. Known as premium tax.

Individual Shared Responsibility Penalty Estimator. Obtain an exemption from the requirement to have coverage. Though in 2019 the Trump administration rescinded the tax penalty established by the Affordable Care Act you may still need to pay a tax penalty in 2021 if you live in California and do not have health insurance.

Beginning January 1 2020 California residents must either. Health Net will mail tax Form 1095-B to everyone who had individual or group health coverage with us in 2020. If you arent covered and owe a penalty for 2020 it will be due when you file your tax return in 2021.

25 Jun 2019640 am. If you are a Californian with no health insurance in 2020 you may face a tax penalty in 2021. The insurance gross premiums tax imposed by the California Constitution Article XIII section 28 is an annual tax imposed on each insurer doing business in California.

In a significant new change California will require people to buy health insurance next year or pay a tax penalty. The California Department of Tax and Fee Administration CDTFA assesses the tax on behalf of the Board of Equalization BOE through an interagency agreement. Get an exemption from the requirement to have coverage.

Starting in 2020 California residents must either. Subscribe to California Healthlines free Daily Edition. A taxpayer who fails to get health insurance that meets the states minimum requirements will be subject to a penalty.

Beginning January 1 2020 all California residents must either. Pay a penalty when they file their state tax return. State-level mandates for health coverage already exist in Massachusetts New.

For background on this new law read our recent article. The health care mandate penalty will be reconciled on your California income tax return and administered by the Franchise Tax Board. You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021.

Summary More than 12 million people buy their own health insurance through Covered California. In addition one of the schedules in the gross premiums tax return is used for the. You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021.

Under California health insurance law California rolled out a new tax subsidy program in 2020. Despite that 93 percent of Californianshave health insurance the California Legislature voted Monday to tax California citizens who do not buy health insurance. Important 2020 Tax Information from Health Net of California Inc.

California residents who do not have health insurance in 2020 will have to pay a tax penalty in 2021. An individual who earns 46000 could be charged 750. Previously those who made above 400 of the federal poverty line FPL were not eligible for premium tax credits.