Excluded untaxed foreign Income. If you do you are not eligible for a subsidy.

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act.

Covered california income. 2021 Covered California Data. Family size adjustments HUD applies to the income limits and 4 determining income limit levels applicable to Californias moderate-income households defined by law as household income not exceeding 120 percent of county area median income. Any financial help you get is based on what you expect your household income will be for the coverage year not last years income.

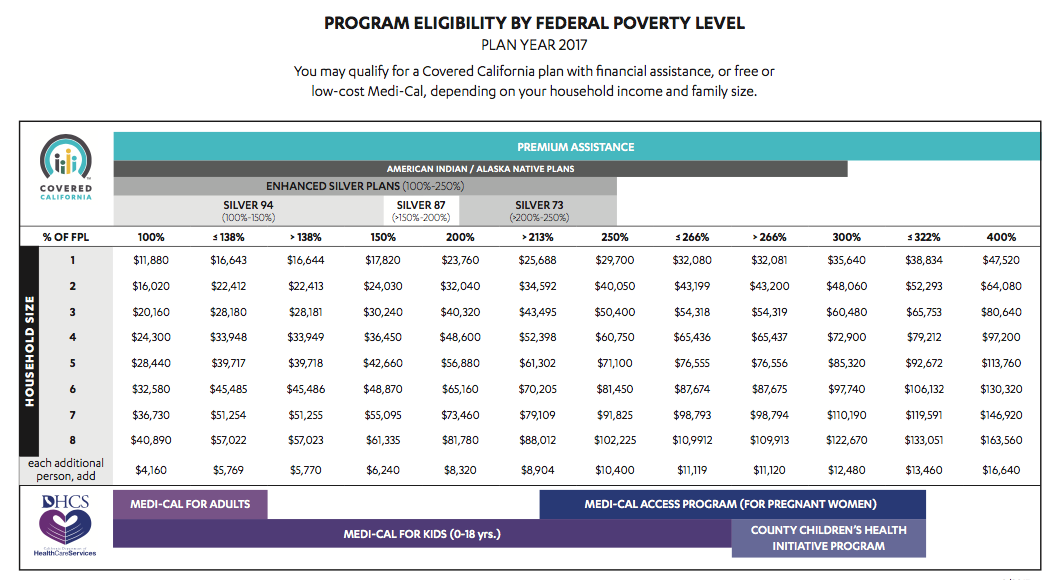

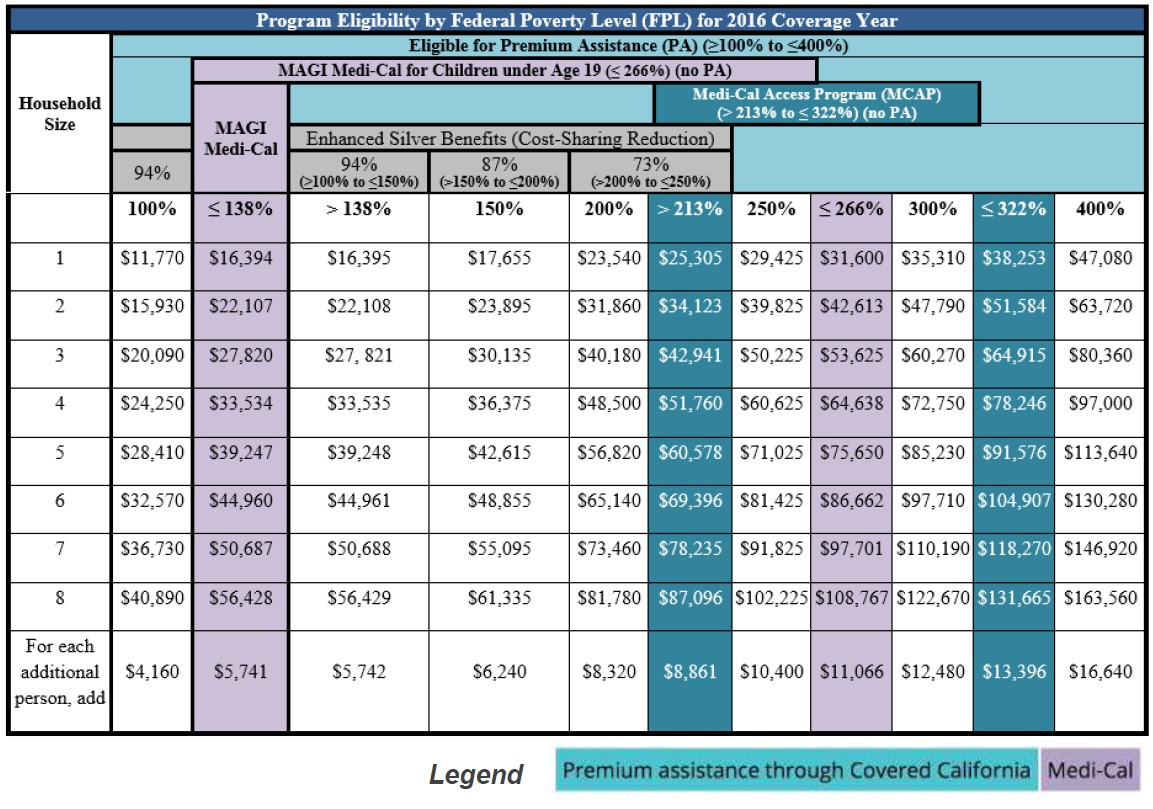

That means you can earn no more than 134960. To be eligible for assistance through Covered California you must meet an income requirement. Be no older than 45 days from the date received by Covered California.

Ad We Do All The Hard Work For You Finding You the Best Cover At The Right Price. Get health coverage through a job or a program like Medicare or Medi-Cal. Can anyone get Covered California.

In order to be eligible for assistance through Covered California you must meet an income requirement. Have a change in income. Once you have enrolled you are required to report information on your Covered California Application that changes.

2021 Individual Product Prices for all Health Insurance Companies - UPDATED 9302020. The state of California is making new financial help available to almost a million Californians many for the first time. When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes.

AB 174 State Subsidy Report March 2020. Ninety percent of people who have signed up with Covered California get financial help and you could be one of them. If you make 601 of the FPL you will be ineligible for any subsidies.

Be on company letterhead or state the name of the company. Changes like income or household size may occur during the year that could affect the assistance that you qualify for. They can check to see if they are eligible for free or low cost Medi-Cal which is coverage through the state of California though benefits may be limited.

Providing You With Financial Support To Help Ensure You Make A Full Recovery. It is very important that you report these types of changes in a timely manner so that you are enrolled in the right program and. Ad We Do All The Hard Work For You Finding You the Best Cover At The Right Price.

Have a change in disability. Reporting Changes to Covered California. Providing You With Financial Support To Help Ensure You Make A Full Recovery.

Have a child adopt a child or place a child for adoption. Be signed by the employer. Its the only place where you can get financial help when you buy health insurance from well-known companies.

How to Estimate Your Income. Compare brand-name Health Insurance plans side-by-side and find out if you qualify. Pandemic Unemploment Compensation 300week Social Security.

Get married or divorced. Under the ARP Covered California enrollees receiving Unemployment Insurance in 2021 are treated as though their income is no more than 1381 FPL for the purposes of the federal premium tax credit meaning their required contribution for a benchmark plan will be 0. You could even qualify for low-cost or.

Include the following information. So lets say youre a family of six. It must contain the persons first and last name income amount year and employer name if applicable.

2021 Products By Zip Code. Alimony only if divorce or separation finalized before Jan. 2021 Open Enrollment Net Plan Selection Profile xlsx 2021 Open Enrollment Gross Plan Selection Profile xlsx 2020 Covered California Data.

You can start by using your adjusted gross income AGI from your most recent federal income. To qualify for government subsidies you must purchase your coverage through Covered California and your annual gross income cannot be more than 400 percent of the FPL. Social Security Disability Income SSDI Retirement or pension.

The employer statement must. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. You must report a change if you.

If you have health insurance through Covered California you must report changes within 30 days. Immigrants Can Apply for Medical Coverage Through Covered California Those who are undocumented have two options. Use the Shop Compare tool to find the best Health Insurance Plan for you.

How Do I Know If I Qualify For Covered California Or Medi Cal

How Do I Know If I Qualify For Covered California Or Medi Cal

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

Covered California Versus Medi Cal Pfeifer Insurance Brokers

Covered California Versus Medi Cal Pfeifer Insurance Brokers

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Covered California Updates Income Reporting Former Foster Youth

Covered California Updates Income Reporting Former Foster Youth

Https Hbex Coveredca Com Toolkit Renewal Toolkit Downloads 2016 Income Guidelines Pdf

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Covered California Health Insurance Income Guidelines

Covered California Income Limits Explained

Covered California Income Limits Explained

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.