USAble Life does not sell or service Blue Cross and Blue Shield of Florida products. For Part A the deductible for a hospital stay up to 60 days is 1408.

What Medicare Covers What Does Medicare Cover Bluecrossmn

What Medicare Covers What Does Medicare Cover Bluecrossmn

Medicare Supplement insurance plans are offered by Blue Cross and Blue Shield of Texas a Division of Health Care Service.

Does blue cross blue shield cover hospital stays. Reviewing the policy with the treatment provider will provide a clear picture of how much it will. Policy Form Series LS-HR-0004 LifeSecure Insurance Company based in Brighton MI is an independent company that doesnt provide Blue Cross Blue Shield of Michigan products or services. Physiciansurgeon fees No Charge Not Covered -----None----- If you need mental health behavioral.

USAble Life is an independent company and operates separately from Blue Cross and Blue Shield of Florida. Independent Licensees of the Blue Cross and Blue Shield Asso ciation F. Blue Cross Blue Shield one of the largest US.

Is covered if the patient meets one of the criteria for a hospital bed and the patients weight exceeds 600 pounds. Medicare Supplement plans will pay their share of costs after Medicare pays its share of the Medicare-approved amount for covered health care costs. Urgent care Not covered Not covered -----none----- If you have a hospital stay Facility fee eg hospital room 300admission up to 750benefit period 500admission then 20 coinsurance -----none----- Physiciansurgeon fees Not covered Not covered -----none-----.

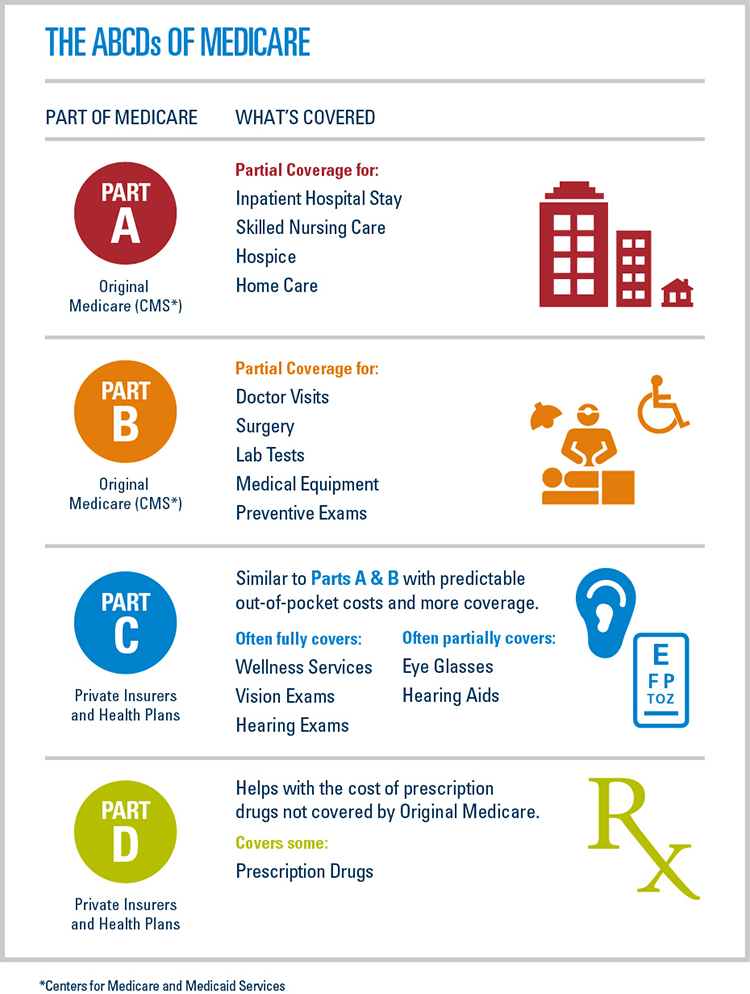

Inpatient hospital stays During and after an approved hospital stay the Independence Care Management and Coordination team monitors your stay. Medicare Plus Blue Group PPO Medicare Plus Blue Group PPO plans provide at least the same level of benefit coverage as Original Medicare Part AB and provide enhanced benefits beyond the scope of Original Medicare within a single health care plan. Blue Cross Blue Shield Out of Pocket Coverage.

Understanding out-of-pocket expenses ahead of time is best. Others will provide less coverage depending on the policy that was selected. Search for Doctors Hospitals and Dentists Blue Cross Blue Shield members can search for doctors hospitals and dentists.

Part B carries a 198 annual deductible. Outside the United States. Health insurance providers will cover with no cost share to the member the appropriate medically necessary diagnostic testing for COVID-19 where.

Select Blue Cross Blue Shield Global or GeoBlue if you have international coverage and need to find care outside the United States. Coverage will be allowed when ALL of the following guidelines are met. Review your policy kit check your plan details in Blue Access for Members or call the number on the back of your membership ID card to get a clear understanding of your coverage benefits.

Some policies will cover expenses much like other hospital stays. Search for Doctors Hospitals and Dentists Blue Cross Blue Shield members can search for doctors hospitals and dentists. Once you are well enough the out-of-network hospital will transfer you to an in-network hospital.

According to Medicaregov Medicare Part A hospital insurance covers medically necessary care in a skilled nursing facility SNF following an acute illness or injury for which you were admitted to a hospital. The team reviews whether you are receiving medically appropriate care sees that a plan for your discharge is in place and coordinates services that may be needed following discharge. This flexibility allows BCBSM to offer enriched plans.

LifeSecure is solely responsible for and underwrites the hospital recovery coverage. While each policy is different most do not cover 100 of the treatment costs. Additionally Medicare covers all medically necessary hospitalizations.

Outside the United States. Medicare Supplement plans will. This includes if you are diagnosed with COVID-19 and might otherwise have been discharged from the hospital after an inpatient stay but instead you need to stay in the hospital under quarantine.

If you have a hospital stay Facility fee eg hospital room No Charge Not Covered Preauthorization is required. In many cases if you are admitted to a hospital that is not in-network for your plan your stay will not be covered. Members will have no out-of-pocket costs.

In the United States Puerto Rico and US. USAble Life is the insurer and is solely responsible for the Accident Critical Illness and Hospital products referenced here. Select Blue Cross Blue Shield Global or GeoBlue if you have international coverage and need to find care outside the United States.

4 You must use network hospitals and doctors for maximum coverage and in non-emergency medical situations. In the United States Puerto Rico and US. Original Medicare does not cover costs related to travel and lodging.

Blue Cross Blue Shield is waiving cost-sharing for treatment of COVID-19 including coverage for testing treatment and inpatient hospital stays. 3 You are free to use any hospital or physician that is a Medicare contracted provider. But if you are in a nursing home only because you need help with daily activities like dressing and bathing Medicare will not cover your stay.

This insurance policy has exclusions and limitations. In addition inpatient deductibles copays and. Failure to obtain preauthorization may result in reduction or non-payment of benefits.