Do you have to offer dental coverage under COBRA. Sometimes dental benefit plans are bundled with health insurance plans.

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

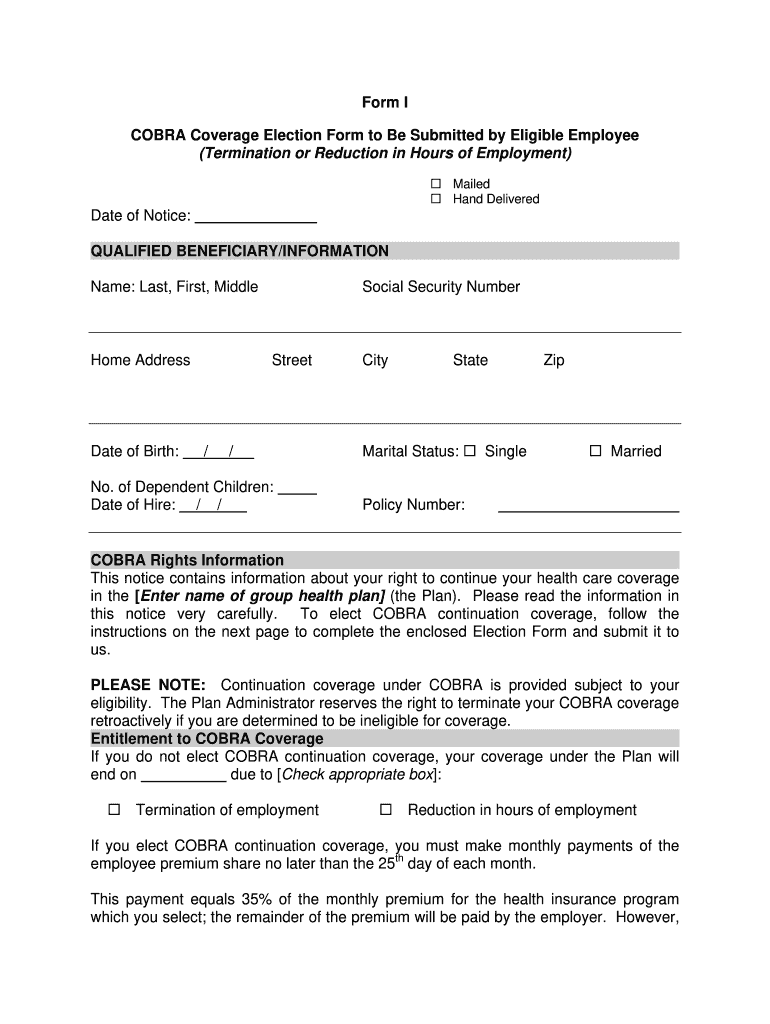

In most situations that give you COBRA rights other than a divorce you should get a notice from your employers benefits administrator or the group health plan.

Can you get cobra for dental only. Usually the beneficiary is required to pay the entire cost of COBRA coverage although a few employers choose to subsidize COBRA. If the employer offered dental and medical through separate plans you can choose to continue both or opt to continue just the medical or dental plan. It will only kick in for dental coverage if you had a dental plan while you were employed.

However some states require insurers covering employers with fewer than 20 employees to let you keep your coverage for a limited time. Yes each qualified beneficiary is eligible to enroll on their own COBRA coverage. Can I elect COBRA coverage for medical benefits only.

You can also apply for Medicaid by contacting your state Medicaid office and learn more about your. According to Gallaghers News Insights the subsidies apply to health plans subject to COBRA including dental and vision. Yes COBRA Has Dental And Vision If You Had It Previously Yes if you had dental insurance and vision coverage when you were an active employee.

Subsidy is available for most benefits that allow COBRA continuation including health and pharmacy benefits uniform dental benefits supplemental dental and vision benefits. You can still enroll in COBRA but you may not be able to find local doctors on your plan. By law you can be.

If your dental is bundled with other benefits you may not be able to continue with dental. COBRA coverage has limits. COBRA continuation coverage is available upon the occurrence of a qualifying event that would except for the.

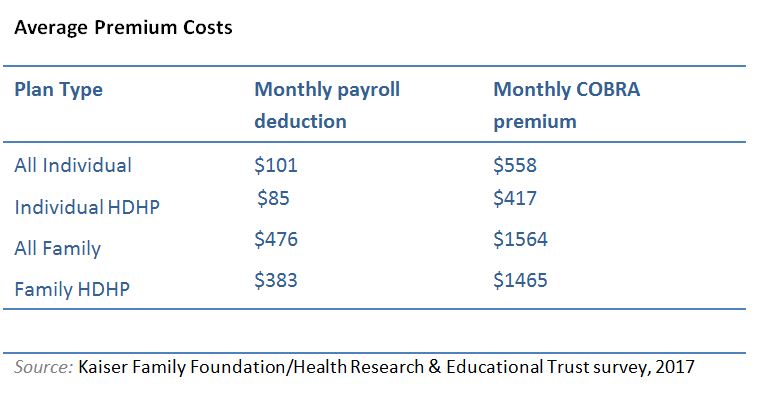

For dental benefits only. Cost is a major factor to consider when buying COBRA coverage. If you are the spouse of an employee who dies you may also be eligible Is dental insurance covered under COBRA.

However you cannot choose new coverage or switch to a different plan from the one you held prior to your change in employment. To be eligible for COBRA coverage you must have been enrolled in your employers health plan when you worked and the health plan must continue to be in effect for active employees. Who pays for the subsidies.

If you did not enroll in dental benefits during your employment you will not be able to get them from your employer post-termination. However you can only continue plans you were actually enrolled in while employed. You are not required to elect all benefits under COBRA.

Meaning instead of having a dental benefits provider and a health insurance provider your benefits all come from the same place. This news item provides a summary of employer responsibilities related to ARP as well as considerations specific to the programs provided by ETF. The Consolidated Omnibus Budget Reconciliation Act COBRA is a federal law.

Many health insurance plans require that you use their local provider networks. If you qualify your coverage begins immediately. You only pay for the coverage that you elect.

However health care flexible spending accounts FSAs are not covered under ARPA rules. Can you get COBRA for dental only. If for example you had a medical and dental plan while employed but not a vision plan you can keep one or both plans under COBRA but you would.

There are limits to the term of coverage and youll pay significantly more than you did when you were employed. COBRA applies to medical vision and dental plans offered by your employer. Employers subject to COBRA will take a refundable tax credit against their payroll taxes.

Your employer isnt required to offer you a plan in your new area. For example if you declined a dental plan you cannot obtain the coverage once you become COBRA-eligible. COBRA coverage is only a short-term solution so its a good idea to explore other options.

Along with medical and vision benefits dental coverage is included under COBRA. The COBRA statute requires employers to offer continuation of group coverage eg medical dental and vision to covered employees spouses domestic partners and eligible dependent children who lose group coverage due to a qualifying event. You do have the option of electing only individual plans ie.

If you want to continue health benefits but no longer want dental coverage you have the flexibility to do so. You have the option to elect any or all of your previous benefits that you are able to pay for. If you lose your job you may still be able to keep your dental coverage under COBRA.

Health flexible spending accounts HFSAs are excluded. 1-800-318-2596 TTY 1-855-889-4325 for more information or to apply for these programs. The COBRA health insurance law allows you and your beneficiaries to continue on the exact same health benefits that you had with the group health plan.

Can I elect COBRA for myself only. The notice will tell you. However in the likely event that the employer chooses not to subsidize COBRA the COBRA premium cannot exceed 100 percent of the cost of the group health plan for similarly situated individuals who have not incurred a qualifying event including both the portion paid by.

Can I elect medical only. The only exceptions from federal COBRA are small employer plans employers with fewer than 20 workers and church plansMedical dental and vision coverages and traditional health reimbursement arrangements HRAs are eligible for the subsidy. Can I elect COBRA for my dependent only.

You can apply for and enroll in Medicaid and CHIP at any time. You must pay all of your health insurance premiums under COBRA. In general COBRA only applies to employers with 20 or more employees.

Besides the time limit referred to above there are a couple of other reasons your COBRA coverage can end. Yes an employer that is subject to COBRA must offer dental coverage under the same circumstances as any other health plan. Medical only dental only medical and vision only etc.

An employee who has been offered COBRA health care coverage has called you to ask whether she can also continue her dental coverage.