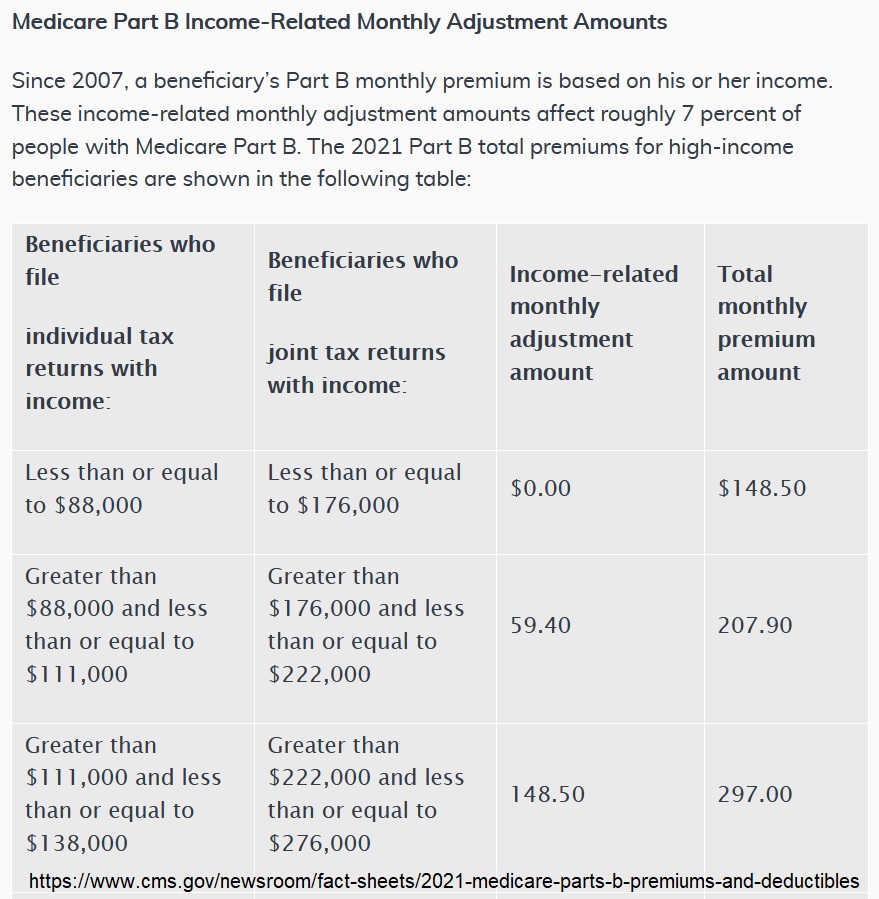

They offer well-priced cover for a range of hearing aids including devices worth from 500 up to worth 5000 cover for devices up to 9000 may be provided over the phone. In addition hearing aid coverage within a plan can vary depending on where you live.

Insurance Coverage For Hearing Aids Faq Hearing Rehab Center

Hearing Aid Insurance Explained Privately bought hearing aids can be very expensive items.

Hearing aid insurance. After all it is another cost you should consider. Every evaluation includes an complimentary hearing health benefits analysis. If you find any insurance for Hearing Aids on a stand alone policy let me know I am looking to insure my mums hearing aids.

Five states Arkansas Connecticut Illinois New Hampshire Rhode Island also extend those mandates to adults. Hearing Health Benefits Check. Hearing Aid Insurance.

An example of a credit option is Care Credit. Fortunately both of them had their hearing aid benefits reinstated. Premium of between 100 - 300 per aid per year Premium varies depending on hearing aid and personal circumstances.

Hearing aid insurance is accepted at HearingLife. A State-by-State Guide for Hearing Aid Insurance Care Credit. In many cases they can cost four-figure sums and that.

For example Kaiser Permanente offers a hearing aid benefit available every 36 months but it depends only on certain places. Our Premium range comes with a 4-year manufacturers warranty while our Essentials range typically comes with a 2-year manufacturers warranty. When the warranty runs out youll probably want to buy insurance.

About your Hearing Aid s All Risks Insurance Includes Accidental Damage Theft and Loss Worldwide insurance with up to 60 days cover for each trip abroad Cover at home and away including accidental loss Pay by monthly direct debit Insurance underwritten at Lloyds of London. Thus one of the most important considerations when purchasing your hearing aids from us is deciding how you will protect them in the event of loss or damage. 50 excess during claim.

They are only 15 months old cost over 2000 and have gone wrong. Once the manufacturer replaces a lost hearing aid the warranty is no longer in effect. Coverage cost is based on the level of technology of your hearing aid as well as its age says Williams.

As well as insurance our hearing aids also come with a warranty giving you that extra protection. In both cases the patients had to open a dispute with their insurance companies. Technically this is insurance fraud.

Upon purchasing insurance for an Essentials product an additional 2-year Boots warranty is included. The two major hearing aid insurance providers in the US are Midwest Hearing and Ear Service Corporation ESCO. In the event of an insured claim occurring under your policy we will also pay up to 15000 towards audiologist consultation and refitting charges if applicable.

Making a claim may affect subsequent premiums. Even if you have it insurance coverage for hearing aids varies in how it is administered. Currently about 23 states mandate health insurance companies provide full or partial hearing aid coverage for children.

Weve negotiated a 10 discount on hearing aid insurance with specialist insurer Assetsure. Assetsure hearing aid insurance policy - Availability Our policy is available for person age 18 years and over. Devices worth between 2000 and 4000 are most commonly insured.

It turns out hearing aids should not be billed unless they have been fit to the patient. Options for your hearing care. Protection Plus is an easy and affordable insurance coverage plan for your hearing instruments.

According to Connect Hearing the CareCredit credit card. One 1 Loss Accidental Damage beyond repair Term This is an Annual Warranty Plan 12 months of coverage. Hearing Aids because of their small size are easily lost or damaged.

Although you keep good care of this vital part of your lifestyle. If it is determined you would benefit from hearing aids we will work closely with your insurance to provide the maximum coverage. There are numerous options and what plans offer varies by state.

Wells Fargo also has a credit card that allows you to pay over your hearing aids over time. Check with your insurance provider to find out if you qualify for a hearing aid benefit. We will explain what benefits and coverage you have available.

This plan provides loss and accidental damage coverage and can be purchased at any point in the hearing instruments life. ESCO insurance coverage options provide you with affordable options to extend the coverage on your hearing instruments giving you valuable peace of mind. In this blog post we highlight potential insurers and how to tell if you re already covered.

For a higher-end device the price averages about 300 a year per aid. Insure your Hearing Aids with myhearingaidcoverie for as little as 9500 a year on-line Your hearing aid keeps you connected to your world. Standard insurance cover of one year applied now we have a bill of at least 200 to mend them.

Midwest Hearing are the originators of hearing aid insurance and have been providing insurance to hearing aid wearers for over 50 years. Hearing care coverage varies not only by state and provider but each policy differs in what is included for hearing aid insurance. We know your first question is often Do you accept my insurance.

Includes accidental damage theft or loss. Hearing aid insurance is always something to bear in mind when it comes down to new or current devices. Once the original manufacturer warranty expires on your hearing instrument s or you have lost a device the cost of repairing or replacing that device can be quite expensive.

There must be a policy somewhere.