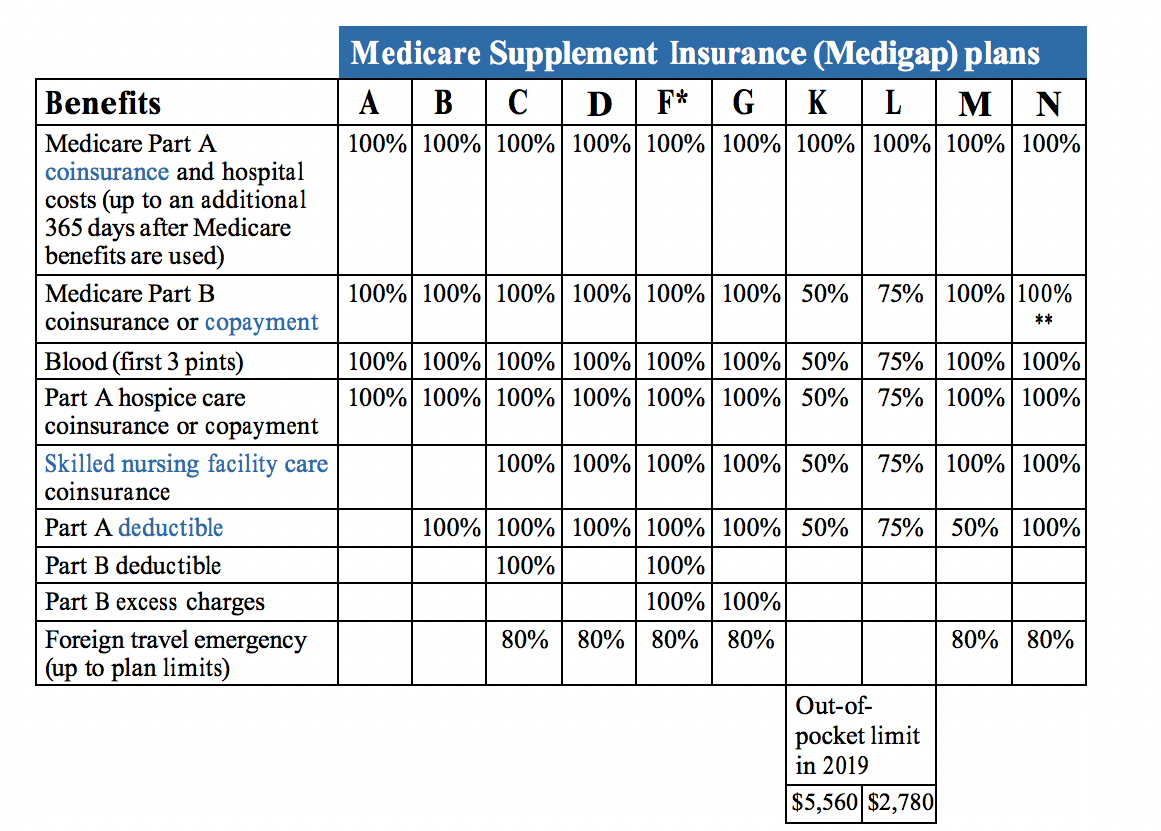

Good As You Can Get If youre turning age 65 this year Medicare Plan G is the most comprehensive Medicare supplement you can buy. Plan G is the top-of-the-line Medigap option if youre newly eligible for Medicare.

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Before you can sign up for Plan G you must enroll in both Medicare Part A and Part B.

Medigap plan g. Plan G offers one of the most comprehensive plan coverages available. With a Medicare Supplement Plan G almost all these costs will be paid. As such it works just like other Medigap plans.

Medicare Supplement Plan G Medigap Plan G Rates for 2022 Coverage Benefits and Eligibility. These supplement policies are. For the premium which is higher than for other Medigap policies youll get more comprehensive coverage.

It covers a variety of expenses that arent covered by Medicare. All Medigap plans regardless of what your insurance company is can be used at ANY doctorhospital that takes Medicare nationwide. Were here with all the information you need to know about what Plan G.

Medigap Plan G is a Federally-standardized Medigap plan. Consider your current monthly insurance costs how much. Ask for a rate-shopping comparison guide.

The short answer for how much does Plan G cost is it depends on. Plan G is a great health insurance plan and it is one of the different options for Medicare Supplements or the Medigap plans. Plan G only fills in the gaps while Medicare provides the foundational coverage.

Yet when choosing supplemental Medicare coverage youll want to know ahead of time if Plan G is right for you. Each of these ideas covers several areas that Medicare overlooked. The Plan G at this point gives you the most benefits for your premium dollar.

When carefully selected seniors find themselves saving a lot of money year in year out. Medigap Plan G is another one of the most popular Medicare Supplement plans and for good reason. Is Medigap Plan G right for you.

Since Medicare Part A and Medicare Part B do not pay for all the healthcare costs and you are responsible for additional co-pays coinsurance and deductibles. The takeaway Medigap Plan G is a Medicare supplement insurance plan. Medigap Plan G rates can vary widely depending on several variables including what part of the country you are in your age and your gender Get Plan G pricing in your area by email.

Medigap cannot operate on its own but must work alongside the basic Medicare plan. Its also the most popular. Contact your State Health Insurance Assistance Program SHIP.

Medicare Supplement Plan G has been found to be the 2 nd most popular Supplement plan. You can apply for Plan G or any other Medigap plan as early as three months before you turn 65. Since Medigap Plan Jwas discontinued in 2010 in orderto get full coverage you need to purchase Plan F or Plan G to get what most consider full coverage.

Depending on where you live in the country it can range from 99 per month to 509 per month for the plan premium which is 1108 to 6108 per year. It offers great coverage at what many consider a more comfortable. Medigap Plan G While Medicare covers many medical costs there are some gaps in the insurance that supplement policies cover.

If you buy a Plan G policy youll pay a monthly premium which can vary by the company offering the policy. You might be thinking that Plan F is the best but thats only true if you turned age 65 before the year 2020. Medigap Supplement Plan G Medicare SupplementPlan G or Medigap Part G dare I say it maybe the best medicare gap insurance and the new standard in complete coverage.

Medicare Plan G one of these Medigap or Medicare Supplement programs is one of the more comprehensive supplement plans available although its coverage is not as complete as Plan F. Contact insurance companies recommended. Use Medicaregovs tool to find and compare Medigap policies.

Medicare Plan G Medigap Plan G. These are complementary health insurance plans that are made to work with the Original Medicare plan and fill in its coverage gaps. Medigap plans including Plan G are among them.

Thats the six months immediately after you turn 65 and sign up for Part B when youre guaranteed by federal law to be accepted by any plan regardless of health. If you have or are at risk of a serious or chronic condition then Plan G might be the perfect choice for you. What is a Medicare Supplement Plan G The Medicare Supplement Plan G has the fastest growing enrollment of all Medicare supplement plans According to a 2017 report from Americas Health Insurance Plans AHIP.

There are no networks to. Other costs include the Medicare Part B. The best time to enroll in Plan G is during your Medigap Open Enrollment period.

There exist ten Medigap covers but only eight are available now across the market. Medigap Plan G also called Medicare Supplement Plan G is the perfect coverage option for people who love great coverage for their money. Plan F however has higher premiums and higher rate increases from year to year.

For this reason Plan G is becoming more and more popular. Medigap Plan G is known for providing the greatest value of the available options to beneficiaries. Medicares basic plan is a prerequisite for Plan G because of how Plan G is designed to supplement or complement it.