All in all its a financial and physical win-win. KAISER HSA Member Services 1-800-464-4000 Principal Benefits for Kaiser Permanente HSA-Qualified High Deductible Health Plan HDHP HMO 712063021 Kaiser Permanente HSA-Qualified High Deductible Health Plan HDHP HMO is a health benefit plan that meets the requirements of Section 223c2 of the Internal Revenue Code.

Your Kaiser Permanente HSA-qualified deductible plan is not just health coverage its a partnership in health.

Hsa kaiser plan. The CARES Act affects your HSA funds. Sign up for the Kaiser Permanente HSA-qualified plan through your employer. Kaiser Permanente health plans around the country.

Consumer-directed health care plans help you manage costs and offer convenience and flexibility to your employees. The two most common are health reimbursement arrangements HRAs and health savings accounts HSAs. Jefferson St Rockville MD 20852 Kaiser Foundation.

Heres a comparison of the accounts and what they offer. Make the most of your money with a Kaiser Permanente health savings account HSA Sign up today. Maximum amount for that year you must remain HSA-eligible through the end of December of the following year.

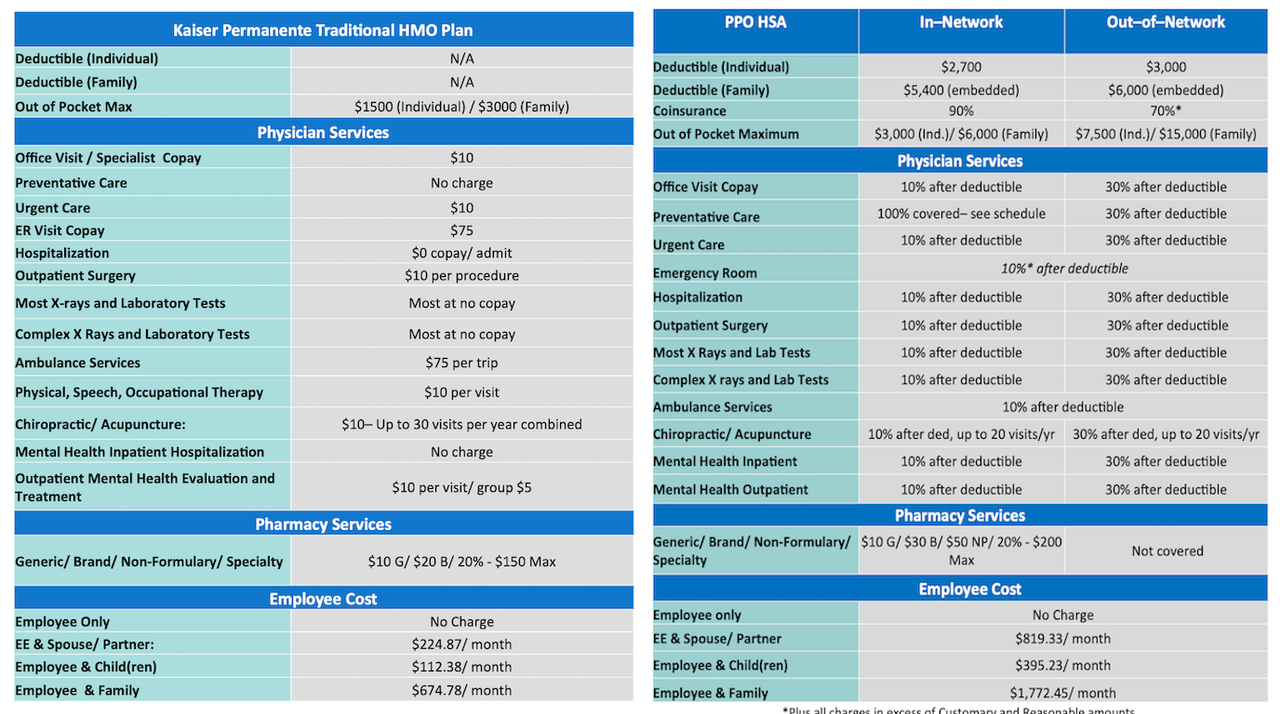

Since your deductible is higher in an HSA based plan you and your employer will save moneylet say that by moving to a 1500 deductible you and your employer now pay 5000 a year instead of the 6000 a year in the co-pay plan. You receive preventive care services at little or no cost to you and online access to manage your care around the clock. With an HSA you can take advantage of tax-free 1 contributions earnings interest and withdrawals to pay for qualified medical expenses 2 including.

You also have the option of setting up a tax-free health savings account HSA which you can use to pay for qualified medical expenses. To submit an HSA claim visit HealthEquitys website. Look for your HSA health payment card and welcome letter in the mail.

Kaiser Foundation Health Plan Inc in Northern and Southern California and Hawaii Kaiser Foundation Health Plan of Colorado Kaiser Foundation Health Plan of Georgia Inc Nine Piedmont Center 3495 Piedmont Road NE Atlanta GA 30305 404-364-7000 Kaiser Foundation Health Plan of the Mid-Atlantic States Inc in Maryland Virginia and Washington DC 2101 E. Let your employer know how much you plan to contribute to your HSA for the year. To help you feel your best.

What is the HSA-Qualified HDHP. Jefferson St Rockville MD 20852 Kaiser. Northern California Region A nonprofit corporation EOC 16 - Kaiser Permanente HSA-Qualified High Deductible Health Plan HDHP HMO Evidence of Coverage for LAWRENCE LIVERMORE NATIONAL SECURITY LLC.

Kaiser Permanente health plans around the country. Health savings accounts HSAs are only available to members enrolled in a PEBB consumer-directed health plan CDHP. Managing your health savings account HSA administered through Kaiser Permanente.

With an HSA plan you can enroll in an HSA that allows you to contribute up to 7200 in 2021 and get up to 3000 in contributions from NVIDIA. You can also set up a health savings account HSA and put money in it1 You wont pay taxes on. Just like a co-pay plan in an HSA based plan you would still have a deductible co-insurance and an out of pocket maximum.

To be eligible to contribute the full annual. Kaiser Foundation Health Plan Inc. With a PPO or Kaiser HMO plan you can enroll in an FSA which allows you to contribute up to 2750 tax-free in 2021.

Like all of our Kaiser Permanente plans this plan gives you access to high-quality care and resources. With this plan youll need to pay the full cost for. Otherwise youll only be able to contribute a portion of the annual maximum.

They work by pairing health plans with health payment accounts HSA HRA or FSA which your employees can use to pay for certain medical expenses. Kaiser Foundation Health Plan Inc in Northern and Southern California and Hawaii Kaiser Foundation Health Plan of Colorado Kaiser Foundation Health Plan of Georgia Inc Nine Piedmont Center 3495 Piedmont Road NE Atlanta GA 30305 404-364-7000 Kaiser Foundation Health Plan of the Mid-Atlantic States Inc in Maryland Virginia and Washington DC 2101 E. With your Kaiser Permanente health plan you receive a wide range of care and support to help you stay healthy and get the most out of life.

You can use your HSA to pay for IRS-qualified out-of-pocket medical expenses. If you have a Kaiser Permanente HSA-qualified high deductible health plan you may be able to open an HSA. HRAs and HSAs are financial accounts that workers or their family members can use to pay for.

Plus it offers flexibility in how you can pay for care. Advantages of Your Health Plan HSA-Qualified High Deductible Health Plan HDHP HMO Plan With this Kaiser Permanente health plan you get a wide range of care and support to help you stay healthy and get the most out of life. For more information about your HSA administered through Kaiser Permanente including how to check your account balance and research claims reimbursement and debit card transactions or to inquire about potential account fees contact.

Kaiser Permanente Health Payment Services at 1-877-761-3399. For you to get access to your HSA dollars youll first need to accept the online user agreements for your account.