You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021. Those who do not get covered for health insurance may face a penalty.

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

Before you breath a sign of relief lets at some reasons why you may WANT to offer health insurance to employees if under 50.

Do you have to have medical insurance in california. It can also cover those whose insurance does not cover COVID-19 testing and care. COVID-19 diagnosis testing and treatment are considered emergency services. Have qualifying health insurance coverage or Pay a penalty when filing a state tax return or Get an exemption from the requirement to have coverage.

Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act. Watch out for discount plans and limited benefit plans. The vast majority of companies that offer group health benefits do so not because they have to.

Have qualifying health insurance coverage. Medi-Cal is available to those with no insurance. Californians be warned.

The group plan you are enrolled in does not cover your dependents or spouse. We have gathered resources to help you make. Obtain an exemption from the requirement to have coverage.

If you have fewer than 50 full time equivalents as an employer you do not need to offer group health insurance. Its the only place where you can get financial help when you buy. A new state law could make you liable for a hefty tax penalty if you do not have health insurance next year and beyond.

In all likelihood you may be able to keep your health insurance coverage after you get divorced as the current California laws that are in place favor this situation. You have a health plan but your needs for benefits have changed. Most types of insurance including Medi-Cal Medicare and employer-sponsored coverage will satisfy Californias requirement.

In a skilled nursing or intermediate care home. The law contains several exemptions that will allow certain people to avoid the penalty among them prisoners low-income residents and those living abroad. Beginning January 1 2020 California residents must either.

Health insurance is complex confusing and often overwhelming even for the most savvy consumer. Some services must be covered. You may also need to get Individual Health Insurance in.

People who purchase insurance for themselves and their families either. Health insurance tax penalties were introduced at the federal level with the Affordable Care Act or Obamacare. However divorce attorneys do recommend that their clients initiate.

This meant that all taxpayers across the country were required to obtain health insurance coverage or pay a tax penalty. They see the benefit in doing so and. On refugee status for a limited time depending how long you have been in the United States.

Pay a penalty when they file their state tax return. Starting in 2020 California residents must either. They are available to all Medi-Cal beneficiaries despite immigration status at no cost.

The mandate requires that most Americans and legal residents obtain health insurance that meets the standards set by the Covered California Exchange. Covered California the states Affordable Care Act insurance exchange will allow residents to enroll in a healthcare plan through March 31 to avoid paying the individual mandate which can be. In California you may need to purchase Individual Health Insurance in the following circumstances.

You can also get Medi-Cal if you are. The federal law was repealed and coverage was not mandatory in the state of California in 2019. We regulate health insurance policies in California to ensure vibrant markets where the health and economic security of individuals families and businesses are protected and insurers keep their promises.

California law says that many health insurance policies must cover essential health benefits which include services like diabetes supplies maternity care cancer screening transgender health care and substance abuse treatment. But some of you need not worry. However under the California Health Mandate beginning in 2020 if you did not have Medi-Cal or other qualifying health care coverage for all twelve months of the previous calendar year and you do not qualify for an exemption from the required coverage you may be penalized by the FTB when you file your state income taxes.

Best Cheap Health Insurance In California 2021 Valuepenguin

California Healthcare Exchange Shop Buy Insurance Online

California Healthcare Exchange Shop Buy Insurance Online

Health Insurance Companies In California Covered California

Health Insurance Companies In California Covered California

4 Important Changes To California Health Insurance In 2020 Cost U Less Insurance

4 Important Changes To California Health Insurance In 2020 Cost U Less Insurance

The 2020 Changes To California Health Insurance Ehealth

The 2020 Changes To California Health Insurance Ehealth

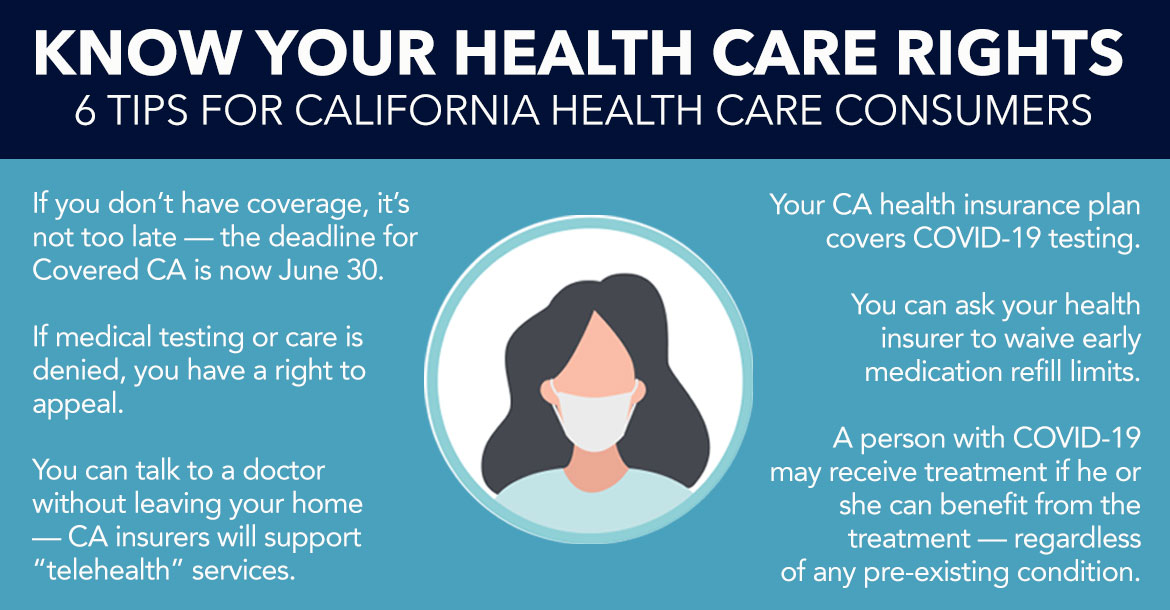

Know Your Health Care Rights 6 Tips For California Consumers During The Covid 19 Pandemic Consumer Watchdog

Know Your Health Care Rights 6 Tips For California Consumers During The Covid 19 Pandemic Consumer Watchdog

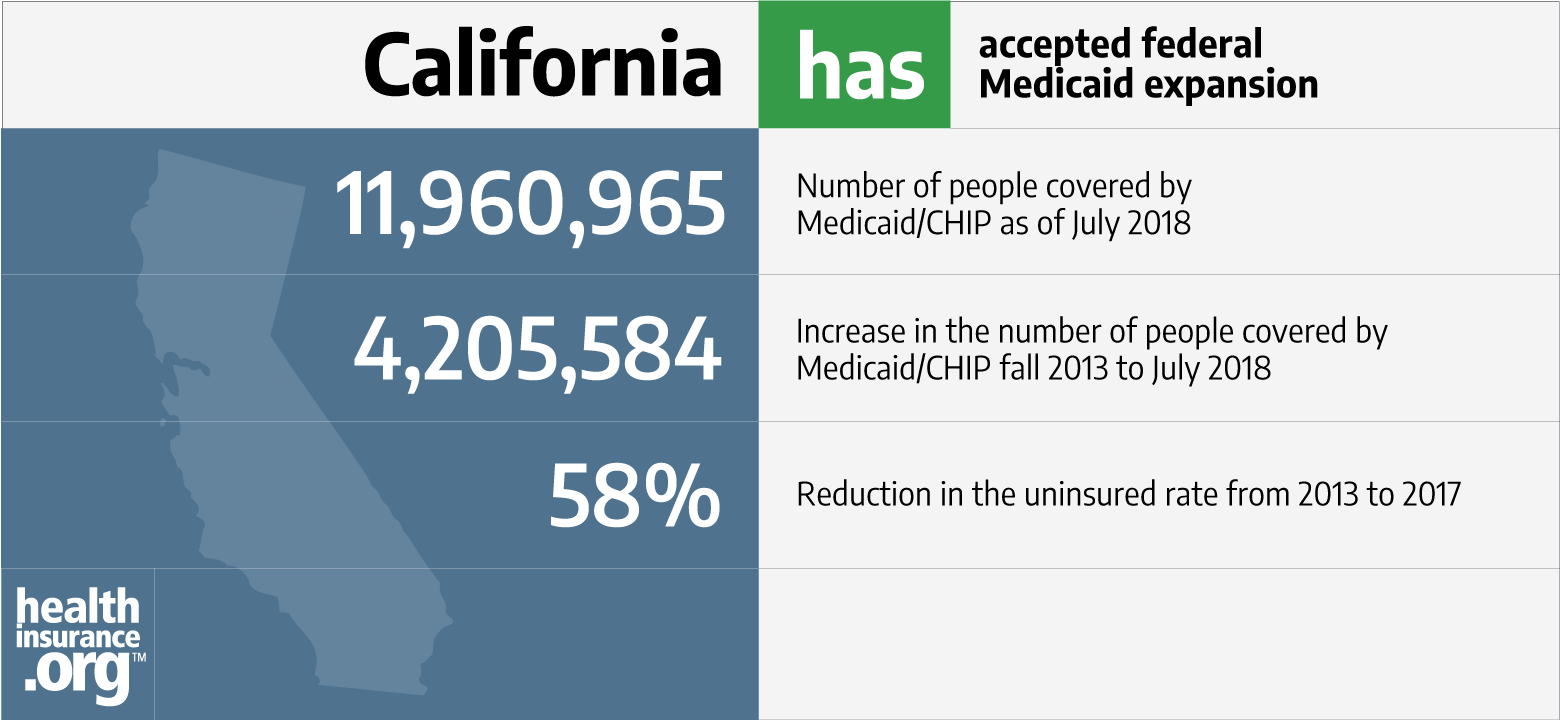

California And The Aca S Medicaid Expansion Healthinsurance Org

California And The Aca S Medicaid Expansion Healthinsurance Org

Medicare Medi Cal Dual Eligible Medi Medi Beneficiaries

Medicare Medi Cal Dual Eligible Medi Medi Beneficiaries

Individual Health Insurance Plans Quotes California Hfc

Individual Health Insurance Plans Quotes California Hfc

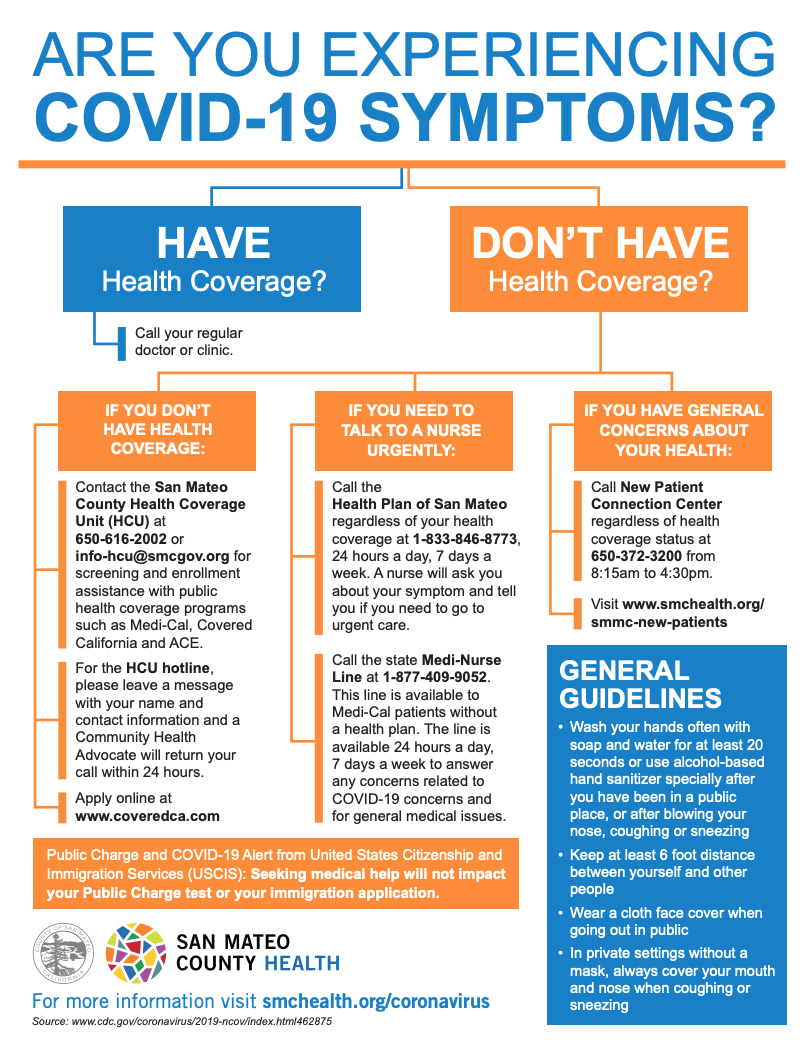

If You Have Symptoms Of Covid 19 But Don T Have Health Insurance San Mateo County Health

If You Have Symptoms Of Covid 19 But Don T Have Health Insurance San Mateo County Health

Insurance Options For 26 Year Olds In California

Insurance Options For 26 Year Olds In California

Group Health Insurance In California For Small Business

Group Health Insurance In California For Small Business

8 Hidden Benefits Your Health Insurance May Be Offering California Benefit Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

8 Hidden Benefits Your Health Insurance May Be Offering California Benefit Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.