An HSA can be paired with a qualified high-deductible health plan and offers the opportunity to save for health care expenses. Employers often offer HSAs for employees but you.

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

These accounts were created in.

What is an hsa medical plan. You can open an HSA with any HSA eligible health plan and use those tax deductible funds to pay for eligible medical costs. An HSA plan type is a commonly known as a high deductible health plan HDHP which typically has lower premiumsplan contributions and higher deductibles than a traditional health plan. A health savings account or HSA plan is a tax-advantaged account you use to save for health expenses.

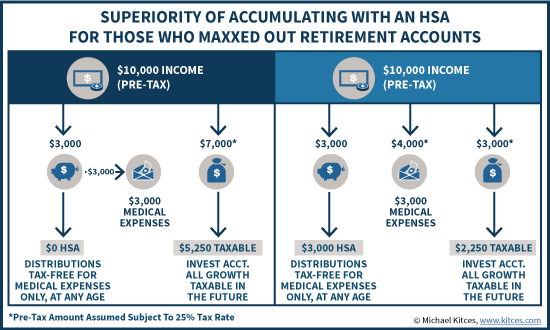

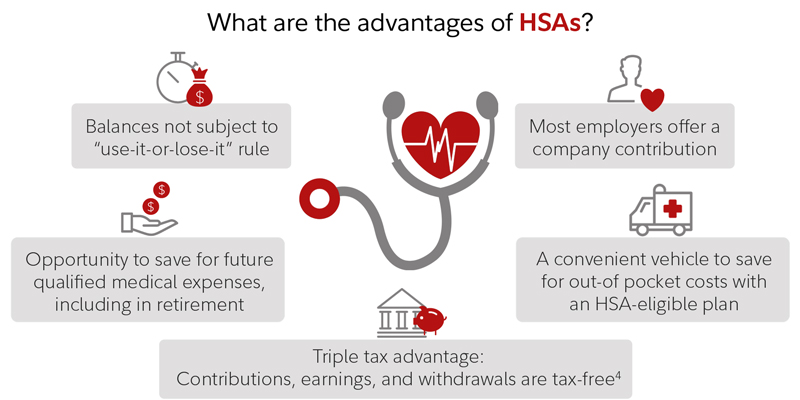

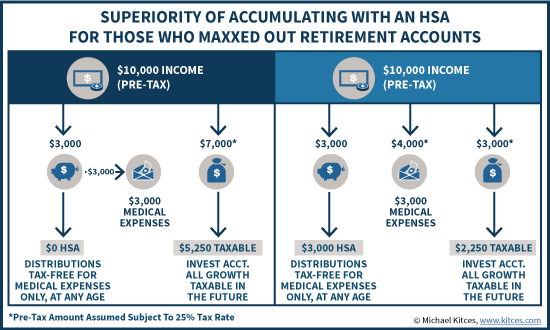

By using untaxed dollars in a Health Savings Account HSA to pay for deductibles copayments coinsurance and some other expenses you may be able to lower your overall health care costs. It seems that an HSA would be most appealing to an individual or family that has relatively modest medical care expenses can afford a high-deductible medical plan and could take advantage of the substantial tax benefits of a health savings account. An HSA is a tax-advantaged account to which you andor your employer contribute funds on a pre-tax basis your taxable gross income is reduced by the amount of your contributions.

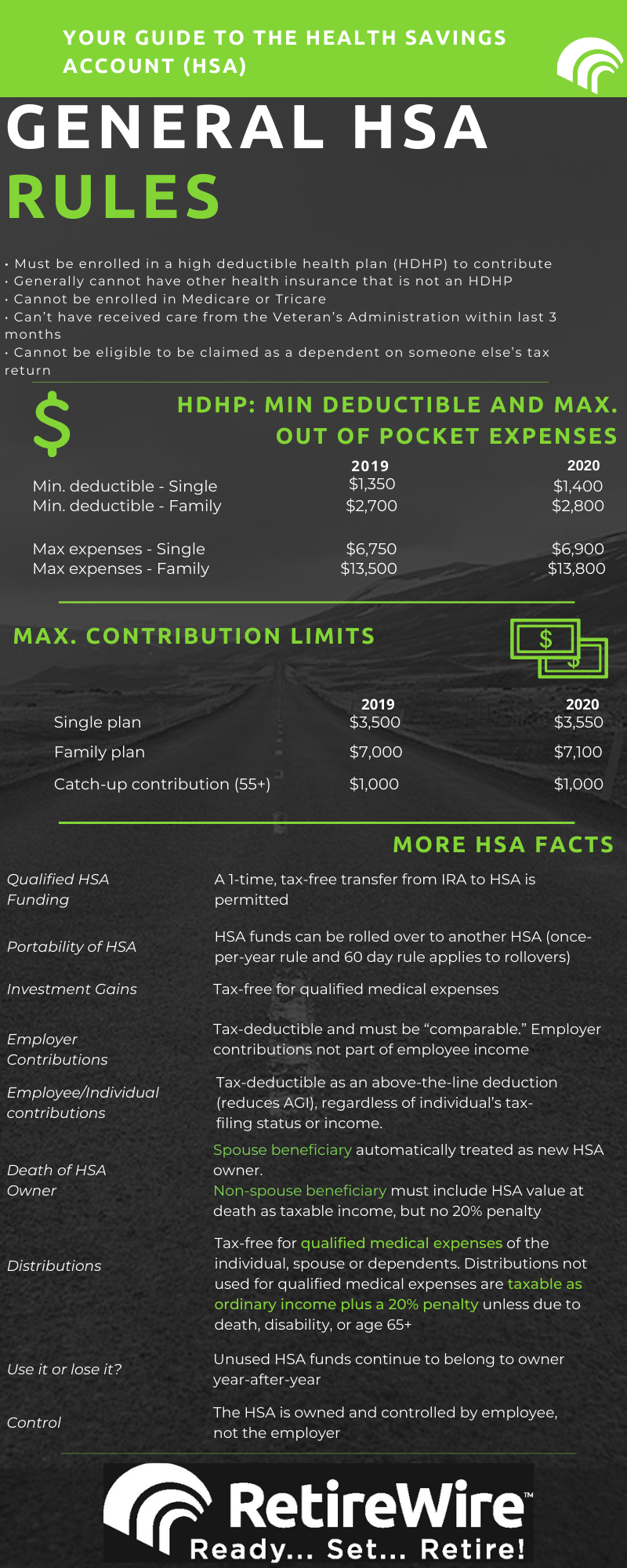

If youre eligible for a health savings account commonly called an HSA taking advantage is a smart way to save money on your current and future medical expenses. A health savings account HSA is a tax-advantaged investment account you can contribute to if you have a high-deductible health insurance plan. Be covered under a high deductible health plan HDHP that is HSA-compatible.

Not be enrolled in any part of Medicare. A health savings account HSA is a tax-favored savings account created for the purpose of paying medical expenses. Who can establish an HSA.

Its separate from the type of network options of a PPO HMO etc. Youre allowed to contribute to one only if. The lowdown on HSAs.

You must be enrolled in a high deductible health plan HDHP. How High Deductible Health Plans and Health Savings Accounts can reduce your costs. And typically is cheaper than non-HSA eligible plans.

It is important for each employee to compare an HSA to other medical plan options. Just as the name implies a health savings account HSA is a financial account designed to help you save for qualified health care expenses. Anyone may establish and contribute to an HSA if he or she meets all of the following requirements.

These include services your health insurance plan may not cover. Not be covered by any other health plan that is not an HDHP with certain exceptions. You not your employer or insurance company own and control the money in your HSA.

HSA stands for health savings account. And not just any HDHP is HSA qualified. One way to manage your health care expenses is by enrolling in a High Deductible Health Plan HDHP in combination with opening a Health Savings Account HSA.

He or she must. A Health Savings Account HSA is an account for individuals with high-deductible health plans to save for medical expenses that those plans do not cover. Health savings accounts HSAs are like personal savings accounts but the money in them is used to pay for health care expenses.

One benefit of an HSA is that the money you deposit into the account is not taxed. Not just anyone can open an HSA. In addition there are three main tax reasons to contribute to a health savings account.

A Health Savings Account HSA is a tax-advantaged account created for or by individuals covered under high-deductible health plans HDHPs to save for qualified medical expenses. An HSA serves as a tax-advantaged medical savings account designed to cover eligible medical expenses. A health savings account or HSA is a savings account that you or you and your employer if you have an employer-sponsored plan.

You will have to meet the deductible first. Health Savings Account HSA A type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses. If youre enrolled in an HSA eligible plan what you save in premium costs can help offset out-of-pocket expenses not covered by the plan especially if you put those savings into an HSA.

Health Savings Account Habits Fidelity

Health Savings Account Habits Fidelity

Retirement Health Savings Account And Medicare

Retirement Health Savings Account And Medicare

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

The Pros And Cons Of A Health Savings Account Hsa

The Pros And Cons Of A Health Savings Account Hsa

Hsa Vs Ppo Motivhealth Insurance Company

Hsa Vs Ppo Motivhealth Insurance Company

What You Need To Know About Hsas Hras And Fsas

What You Need To Know About Hsas Hras And Fsas

How Does An Hsa Work The 2020 Hsa Rules Strategy Retirewire

How Does An Hsa Work The 2020 Hsa Rules Strategy Retirewire

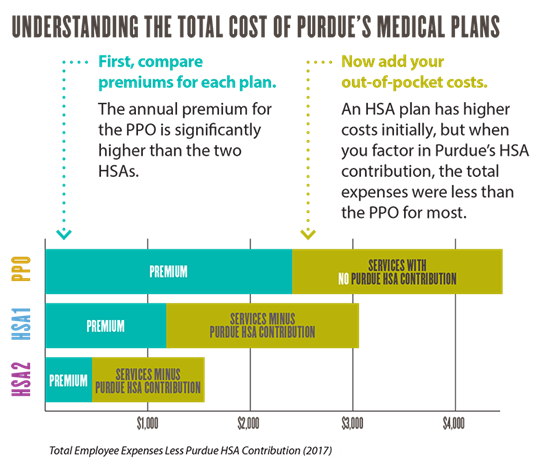

Choosing The Right Medical Plan Human Resources Purdue University

Choosing The Right Medical Plan Human Resources Purdue University

Health Savings Accounts How Hsas Work And The Tax Advantages

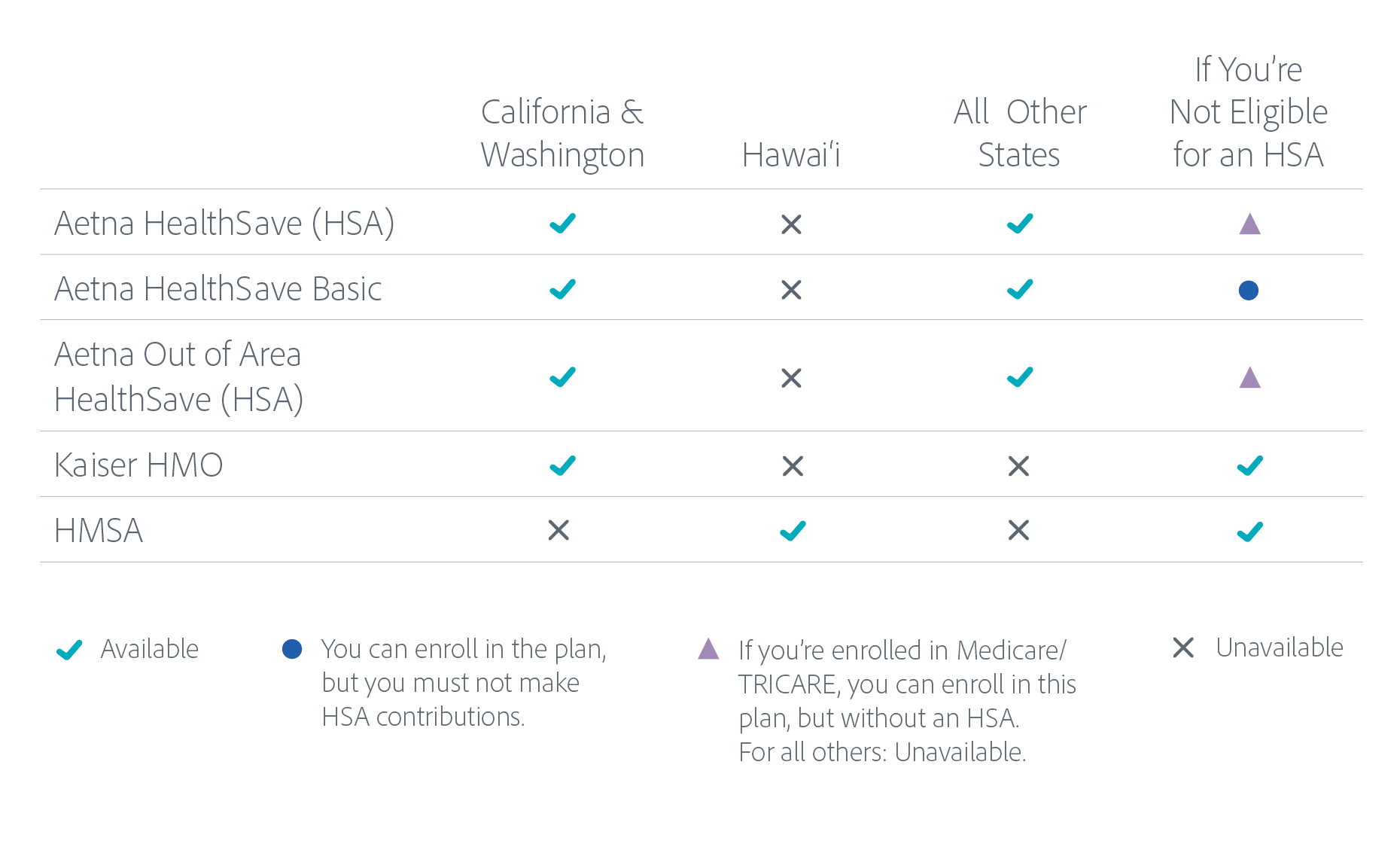

Choosing A Medical Plan Adobe Benefits

Choosing A Medical Plan Adobe Benefits

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.