The plan is guaranteed renewable and does not have to be renewed annually nor does it have any sort of annual renewal period. So what does Plan G cover.

Medicare Supplement Plan G Medigap Plan G Freemedsuppquotes

Medicare Supplement Plan G Medigap Plan G Freemedsuppquotes

As long as youre over the age of 65 and you are enrolled in Medicare then you can purchase one of these plans.

What is medigap plan g. Medicare Supplemental Plan G is one of the popular Medigap plans with comprehensive coverage Medicare beneficiaries are able to purchase. And thanks to the phasing out of the popular Medigap Plan F in 2020 Plan G is now the plan of choice for many. Medicare Plan G is part of MedigapPrivate companies offer Medigap Supplement Insurance Plans to help pay for gaps in Original Medicare.

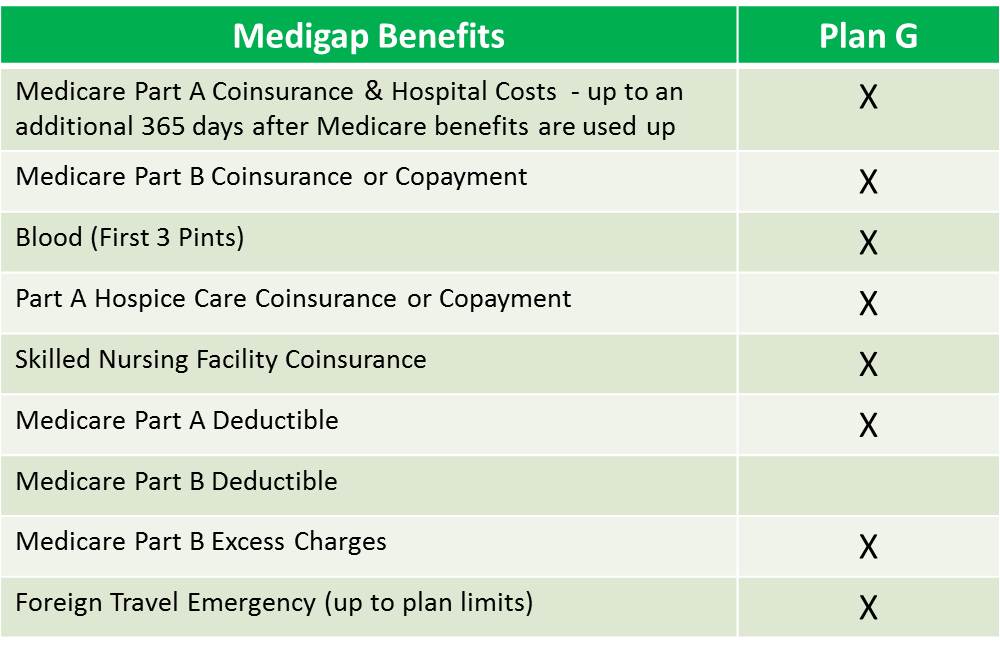

Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used Medicare Part B coinsurance or copayment Blood first 3 pints Part A hospice care coinsurance or copayment Skilled nursing facility care coinsurance Part A. Some people call Medicare supplement plans Medigap because they fill in the gaps that exist in Medicare. 4 Zeilen Medigap Plan G is a Medicare supplement insurance plan.

However in many cases Plan G is the better value. 4 Zeilen This makes Medigap Plan G the best Medicare Supplement plan for most seniors. Original Medicare is the default option when you enroll in Medicare and is.

The only difference between these two plans is the coverage of the Medicare Part B deductible which is 185year for 2019. Medicare Supplement Plan G also called Medigap Plan G is a supplemental policy that has become more common since it was first made available a few years ago. These plans are purchased from private insurance companies who have been contracted by Medicare to sell on their behalf.

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to with one exception. A Small Deductible Big Savings. Medigap Plan G is one of the most common and comprehensive Medicare Supplement plans.

Plan G is one of 10 major Medicare supplement plans currently offered to new Medicare enrollees. Medicare Plan G also called Medigap Plan G is an increasingly popular Supplement for several reasons. Plan F gets all the attention and many agents promote that plan exclusively.

What Does Medicare Supplement Plan G Cover. The only difference is the Part B deductible. The Part B deductible for 2021 is 203.

This deductible is 203 in 2021. Medigap also called Medicare Supplement is an insurance policy that helps to supplement Original Medicare Part A and B by helping to cover the gaps in Original Medicare. First Plan G covers each of the gaps in Medicare except for the annual Part B deductible.

Medigap Plan G also provides great value. Yet when choosing supplemental Medicare coverage youll want to know ahead of time if Plan G is right for you. High deductible Plan G just like any other Medigap plan can never be cancelled for reasons other than non-payment of premium.

Medigap is one of the plans that support such challenges and steps in to cover for the gaps not covered under Original Medicare. It covers a variety of expenses that. It provides you everything that the most comprehensive plan Plan F provides.

Medicare Supplement Plan G is the 2nd most comprehensive plan. Medigap Plan G is known for providing the greatest value of the available options to beneficiaries. While it does not cover the Part B deductible Medicare Supplement G is an affordable Medicare Supplement Plan.

In their initial research phase many people compare Plan G to Plan F which covers the Part B deductible. The plans are named by letter ranging from A to N. With Plan G you will need to pay your Medicare Part B deductible.

Medigap Plan G also called Medicare Supplement Plan G is the perfect coverage option for people who love great coverage for their money. Medigap plans are sold by private insurance companies and they help fill in all of the gaps that original Medicare leaves behind hence the name Medigap. Its less expensive compared to Plan F and provides more benefits compared to Plan N.

Were here with all the information you need to know about what Plan G covers the costs associated with this plan.

/paying-medical-bills-with-no-health-insurance-2385907-Finalcopy-e9fc31084e0e4503acbba84bc6cf7808.png)