Youll be asked to describe the type of work you do. Pandemic Emergency Unemployment Compensation will be counted as income the.

Unemployment Counts As Income For Covered Ca Magi Subsidies

Unemployment Counts As Income For Covered Ca Magi Subsidies

How to Estimate Your Income.

Does unemployment count as income for covered california. Include the following. Total taxable compensation includes. Be on company letterhead or state the name of the company.

In other words the amount of assistance you received is going to be compared to the income that you actually made in that benefit year and depending on whether. In order to be eligible for assistance through Covered California you must meet an income requirement. Below you will find the most frequently asked questions for current and potential Medi-Cal coverage recipients.

You can start by using your adjusted. Changes to things like your address family size and income can affect whether you qualify for Medi-Cal or get help paying for your health insurance through Covered California. There are other requirements youll also need to satisfy to claim the EIC.

Be signed by the employer. As the name implies to be eligible for the Earned Income Credit you must earn income such as through employment. You may also qualify for free or low-cost coverage through Medicaid or the Childrens Health Insurance Program CHIP.

It must contain the persons first and last name income amount year and employer name if applicable. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. Make a subtraction adjustment on the unemployment compensation line in column B of California Adjustments Residents Schedule CA 540.

Section 12553 reads as follows. Premium tax credit and the California state subsidy program. Interest income not.

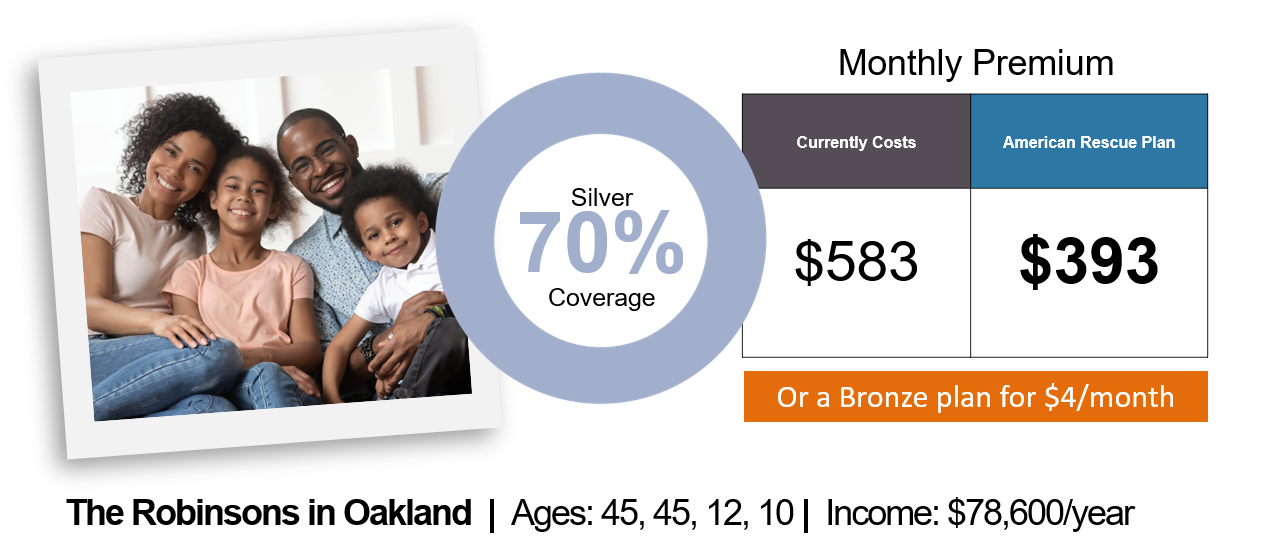

The Form 1099G reports the total taxable income we issue you in a calendar year. Under the American Rescue Plan Covered California enrollees receiving Unemployment Insurance UI in 2021 are treated as though their income is no more than 1381 of the federal poverty level for the. As taxable income these payments must be reported on your federal tax return but they are exempt from California state income tax.

Be no older than 45 days from the date received by Covered California. A Except as provided by subdivisions c and d the amount of unemployment compensation benefits extended duration benefits and federal-State extended benefits payable to an individual for any week which begins after March 31 1980 and which begins in. However receiving unemployment benefits doesnt mean youre automatically ineligible for the credit.

Taxable portion for MAGI in the eligibility determination. The employer statement must. Any financial help you get is based on what you expect your household income will be for the coverage year not last years income.

Medi-Cal these unemployment benefits received under PUA will be counted as income the taxable portion for MAGI in the eligibility determination. Covered Californias answer is Generally no. When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes.

These benefits are counted as property if retained into the following month for the purposes of Non-MAGI Medi-Cal eligibility determinations. Medi-Cal Eligibility and Covered California - Frequently Asked Questions. The premium assistance that is only offered through Covered California is going to be reconciled at the end of each year when you file your IRS tax return.

Employer paid supplemental unemployment benefits from an employer financed fund Count Taxable Portion. Include net self-employment income you expect what youll make from your business minus business expenses. If it says counted in either one of the columns you should put it on your application.

These benefits are counted as property if retained into the following month for the purposes of Non-MAGI Medi-Cal. If youre unemployed you may be able to get an affordable health insurance plan through the Marketplace with savings based on your income and household size. When the information that you put on your application changes during the year you must report it.

Back to Medi-Cal Eligibility. Pension Law - Section 12553. This income is reported to the IRS.

First of all it is important to know how the system is going to work. People with Medi-Cal must report changes to their local county office within 10 days of the change. California return Unemployment compensation is nontaxable for state purposes.

Unemployment Insurance UI benefits. MAGI MC is for the Medi-Cal rules and APTCCSR is for Covered California subsidies. If you make 601 of the FPL you will be ineligible for any subsidies.

If you do not find an answer to your question please contact your local county office from our County Listings page or email us. For Covered California programs the taxable portion is. It is your responsibility to report this change to Covered California.

If you have farming or fishing income enter it as either farming or fishing income or self-employment but not both. Total and Partial Unemployment TPU 46055 Pension or Retirement Pay A. Traditional federal and state unemployment benefits are considered income for Covered California Medi-Cal and CHIP and you should include it in the income.

If your income is verified as eligible for premium assistance and then later you become Medi-Cal eligible you do not have to repay the premium assistance you received as long as you report the income change within 30 days.

What Type Of Income Does Covered California Consider

What Type Of Income Does Covered California Consider

Covered California Annual Income Estimate Prevents Medi Cal Enrollment

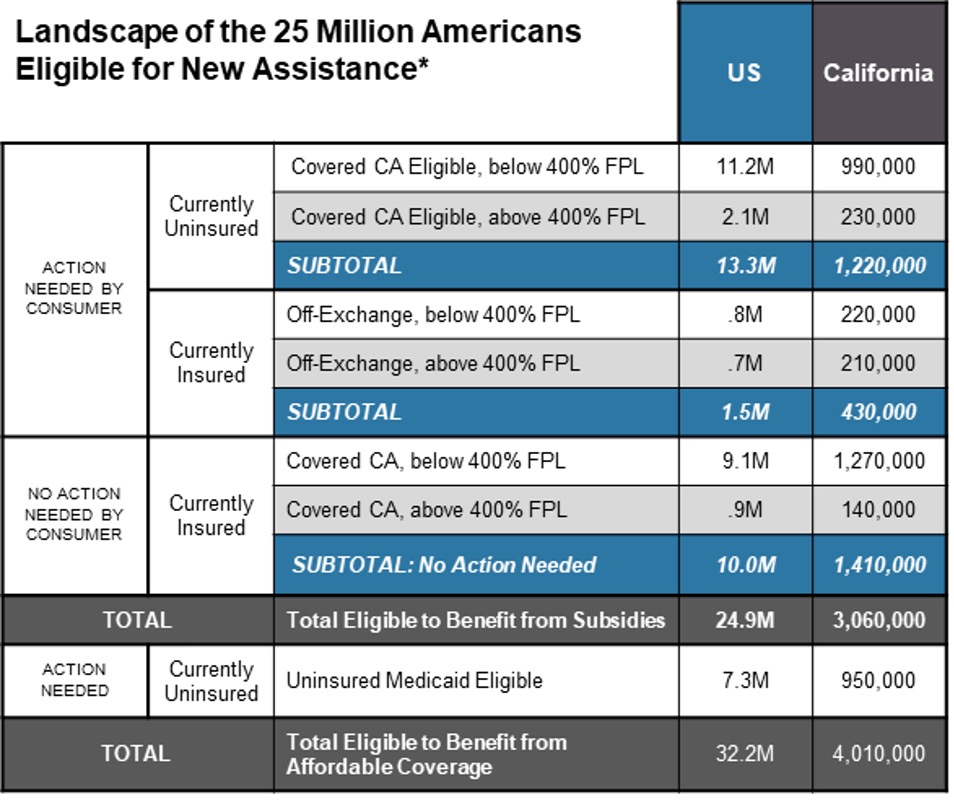

Covered California Opens The Doors For Millions Of Californians To Benefit From Lower Health Care Premiums Save Money And Stimulate The Economy Through The American Rescue Plan

Covered California Opens The Doors For Millions Of Californians To Benefit From Lower Health Care Premiums Save Money And Stimulate The Economy Through The American Rescue Plan

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

What Type Of Income Is Counted For Covered California Aca Plans

What Type Of Income Is Counted For Covered California Aca Plans

What Type Of Income Is Counted For Covered California Aca Plans

Unemployment Counts As Income For Covered Ca Magi Subsidies

Unemployment Counts As Income For Covered Ca Magi Subsidies

What Type Of Income Is Counted For Covered California Aca Plans

How To Report Unemployment Benefits Covered California Youtube

How To Report Unemployment Benefits Covered California Youtube

What Type Of Income Is Counted For Covered California Aca Plans

Covered California Community Leaders And Health Plans Highlight Key American Rescue Plan Provisions And Lay Out A Roadmap To Lower Premiums And Help Millions Get Covered

Covered California Community Leaders And Health Plans Highlight Key American Rescue Plan Provisions And Lay Out A Roadmap To Lower Premiums And Help Millions Get Covered

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.