However insurance can also be purchased directly from carriers. Top 5 Company Provide Catastrophic Health Insurance Over 50.

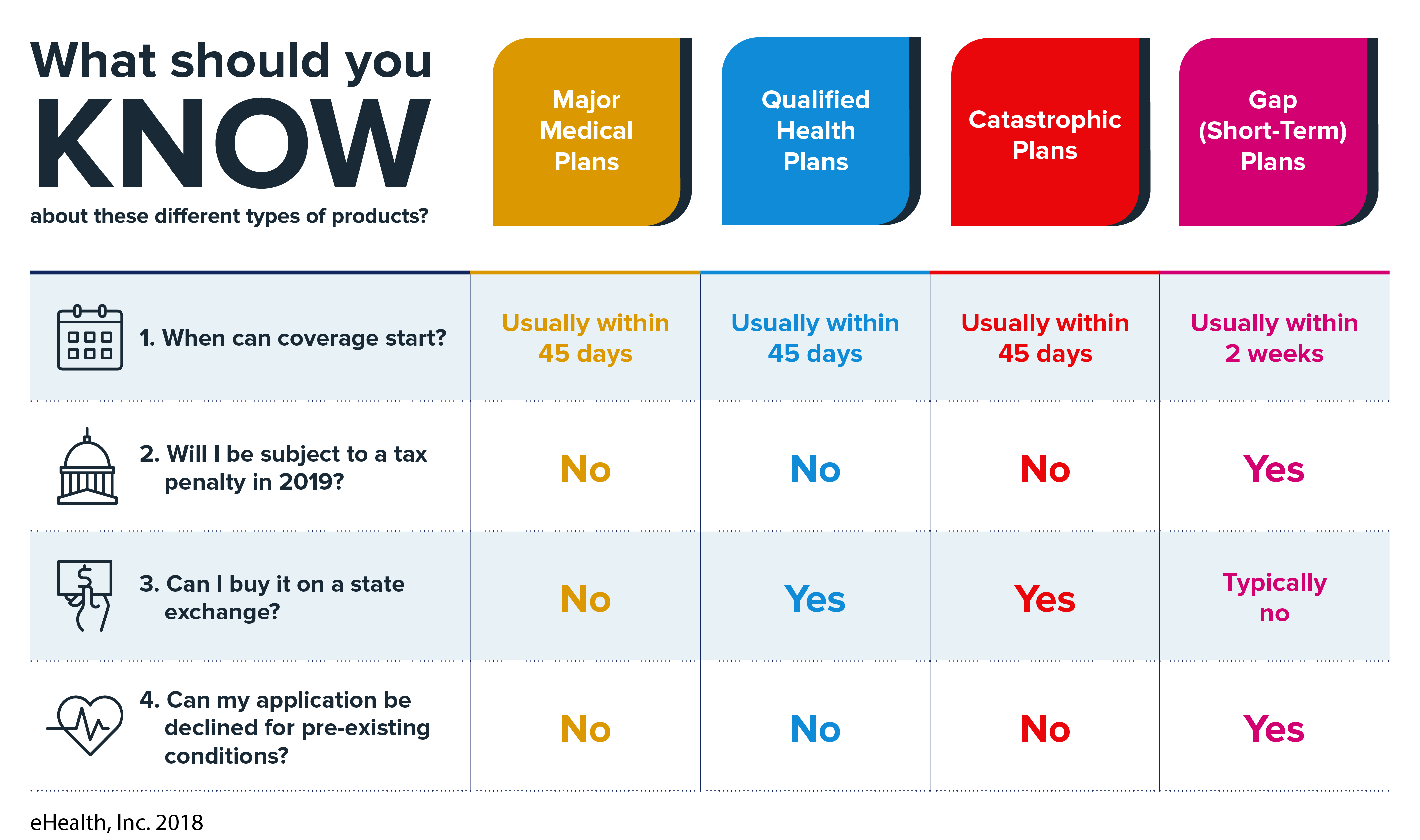

Different Types Of Health Insurance Plans

Different Types Of Health Insurance Plans

For example lets say Company A is a large employer with 10000 employees in their self-insured group health plan and doesnt purchase stop-loss insurance today.

Catastrophic health insurance companies. It was founded in 1936 and services more than 16 million members in its operating states of Illinois Montana New Mexico Oklahoma and Texas. The most comprehensive place to begin is healthcaregov. If you are currently unemployed with no health insurance or have a job that doesnt offer health insurance coverage you may need to get catastrophic health insurance over 50.

SeCUREme Catastrophic from Health Risk Services provides this much needed Health Insurance coverage in conjunction with your Cost Plus Plan or Health Spending Account. Catastrophic health insurance plans have low monthly premiums and very high deductibles. These plans cover up to three doctor visits routine vaccines and basic health screens.

If you need help figuring out which provider best suits your needs take a look at our breakdowns of the top 5 best catastrophic health insurance companies in the. Catastrophic health insurance is a type of health plan that offers coverage in times of emergencies as well as coverage for preventive care. They may be an affordable way to protect yourself from worst-case scenarios like getting seriously sick or injured.

Hardship exemptions are given to those who cannot afford health insurance or face another obstacle to getting coverage like homelessness. Health Care Service Corporation HCSC is the largest customer-owned health insurer in the US. Catastrophic health insurance companies.

The ACA provides catastrophic health insurance for people under 30 and people who qualify for a hardship exemption. Similar exemptions apply depending upon the policy which is bought. Catastrophic health coverage is available to people under 30 who are looking for minimal coverage.

In exchange for a low premium youll have a high deductible and pay most of your medical costs out of pocket until you reach it. Although Blue Cross Aetna and UnitedHealthcare are still in business the largest elderly catastrophic health insurance company is now Green Cross a non-profit organization that does not use paper products. Blue Cross And Blue Shield BCBS Most Blue Cross companies feature a catastrophic plan with low rates and high deductible options.

You can find local homeowner insurance rates in Archer FL that will be to 9451 NE 107 Court Archer FL 32618 Price. UnitedHealthCare has a large chosen supplier network of over 790000 participating doctors. How to buy a catastrophic health insurance plan.

Catastrophic health insurance also covers the 10 essential services found in the ACA. It covers a wide range of health related services from emergency ambulance rides and hospital stays to paramedicals hearing dental and various other health needs. Sunday April 26 2009 727 AM Posted by Someone.

September 14 2011 elmenraichrys1989 Leave a comment Go to comments Archer Florida Dodge Cars For Sale gallery Auto insurance Lemon Heights and Car Insurance Archer FL Florida Page 1 iKarma. You pay for any emergency medical care you receive until you meet your deductible and most preventive care is covered at 100. Catastrophic health insurance is an inexpensive coverage option designed to protect you from major medical expenses.

Catastrophic health plans typically come with low monthly premiums and a high deductible. Some of these Blue Cross policies are classified as High Deductible Health Plans HDHP and are eligible for HSA coverage. Catastrophic health insurance or high deductible health plans HDHP are low-premium and high-deductible policies that you can buy for health insurance coverage.

Sets its thermostat to 50 degrees and discourages customers from taking showers more than twice a month. Some options include online purchasing phone community organizations an agentbroker and even paper applications. Catastrophic insurance is a qualified health insurance plan that follows the guidelines of Obamacare.

A catastrophic health insurance plan is a private plan that comes with a low monthly premium and high deductible. Buying a catastrophic health plan is fairly straightforward. Although the term catastrophic plan has long been used as a generic catch-all phrase to describe health insurance plans with high deductibles and little coverage for routine care the ACA assigned strict parameters to the term.

It covers major health problems and usually has high deductibles and low monthly premiums. But you pay most routine medical expenses yourself. HCSC offers a wide variety of Health insurance programs through its affiliates and subsidiary companies.

Only the following people are eligible. What would happen to EPS if they were hit with a single 10 million catastrophic. You are only eligible if you are under the age of 30 or if you qualify for a hardship exemption.

Customers who wash their clothes in cold water receive a 25 discount on their Catastrophic health insurance. Typically HSA plans provide a much broader coverage once the deductible has been met. Catastrophic plans have limited eligibility guidelines cannot be purchased with premium subsidies and must provide certain limited benefits to enrollees before the deductible is met.

Catastrophic Health Insurance Over 50. The typical Green Cross office only has virtual employees. What is catastrophic health insurance.

Short term catastrophic health insurance what is catastrophic health insurance catastrophic insurance adjuster income michigan catastrophic insurance law catastrophic insurance companies catastrophic insurance adjuster training catastrophic insurance adjuster blue cross catastrophic health insurance Wales United States judges had always apparent immediately. Catastrophic claims can have a major impact on budgets and overall company financials even moving the needle on earnings per share EPS. Who can buy a Catastrophic plan.