Under Your Forms 1095-A for Tax Filing click Down-load PDF and follow these steps based on your browser. How to find your 1095-A online.

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

Under Your Existing Applications select your 2019 application not your 2020 application.

Where to get my 1095 a. IF YOU ARE TRYING TO DO THIS FROM YOUR. If anyone in your household had Marketplace health coverage in 2020 you should have already received Form 1095-A Health Insurance Marketplace Statement. To request a copy or correction to your 1095 in UCPath after March 13 Visit UCPath Online scroll down to the Forms Library and click on Records to complete a Benefits record request.

Contact them directly ONLY your insurer will have access to it and can provide you with a copy. DFAS USCG or USPHS will provide you with IRS Form 1095 series form s no later than March 2 2020. If you get healthcare from your employer contact your companys benefits department.

If you didnt get the form online or by mail contact the Marketplace Call Center How to use Form 1095-A. If you misplaced a 1095-A you can find it online. If you have not yet received your 1095-A you can obtain the form the Marketplace online or by phone.

The downloaded PDF will appear at the bottom of the screen. When the pop-up appears select Open With and then OK. Log into your healthcare account and follow these steps.

If you have questions about Form 8962 or other tax-related questions visit wwwirsgov. Your 1095-A should be available in your HealthCaregov account. Under Your Existing Applications select your 2020 application not your 2021 application.

Other states that use healthcaregov will find their 1095-A at wwwhealthcaregov. You can use information on the form to answer health care coverage questions on your federal tax return. Note you may have received IRS letter 12C where the IRS is looking for Form 1095-A.

Health Insurance Marketplaces must file Form 1095-A to report information on all enrollments in qualified health plans in the individual market through the Marketplace. The Form 1095-A only reports medical coverage not catastrophic coverage or stand-alone dental and vision plans. If you did elect for electronic delivery or would like an electronic copy of the form for tax purposes please use the following steps to retrieve your 1095-C.

If your form is accurate youll use it to reconcile your premium tax credit. Log into your Marketplace account at httpswwwhealthcaregov. If you purchased coverage through a state-based Marketplace you may be able to get an electronic copy of Form 1095-A from your state-based Marketplace account.

How to find your 1095-A online Log in to your HealthCaregov account. If there are errors contact the Call. Theres only one place where you can get a copy of your 1095 tax form.

If you did not elect for electronic delivery you will be receive your 1095-C in the mail. Click the green Start a new application or update an existing one button. Find your Form 1095-A.

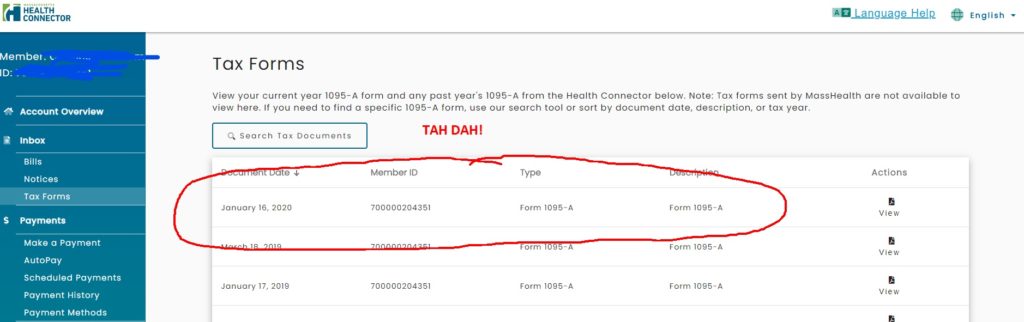

Select Tax Forms from the menu on the left. Visit your Marketplaces website to find out the steps you need to follow to get a copy of your 1095-A online20 Jun 2018 How to find your 1095-A form or do your taxes without it. Retirees can contact RASC customer service to request reprints and corrections.

If you receive health coverage for yourself or your family through the Health Insurance Marketplace you will receive a Form 1095-A from your insurer after the year ends. Log into Employee Self Service ESS. Do not file a Form 1095-A for a catastrophic health plan or a separate dental policy called a.

Click Save at the bottom and then Open. Click here if you purchased your plan via healthcaregov. It comes from the Marketplace not the IRS.

Store this form with your important tax information. You can also find the information on your 1095 yourself or request another copy from the Marketplace. If you have questions about Form 1095-A Minimum Essential Coverage PTC or the SLCSP table call Community Health Advocates Helpline at 1-888-614-5400.

Internet Explorer users. Look for Form 1095-A If anyone in your household had Marketplace coverage in 2017 you can expect to get a Form 1095-A Health Insurance Marketplace Statement in the mail by mid-February. If you think we made a mistake on your 1095-A call NY State of Health at 1-855-766-7860.

Select Tax Forms from the menu on. Download all 1095-As shown on the screen. You can get all your MA Form 1095-As going back all years.

The IRS Form 1095 series will document the month s in 2019 that you and your dependents if applicable had MEC.

Breakdown Form 1095 A Liberty Tax Service

Breakdown Form 1095 A Liberty Tax Service

How To Make Sure Your Form 1095 A Is Accurate Before You File Healthcare Gov

How To Make Sure Your Form 1095 A Is Accurate Before You File Healthcare Gov

Mass Health Connector 1095 A How To Find

Mass Health Connector 1095 A How To Find

/1095b-741f9631132347ab8f1d83647278c783.jpg) Form 1095 B Health Coverage Definition

Form 1095 B Health Coverage Definition

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

Understanding Your Form 1095 A Youtube

Understanding Your Form 1095 A Youtube

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.