When filing these claims the provider needs to have the beneficiary complete the Possible Third Party Liability form. Your records may be.

Best Dd 2527 Us 2019 Update Formspro Io

Best Dd 2527 Us 2019 Update Formspro Io

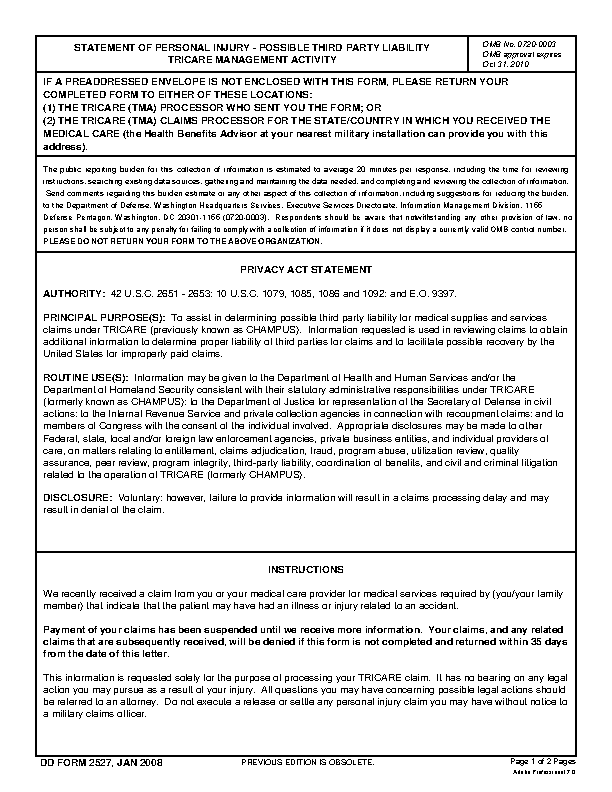

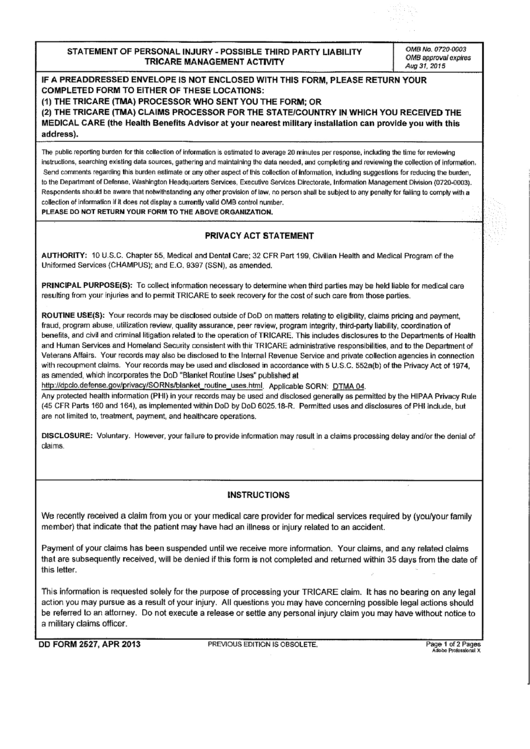

STATEMENT OF PERSONAL INJURY - POSSIBLE THIRD PARTY LIABILITY TRICARE MANAGEMENT ACTIVITY.

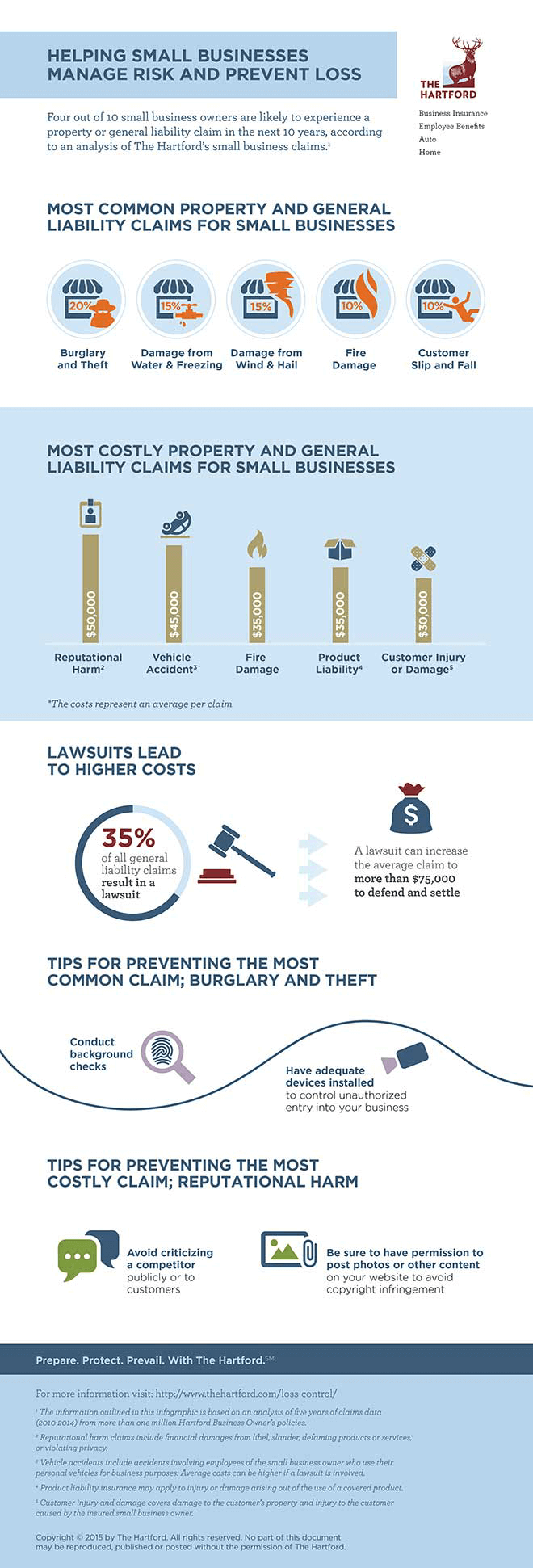

Tricare 3rd party liability form. Describe Condition For which Patient Received Treatment Supplies or Medication. Your information is collected to allow recovery from third parties for medical care provided to you in a Military Treatment Facility ROUTINE USES. Youll be reimbursed for TRICARE-covered services at the TRICARE allowable amount.

TRICARE West Claims - TPL. SubrogationLien cases involving third party liability should be sent to. IVIG Intravenous Immunoglobulin Drug Authorization Request Form.

Sometimes TRICARE receives claims that include diagnosis codes that may or. Tricare claim forms can be downloaded from the Tricare website link below. Femoroacetabular Impingement FAI Authorization Request Form.

EO 9397 SSN as amended. If accident or work related the patient is required to complete DD Form 2527 Statement of Personal Injury-Possible Third Party Liability. Please fill out this form to permit the United States to recover medical expenses from whoever caused your injury.

Submit it by mail or fax to. There are special rules for filing claims if youre involved in an accident with possible third-party liability. There are three ways to return your DD2527 Third Party Liability Form.

What Is DD Form 2527. You must complete and sign this form within 35 calendar days. Check box to indicate if patients condition is accident related work related or both.

Inpatient Mental Health Authorization Form. Claims submitted with diagnosis codes 800999 for professional services exceeding 500 and inpatient services often indicate an accidental injury or illness. Complete the appropriate form and send it to the appropriate claims processor.

Statement of Personal Injury-Possible Third Party Liability DD Form 2527 Youll need to use this form when you submit claims for an injury or illness caused by a third party. Hospice Authorization Request Form. DD Form 2527 Statement of Personal Injury - Possible Third Party Liability is an Army form sent out by TRICARE to individuals whose medical expenses may have been a result of injuries caused by a third party.

Statement of Personal Injury Possible Third Party Liability Costs and Fees 2021 Enrollment TRICARE PrimeTRICARE Prime Remote. The liable side may be an individual or a business. This amount wont include any copayments cost-shares or deductibles.

Statement of Personal Injury Possible Third Party Liability Beneficiaries may be asked to complete the Possible Third Party Liability form if the health care services received indicate an accident or injury. Alpha-1 Antitrypsin AAT Cancer Clinical Trial CCT or COVID-19 Clinical Trial Authorization Request Form. When TRICARE receives claims with these types of diagnosis codes we mail the DD2527 Third Party Liability Form to patients or sponsors in order to determine how the injury or illness occurred.

Processing of your TRICARE claim will be suspended until you complete and return this form in the attached self-addressed envelope. When filing these claims the provider needs to have the beneficiary complete the Possible Third Party Liability form. Chapter 32 Third Party Liability For Hospital and Medical Care.

Third party liability claim form DD2527 Send third party liability form to. Diagnosis codes 800-999 Professional services exceeding 500. Please make sure you return it within 35 days of the mailing date.

Claims submitted with diagnosis codes 800999 for professional services exceeding 500 and inpatient services often indicate an accidental injury or illness. Your regional contractor will send you the Statement of Personal Injury-Possible Third Party Liability DD Form 2527if a claim is received that appears to have third-party liability involvement. A claim form should be submitted for each.