Specialist urgent care facility and emergency room copays are generally higher than that of your primary care physician. No matter how many copays.

Understanding Premiums Deductibles Copays And Out Of Pocket Maximums Youtube

Understanding Premiums Deductibles Copays And Out Of Pocket Maximums Youtube

How do deductibles coinsurance and copays work.

How do deductibles and copays work. Understanding how they work will help you know when and how much you have to pay for care. For example if your plan comes with a 3500 deductible this means that you will. Copays deductibles and coinsurance all work together to limit your out-of-pocket medical expenses and help protect your finances.

She loves that her building has a gym and pool because she likes to stay in shape. Deductibles and copays define the different ways health insurance companies pay most of the costs to keep you healthy. If your plan includes copays you pay the copay flat fee at the time of service at the pharmacy or doctors office for example.

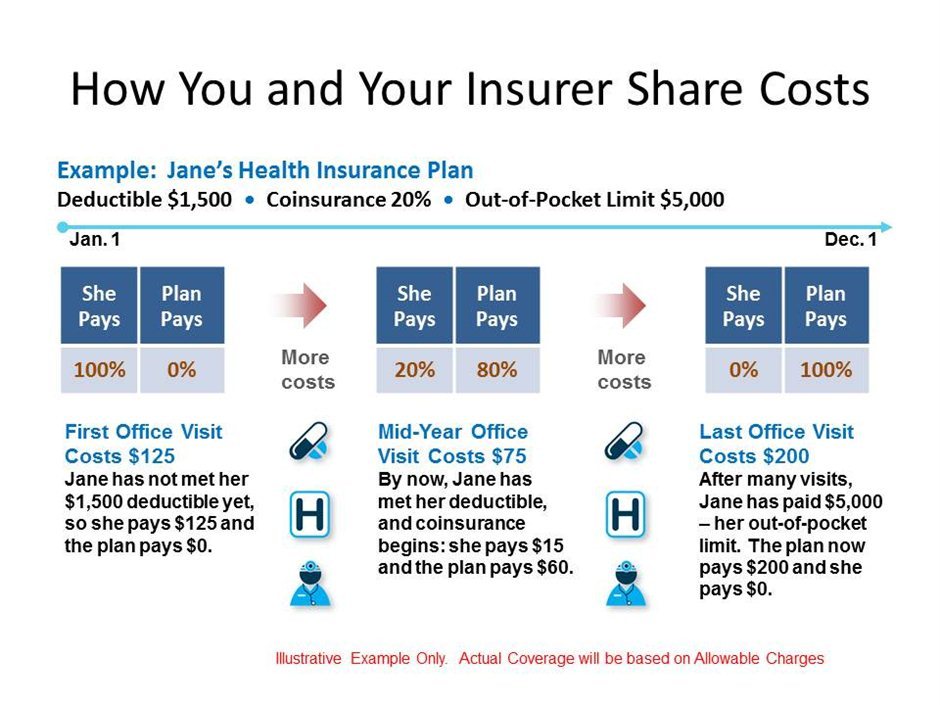

How do deductibles coinsurance and copays work. A deductible is the amount you pay out-of-pocket for covered services before your health plan kicks in. An example of how it works.

Your Blue Cross ID card may list copays for some visits. With these plans your deductible is the amount you pay out-of-pocket before your coverage begins sharing costs with you through coinsurance for instance. Assume you have a 2000 deductible a 50 copay 8020 coinsurance and an out-of-pocket maximum of 3000.

When you have to pay something for your care even a small copayment youre less likely to. When you see the doctor or use healthcare services you pay for part of the cost of those services yourself in the form of deductibles coinsurance and copayments. Copays Copayments Most people are familiar with copays a flat fee you pay toward services such as doctor visits or prescriptions.

You may also have a copay after you pay your deductible and when you owe coinsurance. Lets take a look at each of these terms and how they affect your overall medical expenses. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features.

A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin to pay. When both you and your health insurance company pay part of your medical expense its called cost sharing. Deductibles coinsurance and copays are all examples.

Deductibles can work differently depending on your health insurance plan. Now lets say you have a deductible of 500 with a 10 copay. Once your copays reach the 500 deductible amount your insurance pays 100 of all invoices.

However in many health insurance policies you can use some services like a visit to the emergency room or a routine doctor s visit without meeting the deductible first. Generally all payments you make for covered healthcare services will count toward your annual deductible unless the payment is considered a copay. Knowing the difference between deductibles co-insurance and copays is essential when making such significant decisions.

Copays are a fixed amount you pay to see your doctor or a specialist. A deductible is a fixed amount of money you have to pay before most if not all of the policys benefits can be enjoyed. These services will vary with each type of plan.

Cost-sharing is part of a PPOs system for making sure you really need the healthcare services youre getting. This means that for all services invoiced you will be required to pay 10 of the total while your insurance company pays the remaining 90. You can also log in to your account or register for one on our website or using the mobile app to see your plans copays.

Copays and deductibles are both features of most insurance plans. Courtney 43 is a single lawyer who just bought her first home a condo in Midtown Atlanta. Medicare copays also called copayments most often come in the form of a flat-fee and typically kick in after a deductible is met.

Understanding Medicare Copayments Coinsurance. How insurance premiums and deductibles work - YouTube. A deductible is an amount that must be paid for covered healthcare services before insurance begins paying.

Understanding how they work will help you know when and how much you have to pay for care. You may have a copay before youve finished paying toward your deductible. You visit an orthopedist 50 copay since you have hip pain.

When both you and your health insurance company pay part of your medical expense its called cost sharing. Deductibles coinsurance and copays are all examples. If playback doesnt begin shortly try restarting your device.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features. A deductible is the amount of money that an insured person or family pays per year for eligible medical services and medication before their health insurance plan starting to share the costs. A deductible is the amount you pay for most eligible medical services or medications before your health plan begins to share in the cost of covered services.

Your plan determines what your copay is for different types of services and when you have one.

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Deductibles Co Pay And Out Of Pocket Maximums

Deductibles Co Pay And Out Of Pocket Maximums

Imagine Healthcare Insurance Information How Do Co Insurance Copays And Deductibles Work

Imagine Healthcare Insurance Information How Do Co Insurance Copays And Deductibles Work

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

How Do Deductibles And Co Pays Work When You And Your Health Insurance Company Pay Part Of Your Health Insurance Companies Medical Insurance Health Insurance

How Do Deductibles And Co Pays Work When You And Your Health Insurance Company Pay Part Of Your Health Insurance Companies Medical Insurance Health Insurance

Coinsurance Copay Deductible What S The Difference

Coinsurance And Medical Claims

Coinsurance And Medical Claims

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance Ramseysolutions Com

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.